Decoding RBI's guidelines for digital lending

Put together by RBI's Working Group on Digital Lending, the guidelines focus heavily on protecting and informing borrowers, to ensure their data isn't used for anything but the specific function it was meant for.

Hello Reader,

The battle between blue and green continues. And no, this isn’t about any sport. These are the colours iPhones use to denote texting within the iOS ecosystem (the royal, elite blue) and outside, i.e., Android (the common, lowly green).

A Google campaign has now accused Apple of creating a “substandard experience” of texting between iPhone and Android users by refusing to adopt RCS (Rich Communication Services), a cross-platform messaging protocol that was meant to solve ageing SMS and MMS standards.

In other news, Motorola is finally revealing its newest foldable Razr 2022 at the company’s launch event in China. And if the rumours are true, it is going to be cheaper than its first variant.

This comes on the heels of Samsung’s launch of its latest foldables—Galaxy Fold4 and Galaxy Flip3—at the Samsung Galaxy Unpacked event last night. While the South Korean manufacturer does seem to have the edge (and a greater share) in this segment at the moment, it is too soon to rule out the Razr.

After all, who can forget the iconic Motorola Razr, which went on to become the best-selling clamshell phone in the world?

Tell us, what do you think about foldable phones?

RBI’s guidelines for digital lending platforms

The Reserve Bank of India came out with a set of guidelines for regulated digital lenders and entities. While loan disbursals can now be executed only between the bank accounts of borrowers and entities such as banks, NBFCs, and microfinance institutions, all fees and charges have to be paid directly by the regulated entity and not by the borrower.

The digital lending guidelines were put together by the RBI's Working Group on Digital Lending, constituted in January 2021, to study issues related to online lending.

Greater transparency:

- If a complaint is not resolved within 30 days, consumers have the option to lodge a complaint.

- All costs pertaining to the loan must be disclosed to the borrower.

- Loan platforms need to provide a cooling-off or look-up period to borrowers.

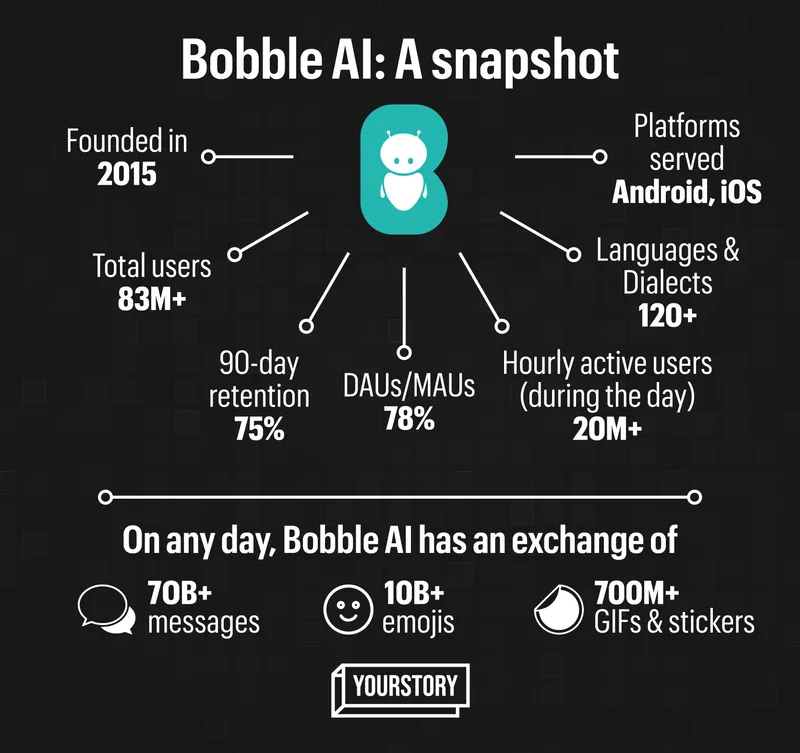

Inside Bobble AI’s bet on conversational commerce

For AI-powered , conversational commerce is the future of online shopping. The startup offers Indic keyboards that allow users to type in Indian languages, supporting over 120 languages and dialects including Hindi, Bangla, Marathi, Malayalam, Tamil, and Punjabi.

“Our idea of commerce is through the keyboard within the same interface. Keyboard as-a-platform suitable in picking up real-time intent, on the basis of what the user is acting on in the smartphone and giving personalised suggestions,” co-founder Ankit Prasad says.

Smart keyboard:

- ‘Super Assist’ icon introduces super keyboard that aggregates services such as payments, shopping, or product services.

- It processes user data from 20 million users to generate signals and insights, and earns from it.

- 70 billion messages, with 10 billion emojis and 700 million GIFs and stickers, are exchanged on a daily basis.

Brewing for success: Meet Graduate Chaiwali

When economics graduate Priyanka Gupta started selling tea outside Patna Women’s College, many questioned why she wasn't finding a job. But she didn't give up, and with Rs 30,000 in hand, she started .

Now Graduate Chaiwali sells over 300-400 cups of chai daily. The menu is limited for now with four variants of tea, which includes the best-selling pan chai, elaichi chai, rose chai, and chocolate chai.

Chai pe Charcha:

- Priyanka managed to make approx Rs 1.5 lakh profit.

- She scaled her business to open a second outlet.

- Recently, actor Vijay Deverakonda made a visit to Priyanka’s tea stall.

Priyanka Gupta making chai at her stall

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!