It’s spring at ah! Ventures despite the funding winter

Early-stage investment platform ah! Ventures is busy scrutinising around 300-400 startup proposals every month as well as getting more investors into its fold.

The mood within the Indian startup ecosystem is sombre—venture capital firms are keeping their purse strings tight and companies are cutting down costs. However, investment platform says it is business-as-usual at the firm and that it is scrutinising about 300-400 proposals every month.

While, the slowdown of funding into startups is evident, very early stage investment category is still seeing plenty of action—about $4.5 billion in capital is awaiting deployment.

Mumbai-headquartered ah! Ventures is one such early-stage investor that’s seeing its business activity remain constant. “From a network perspective it is business as usual as a lot of startups are coming to us and we listen to them,” Amit Kumar, Partner, ah! Ventures tells YourStory.

In June, ah! Ventures announced the launch of its maiden angel fund with a corpus of Rs 100 crore and a greenshoe option of Rs 50 crore to invest in early-stage and Pre-Series A startups.

This new fund will be sector agnostic and will invest Rs 3-5 crore each in 30-35 startups.

The beginning

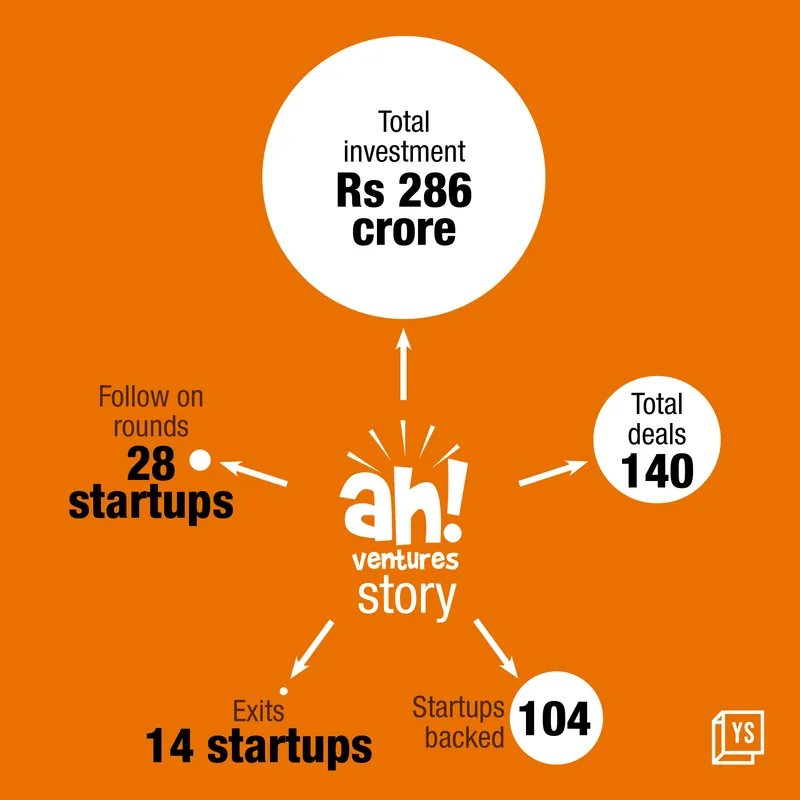

ah! Ventures, launched by Abhijeet Kumar and Harshad Lahoti, began its investment activity in 2012-13, and has so far been part of 140 deals worth Rs 286 crore.

Typically, it gets into the early stage of investment with an amount in the range of Rs 3-3.5 crore.

Amit claims that only 11 startup investments, out of the 104, have been a bust.

A sector agnostic platform, ah! Ventures has backed startups across fintech, edtech, B2B (business-to-business), media, and ecommerce among others.

The investment company has had about 14 exits while 28 of its portfolio startups have raised follow-on round of funding. It has backed companies such as fresh fish and meat e-retailer Zappfresh; baby products and parenting platform Baby Chakra and customer engagement company Exotel, among others.

“We believe in giving an opportunity for anybody to come to our platform and as an early stage investor it is better to be sector agnostic,” says Amit.

India has several angel investing platforms such as Indian Angel Network, and Mumbai Angels as well as other accelerators and incubators. According to Amit, the strongest point of ah! Ventures is its curation process of the startups.

Investment philosophy

As part of its investment process, ah! Ventures typically looks at the 3 Ps—people, product and potential. Amit says it is very important for ah! Ventures to understand the mindset of founders on how passionate they are about running a business.

At the same time, ah! Ventures says it also looks at how the product or service of a startup can be turned into an implementable activity in the market and lastly, at the potential of these startups.

Amit says, “We do not run a deal unless we have our sectoral experts give their opinion on any startup.”

The due diligence process of ah! Ventures, which is done both internally and externally, is rigorous, the co-founder adds.

Added to this, a wide portfolio of investors on its platform provides the specialised expertise where sometimes its core team of venture partners may not be adequately equipped.

“We have investors both from India and abroad who are happy to invest in startups. There are now more people who are joining this asset class,” says Amit. According to ah! Ventures, the investors are largely the HNIs, UHNIs and family offices.

On asked about advice for startup founders, Amit says that the community tends to be enamoured by the product without necessarily focusing on market validation.

He says it is important for a startup to create value first before even starts chasing valuation. And lastly, Amit wants these entrepreneurs to focus on the financial and business model of their startups.

“The only tangible thing for any business are the numbers,” remarks Amit.

The startup ecosystem has gone through wild swings starting from 2020 to now, as funding so far in 2022 has been muted compared to the highs of 2021. According to Amit, investors are being cautious, but there are opportunities for founders to raise capital.

“VCs have the money but it will take some more time for the positive attitude and sentiment to come back,” says Amit.

Edited by Affirunisa Kankudti