India’s software products export revenues can hit $100B by 2030: NASSCOM

Industry body NASSCOM is upbeat about the growth of deep tech startups from India. It expects this segment to boost the overall prospects of the software products industry in the country.

Hello Readers,

The strides made by the Indian startup ecosystem over the years have led to the emergence of a strong set of software product companies whose momentum has started to pick up the pace. Currently, the segment is dominated by software as a service (SaaS) startups, and the next step in this evolution will be the growth of deep tech companies.

NASSCOM, the leading trade body representing India’s technology industry, has been nurturing software product companies over the years and expects the export revenue from this segment to touch $30 billion by 2025.

“If we are getting brave, then it should be closer to $100 billion by the end of the decade,”

NASSCOM Product Council Chairperson Ramkumar Narayanan tells YourStory in an interview,

Ramkumar is optimistic about the growth of India’s startup ecosystem, particularly after the way businesses handled the COVID-19 pandemic.

“We believe the next 10 years are going to be a phenomenal growth vector for this ecosystem,” he adds. Read more.

The Interview

Over the past couple of decades, AU Small Finance Bank has positioned itself as a bank for underserved and unserved low- and middle-class individuals. Hear Mayank Markanday, the head of Credit Cards Business at AU Small Finance Bank, delving deeper into the context of its recently introduced credit card promised to every applicant.

Editor’s Pick: Techie Tuesday

In this week’s Techie Tuesday, we feature Nitin Das, Co-Founder and Chief AI Officer at , a startup that builds artificial intelligence (AI)-first suite of solutions for an enterprise’s business operations. Nitin says his curiosity in technology has helped him forge a career in AI. Read more.

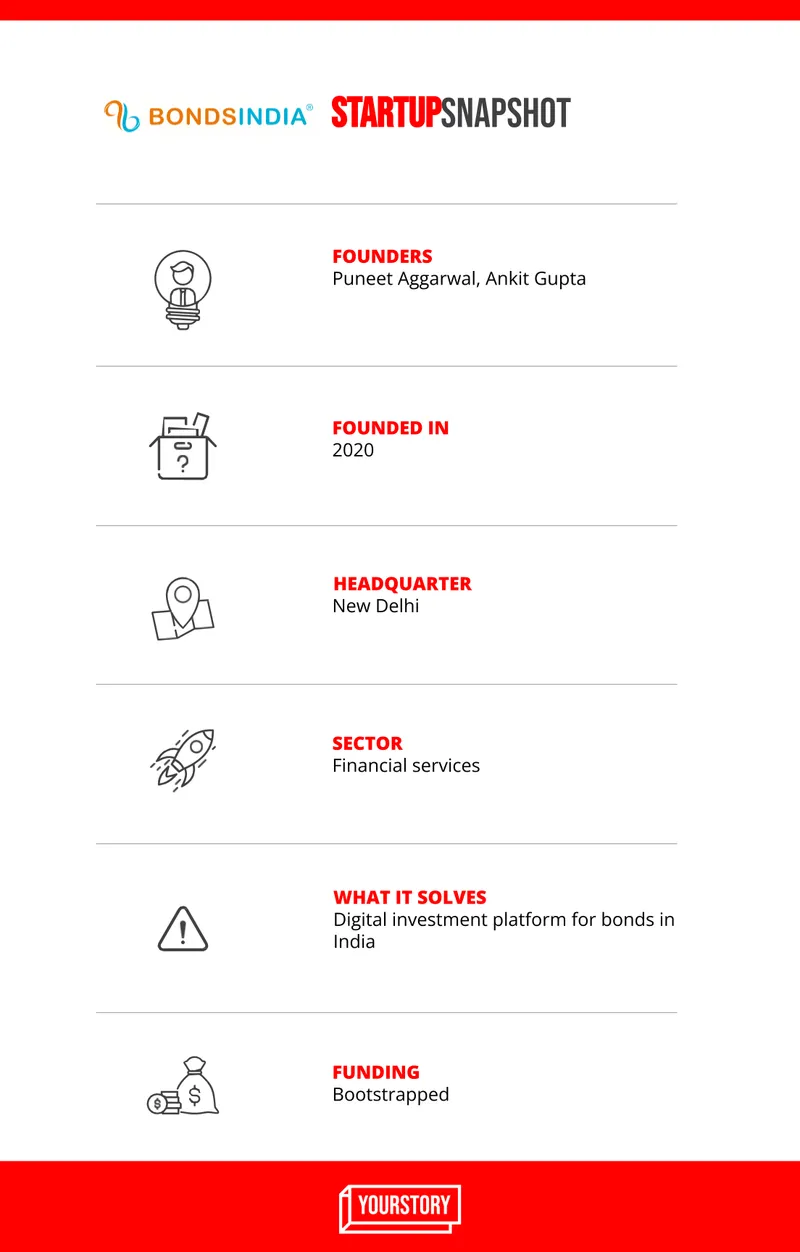

Startup Spotlight

Introducing investors to bonds market

Bonds come in various formats like government securities, public sector bonds, corporate bonds, etc. This market predominantly has investors who belong to the HNIs, corporates, and institutions categories.

Founded by Ankit Gupta and Puneet Aggarwal in February 2020, is keen to introduce retail investors to the world of bonds and show them how one can generate a higher return than a fixed deposit (FD). Read more.

News & Updates

- Conscious-tech platform OneGreen has raised investment and backing from Nikhil Vora (Founder and CEO, Sixth Sense Ventures) and Nimisha Nagarsekar (CFO, Sixth Sense Ventures). The round also had Gul Panag invest an undisclosed amount in .

- Bengaluru and Dubai-based fintech app Zenda has raised $9.4 million in an oversubscribed seed round with participation from STV, COTU, Global Founders Capital, and VentureSouq.

- Awadesh Jha, Executive Director at Fortum, said that Electricity (Promoting Renewable Energy Through Green Energy Open Access) Rules, 2021 allowing any consumer requiring above a 100KWh load to source their electricity from green sources outside could aid the electric vehicle industry.

Before you go, stay inspired with…

Entrepreneurship is not a straight line with a 20-degree slope, it is a sinusoidal curve. So, build emotional and mental resilience.

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!