PhonePe-Flipkart separation hammers Walmart's holiday quarter

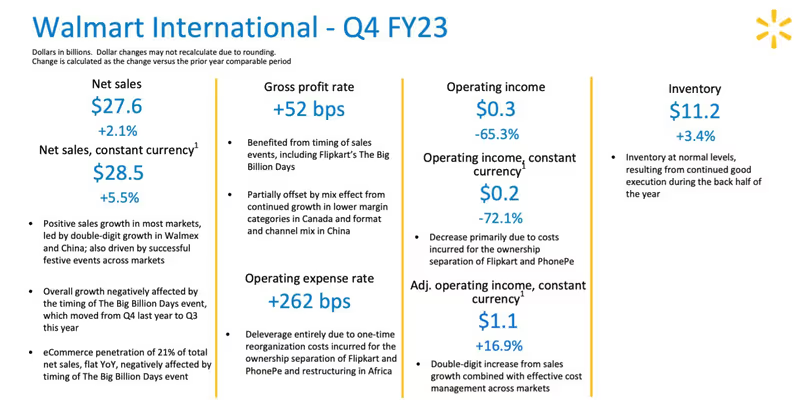

The ownership separation of Walmart's Indian entities, Flipkart and PhonePe, contributed to the decline in fourth-quarter operating income at its international business.

Walmart International's business took a hit in the fiscal fourth quarter with its operating income plunging 65.3% mainly owing to the separation of its Indian entities and .

The Bengaluru-based online marketplace and the fintech startup announced a full ownership separation of PhonePe in December. Flipkart and PhonePe continue to operate under US-based Walmart, which remains the largest shareholder in both.

Operating income for the three months ended January 31 fell to $300 million from about $800 million in the corresponding year-earlier period, primarily because of the “costs incurred for the ownership separation of Flipkart and PhonePe,” the company said announcing its quarterly earnings report.

Walmart Inc shares fell in early trade on NYSE after the company projected weaker earnings for the ongoing fiscal year and reported a second year of declining profit, signalling a troubled year for the wider retail sector.

The US retail giant and other PhonePe shareholders faced capital gains tax of nearly $1 billion after the digital payments company shifted its headquarters to India in October, followed shortly after by its separation from Flipkart, which had acquired it in 2016.

Walmart Inc became the majority owner of PhonePe after acquiring parent firm Flipkart in 2018.

PhonePe CEO and Co-founder Sameer Nigam had earlier said the company had to pay Rs 8,000 crore in taxes to the Indian government after it shifted its domicile.

Walmart International's net sales in the fourth quarter inched up 2.1% to $27.6 billion, affected by Flipkart's decision to advance its flagship Big Billion Days sale to the third quarter.

Courtesy: Walmart

“The consolidated operating expenses as a percentage of net sales decreased 44 basis points primarily due to strong sales growth and lower Covid-related costs, partially offset by reorganisation and restructuring charges incurred in the international segment,” Walmart said.

Overall, the US retail giant reported strong revenue growth globally in the fourth quarter, with stores and ecommerce having a strong showing. Total revenue was $611.3 billion—up 7.3%.

Consolidated operating income for the Walmart group in the quarter decreased by 5.5% to $5.6 billion.

Global advertising business in the fiscal year 2023 grew nearly 30% to $2.7 billion, led by Walmart Connect in the United States and Flipkart Ads.

Edited by Kanishk Singh