[Weekly funding roundup] SVB developments increase uncertainty level on VC fund-flow into startups

The venture funding environment for startups saw another round of instability with the latest happenings at Silicon Valley Bank and this may have a bearing on the capital inflow.

The developments surrounding US-headquartered Silicon Valley Bank (SVB) have sent tremors across the Indian startup ecosystem and may worsen the present environment of a funding winter.

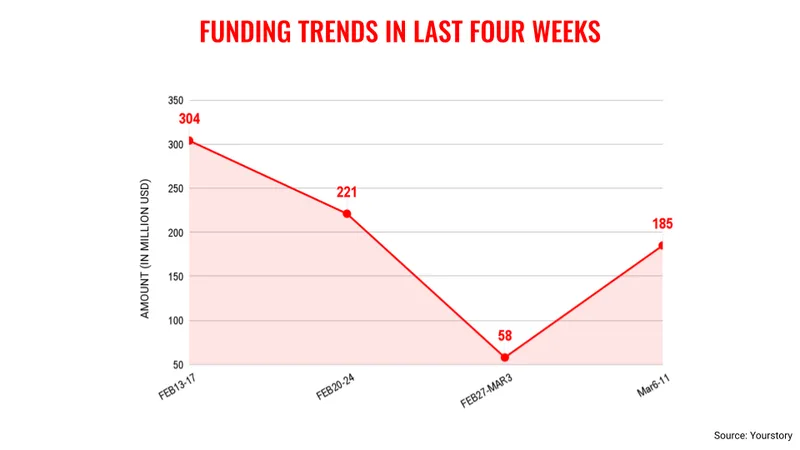

The venture funding trends suggest that over the last four weeks, the Indian startup ecosystem is yet to show any meaningful size of capital coming into these companies.

For the second week of March, the total venture funding stood at $185 million and this was largely due to the single transaction of Mintifi. In comparison, the previous week saw venture funding of $58 million.

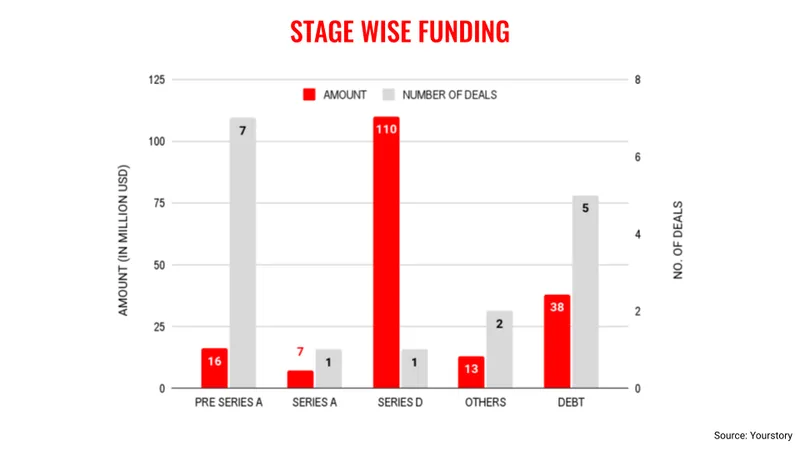

Outside of the transaction, most of deals were around $10 million in value. This has been the trend over the last 18 months where early stage investment has seen the highest traction among the investors.

During the week, venture debt made a kind of comeback with a value of $38 million when compared to the similar period of previous week. If one removes the transaction of Mintifi, debt is the segment which saw the highest transaction during the week. The increased reliance on debt by startups is largely because the founders do not have to dilute equity and also keep their valuation intact.

Now, the entire focus will be on how the developments around SVB will unfold. The startup ecosystem will be hoping for a swift closure to the entire saga. If not, any prolonging of the crisis will only accentuate funding woes.

These developments are a setback for the Indian startup ecosystem as there was expectation that there would be some sort of revival in the funding environment in the second half of the year.

Key transactions

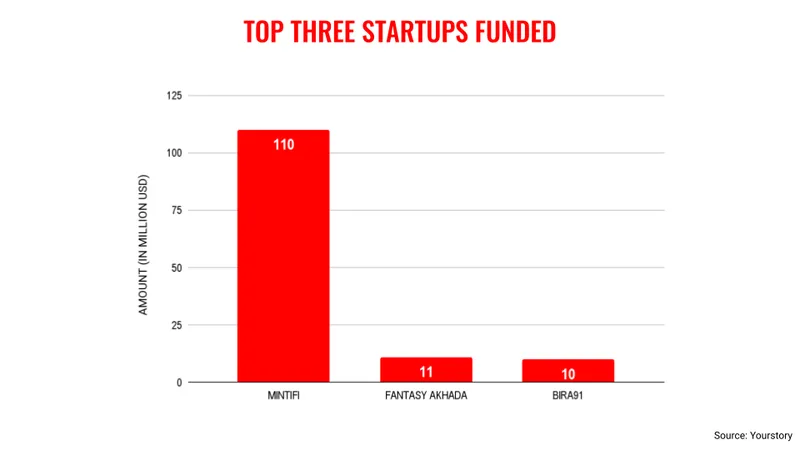

Supply chain financing platform Mintifi raised $110 million from Premji Invest, Norwest Venture Partners, Elevation Capital, and International Finance Corporation (IFC).

Fantasy gaming platform raised $11 million from Florintree Advisors, Mukul Agrawal of Param Capital and the family office of GMR Group.

, a premium beer company raised $10 million from Japan's largest bank MUFG Bank.

Disclaimer: This story was updated to correct a formatting error.

Edited by Akanksha Sarma

![[Weekly funding roundup] SVB developments increase uncertainty level on VC fund-flow into startups](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-roundup-1670592545805.png?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)