This startup plans to be a one-stop solution for the financial API stack, and scale rapidly. Here’s how

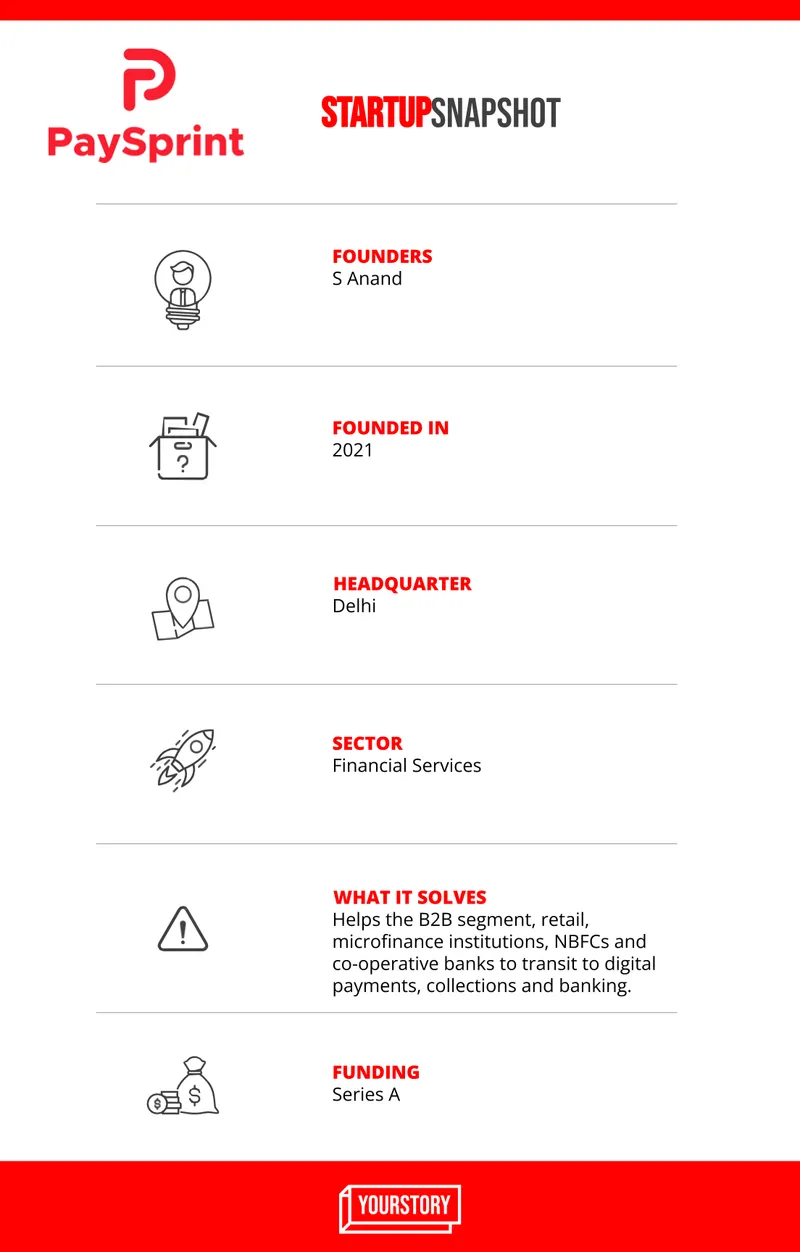

Delhi-based PaySprint, founded by S Anand in Dec 2020, is a one-stop solution for the entire financial Application Programming Interface (API) stack. In just one year, it has onboarded 600 partners across banks, NBFCs and more.

According to Tracxn, India has 7,129 fintech startups. So huge is the impact of these startups, that even the country’s central bank, the Reserve Bank of India (RBI) has announced its plans to set up 75 Digital Banking Units in 75 districts of the country in the financial year 2022-23. It also plans to bring out a policy framework for digital banking and fintech, and in January this year, it set up a department for fintech.

This clearly shows the trend, with practically every enterprise yearning to go digital, including the traditional banks. In fact, digital banking is gaining such fast-paced momentum that every player in the BFSI segment wants a share of the customer pie.

To do this, banks must go to the customer, unlike earlier when customers went to banks for every transaction.

Delhi-based , founded by S Anand in Dec 2020, is a startup that is helping the B2B segment, retail, microfinance institutions (MFIs), NBFCs and cooperative banks to transit to digital payments, collections and banking.

A fintech venture focussed on next-gen neobanking solutions, it offers a unified open API platform. In simpler words, a one-stop solution for the entire financial Application Programming Interface (API) stack.

Solutions for online payments

Through its one-stop solution for the entire financial API stack, PaySprint provides solutions for online payments such as IMPS and NEFT, bill payment, digital KYC, insurance, and loans to name a few.

“We work with banks in two ways,” explains Anand. “Firstly, we work as a tech partner and secondly, we consume their APIs, create a wrapper around it, and take it to the market for larger adoption.”

PaySprint’s clients can be broadly categorised into two types. The first is banks, with which it works as a technology partner and uses their APIs. The banks it has worked with so far include , Payments Bank, , , , and .

The second type of clients it works with is from the B2B segment, retail, microfinance institutions (MFIs), NBFCs and cooperative banks such as , Paypoint, Paisa Box, Equity Capital, Manipal Business, Digital Payments, Bhartipay, Vakrangee Kendra, P2P Microfinance, PayTel, Prologic, Netlink, Paydear, GoPayments, and Roinet to name a few.

With its first set of clients, PaySprint adds more value to its partner banks’ APIs, like adding an onboarding suite, reconciliation, transaction status, refund, dashboarding and analytics.

These value-added APIs are then used by its second set of clients to deliver services to their customers.

“We position ourselves as a one-stop solution to everything in the banking and fintech space. Our objective is to have the entire banking stack available, which will ensure that we can take care of every single opportunity,” explains Anand.

He adds that traditional banks need handholding to help go digital, as they play a very crucial part in small cities in the country.

“We believe there's a huge opportunity there in terms of empowering those cooperative banks, MFIs, and NBFCs to get into digital banking. That's where our strength lies, converting both as a partner and offering services and APIs,” Anand says.

Team PaySprint

Market acceptance

Though the company was registered in December 2020, PaySprint’s operations only started a month later in January 2021.

It went live with its first banking API for cash withdrawal and deposits six months later, at the end of May 2021. It now has over 30 APIs live.

In April this year, it raised Series A funding from Fino Payments Bank, when the latter acquired a 12.19 percent stake in PaySprint.

In FY22, its first full year of operations, PaySprint achieved an annual GMV of Rs 5,500 crore, stated a press release by Fino Payments during its funding announcement.

The startup, which works as a fintech Platform as a Service (PaaS), works on a transaction fee model charging .01 to 1 percent for every transaction. It also has an initial onboarding fee ranging from Rs 10,000 to Rs 50,000.

According to Anand, the company onboarded over 600 partners across banks, NBFCs, MSMEs, fintechs and various other startups during the year.

Team PaySprint

With over 18 years of leadership experience in the telecom industry, Anand moved to finance six years ago in 2016 he joined as Executive Vice President and Business Head - Payments and Remittance for Eko India Financial Services, a fintech company.

Four years later, Anand founded PaySprint, which is now a 40-member team with over 10 employees on the technology side and three on product development.

Market opportunity

According to IBEF, India’s digital lending stood at $75 billion in FY'18, and is estimated to reach $1 trillion by FY'23 driven by the five-fold increase in digital disbursements. By 2025, India's fintech market is expected to reach $83.48 billion (Rs. 6.2 trillion).

Anand has an ambitious goal of achieving a massive Rs 20,000 crores in revenue this FY, and a market share of approximately 10 percent of API banking.

He further adds that API banking currently is at $150 billion in transactions, expecting a growth of 22 percent year on year for the next five years.

PaySprint competes with the likes of Razorpay, , to name a few.

Edited by Anju Narayanan

![[YS Trend] Hot off the oven: New-age platforms entice retail investors with solar biscuits](https://images.yourstory.com/cs/2/628912e0d7f211eb8e8307e5b6451cf7/SolarInvestmentCover-1695052373255.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)