[Weekly funding roundup Jan 30-Feb 3] Venture capital inflow remains low amid macro headwinds

The absence of any encouraging policy initiatives from the Union Budget and uncertain global macroeconomic conditions has kept the venture funding inflow low.

The month of February has begun on a sour note for the Indian startup ecosystem as expectations were riding high from the Union Budget, but most of their key recommendations were not addressed. This was reflected in the low funding raised in the first week.

In addition, the irritant of Angel Tax has once again resurfaced in Budget 2023, as the government recommends that all investments into private companies by non-residents of the country will now come under the purview of this tax and exemptions will be given based on certain conditions.

This has set the alarm bells ringing as the Indian startup ecosystem is still very much dependent on overseas capital, and certain reports indicate the investor community will be approaching the finance ministry for further clarification.

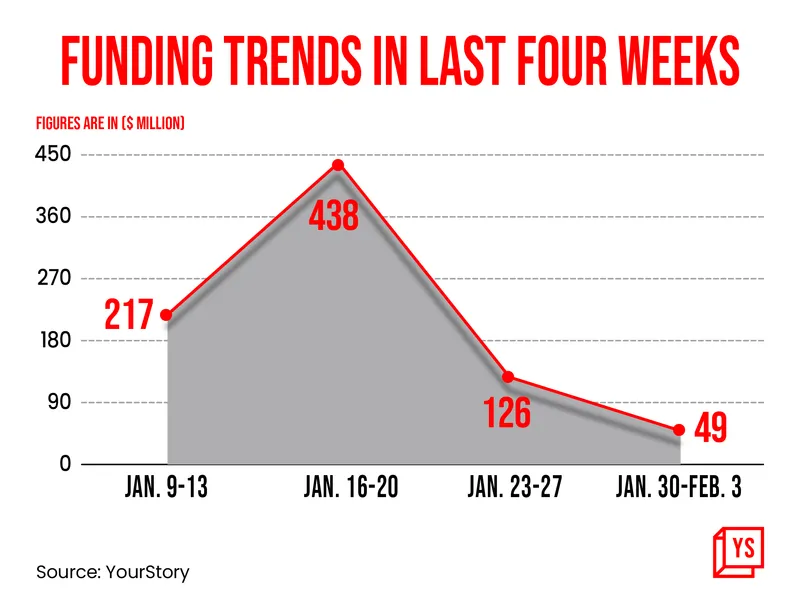

The first week of February saw a total venture funding of just $49 million as against $126 million in the comparable previous week.

Now, it remains to be seen how the funding activity will pick up in the coming weeks as the broad macroeconomic indicators do not inspire too much confidence. The financial results of leading technology companies such as Amazon, Meta, and Alphabet were also below expectations.

According to a media report, Tiger Global, a leading VC investor in startups globally, has marginally scaled down its plan to raise a new fund from $6 billion to $5 billion.

These measures are likely to have a bearing on the Indian startup ecosystem—not only in terms of funding but also in the startups' ability to create new jobs. Startups across segments have already resorted to layoffs fearing recession and the funding winter.

The only positive in the entire scenario is the capital raised by VC firms, specifically for Indian startups. The figure is now near $6 billion, and many founders expect this money to start flowing into the ecosystem soon.

Key transactions

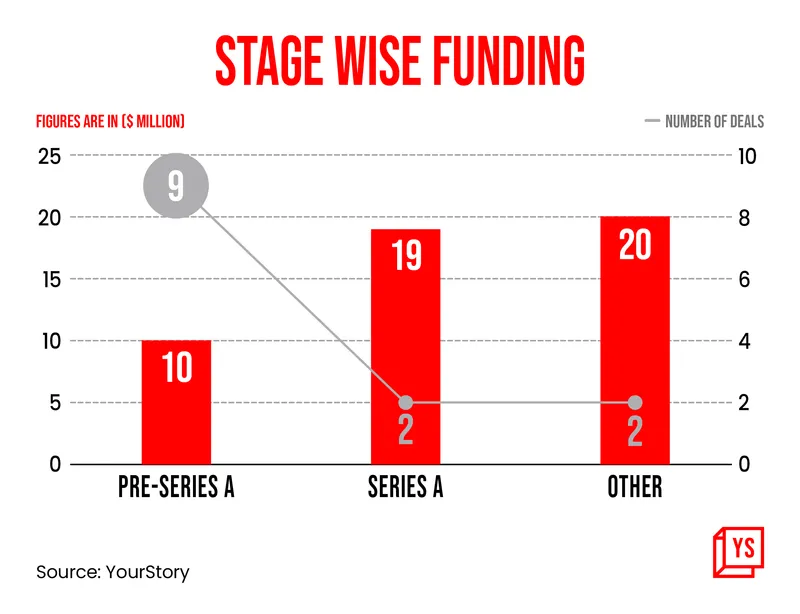

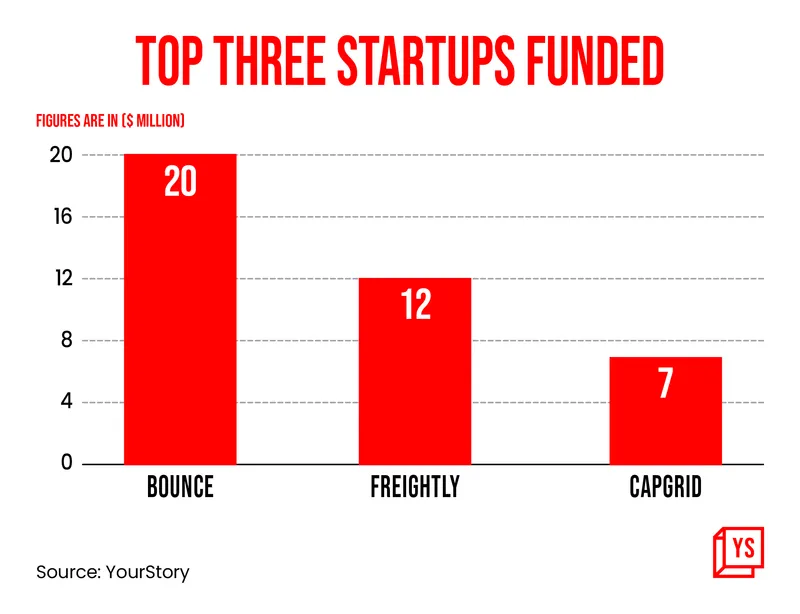

SaaS startup Freightify raised $12 million in Series A funding from Sequoia Capital India, TMV, Alteria Capital, Nordic Eye Venture Capital, and Motion Ventures.

CapGrid, a B2B startup, raised $7 million from Nexus Venture Partners, Axilor, Anicut Capital, and angel investors.

Edited by Kanishk Singh

![[Weekly funding roundup Jan 30-Feb 3] Venture capital inflow remains low amid macro headwinds](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)