Why US-based QED Investors wants to place bigger bets on India’s fintech market

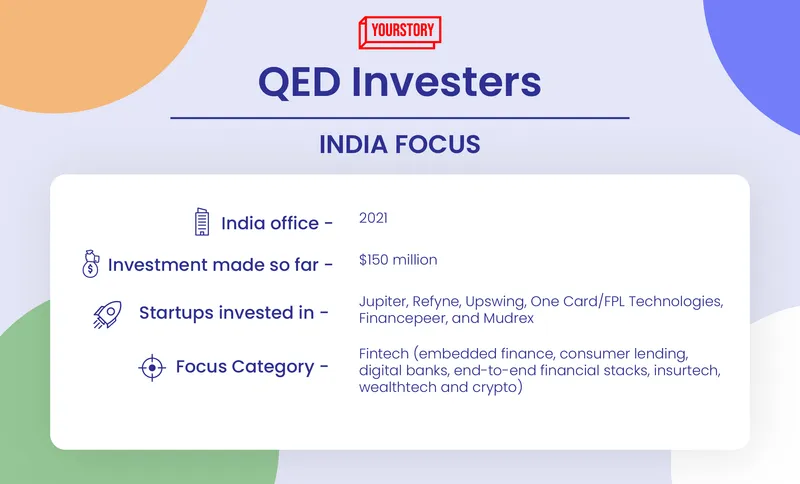

Global VC QED Investors set up its office in India last year, and has signed cheques worth $150 million (seed to Series C) across six fintech startups. Now, it wants to double down on its bets in the next three years.

The last few years saw a breakout moment for Indian startups as a great deal of global venture capital (VC) firms began to invest across sectors and series. According to Tracxn, around 211 funds made debut investments in India in 2021, 64 more than in 2020.

Among the global VC names to have taken the plunge, US-based QED Investors set shop in the Indian market last year, targeting to deploy a significant corpus in the next three years.

Besides the “thriving macroeconomic story” of the country, QED is looking to place its bets on innovations coming out in the fintech space, including startups building for Bharat.

“Over the last decade, India has assembled comprehensive infrastructure to address gaps across financial services. JAM (Jan Dhan-Aadhaar-Mobile) trinity opened up financial access. UPI (Unified Payments Interface) and now OCEN (Open Credit Enablement Network) and AA (Account Aggregator) are deepening payments and credit, providing a robust basis for grassroots level innovation in fintech,” Sandeep Patil, Partner and Head of Asia for QED, tells YourStory.

Sandeep joined the global investment firm in 2020 to lead its Asia operations. Since then, the firm has made investments worth $150 million (seed to Series C) across six fintech startups — Jupiter, Refyne, Upswing, OneCard, Financepeer, and Mudrex.

“These investments have bolstered the firm’s conviction on the India opportunity and we expect the momentum will continue as we scout for new opportunities,” he adds.

Globally, over the span of 15 years, QED has backed about 180 startups — of which 26 have emerged as unicorns — across 14 countries. It has $4.8 billion worth of assets under management (AUM).

Some of its notable investments include AvidXchange, Credit Karma, Current, GreenSky, Flywire, Mission Lane, Remitly, and SoFi in the US; ClearScore, Wagestream, and Klarna in Europe; and Bitso, Creditas, Kavak, Loft, Konfio, Nubank, and QuintoAndar in Latin America.

A dedicated focus

Back in 1994, when Nigel Morris, Co-founder and Managing Partner at QED, incorporated his first startup Capital One Financial Services, the term ‘fintech’ was not commonplace.

One of the first fintech companies in the US, Capital One is often credited to have taken the term fintech mainstream. After a 10-year stint as President and COO, Nigel felt that his knowledge and expertise gathered while building Capital One would be invaluable to the startup world and nascent disruptors in the emerging fintech space.

Hence, in 2007, Nigel co-founded QED Investors with Capital One alum Frank Rotman. QED started as a family office, and later transformed into a VC fund with a dedicated focus on fintech.

“Financial services are devilishly complicated and we know how to navigate its idiosyncrasies. We play hands-on roles and want to help startups with our entrepreneurial and operational experience,” says Sandeep, who started his career with Capital One in 2000 and spent two decades leading, operating, and advising companies globally.

QED later expanded geographically as the sheer size of the fund grew organically.

“We expanded our focus towards the Asian market, including India, a few years back. Nigel has been looking at India for a long time. We believe this is the right time for India given the compelling macroeconomics and growing disposable incomes, fast-growing yet under-penetrated financial services supported by forward-looking regulator and deep talent pool,” says Sandeep.

In September 2021, the firm closed its seventh fund totalling $1.05 billion, including a $550 million early-stage fund and a $500 million growth-stage fund, both of which are aimed at backing fintech companies globally.

Investment thesis and segments

QED claims to be a multi-series investor, looking to infuse capital across Pre-Seed, Seed, Series A, B, and growth-stage, with cheque sizes from below $1 million to up to $50 million.

Detailing its Indian investment strategy, Sandeep says QED is eying startups across multiple themes. For example, companies reinventing financial services across the entire stack (end-to-end solutions) in a particular segment are of keen interest.

The VC is also looking for innovations across verticals like wealth management, insurance, SME lending, and so on. In addition, it is closely evaluating startups in embedded finance. These are finance ecosystem enablers or plug-and-play platforms that help consumer tech players offer financial services easily as they take care of tech stack, security infrastructure, banking partnerships, compliance, and so on.

Its investment in Upswing is one such example. Others could include ecommerce or logistics companies that have proprietary customer access or data to power financial services products.

Another important theme is ventures that use innovative yet reliable basis to provide financial products for the mass affluent market and middle class. QED is also looking to invest in insurtech and wealthtech, and is closely monitoring crypto companies as well.

What is QED looking for in a fintech startup?

QED claims to have an intensive business model, with global partners deeply involved in startup evaluation and company building, right from the selection to post-funding advisory and mentoring.

“We operate as a single global team and are not siloed by geography. We are easily accessible to each other to share expertise and experiences, and are equally involved and available for startups across the world,” says Sandeep.

Sandeep undertakes initial conversations with founders to form an initial assessment of the opportunity and gauge the overall sentiment of the business. The next three to four weeks involve deep dives to evaluate the economic model, the problem statement, proposed solution, proof points, total market size, and so on, following which an investment case is created.

The idea is then discussed in detail with the global team and a term sheet is offered. Financial and legal diligence follow thereafter.

“Unit economics are extremely important for us. A company creates value when customers are willing to pay more than the economic cost to manufacture and serve. We are interested in companies that have either demonstrated positive unit economics or are showing early proof points to that effect,” says Sandeep.

QED looks for business models that can grow quickly, have real problems to solve, and exhibit strong traction.

“If the disruption doesn’t happen in three-to-five years, then it might as well not have happened. The growth needs to be exponential over a five-to-seven-year horizon. That is the second important criteria for us,” he adds.

Emphasising having a strong founding team, Sandeep says, “Emerging markets are rife with challenges. In order to be successful, the team should be able to solve problems across business/growth, product, credit/underwriting, user experience, and so on in a credible and long-term fashion. It is important that the team is able to come together and work together as a cohesive and coherent unit.”

According to him, international expansion is not an essential evaluation criterion for QED.

“India is a massive market in itself. Plus, international expansion is hard. Fintech is unique for every country as they have different infrastructures and problem statements,” he adds.

In the case of a seed investment, the process is much faster and involves more front-loaded conversations with the founders.

Operator than an investor

QED remains deeply involved with its portfolio companies and connects with them almost every week to understand the functioning and provide necessary guidance.

When it comes to accessibility, the QED team is a mere text away on professional networking sites, says Sandeep. Interestingly, its portfolio startups originated via a mix of fellow investor references, direct inbound by founders, introduction by portfolio companies and outreach by the team as part of its research.

“We are incredibly excited about India being a major milestone in our global story going forward. We are already looking at a number of new companies for investment at various stages,” signs off Sandeep.

Edited by Saheli Sen Gupta