(Weekly funding roundup) Venture capital investments decline by 74%

The absence of any positive indicators on the macroeconomic front has led to a depressed environment with regard to venture funding into startups

Bad news for the Indian startup ecosystem does not seem to end as the month of March began on a very dismal note with a 74% decline in venture funding on a weekly basis.

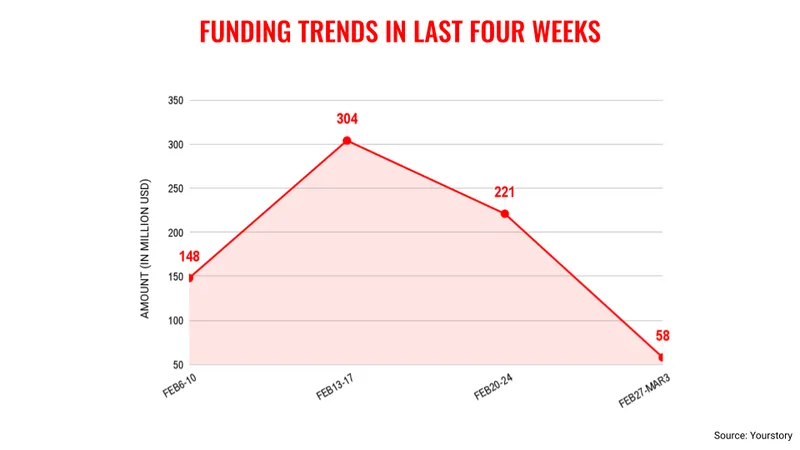

The venture funding into Indian startups for the first week of March came in at just $58 million with 17 transactions. In comparison, the previous week total venture funding of $221 million.

This is the second time this year that total venture funding on a weekly basis has come down to double digits. In the first week of February it had touched $49 million. Even funding on a monthly basis has seen a steep fall with 77% decline in February.

The startup ecosystem is very much under the grip of “funding winter” and there are no signs that it is going to end anytime soon. Even the global macro-economic indicators are not showing any positive developments as indications are that the US Fed will continue with its interest rate hike to bring inflation under control.

This has a direct bearing on the fund flow into startups as money supply is constrained and there is an abundance of caution among investors to put in their money.

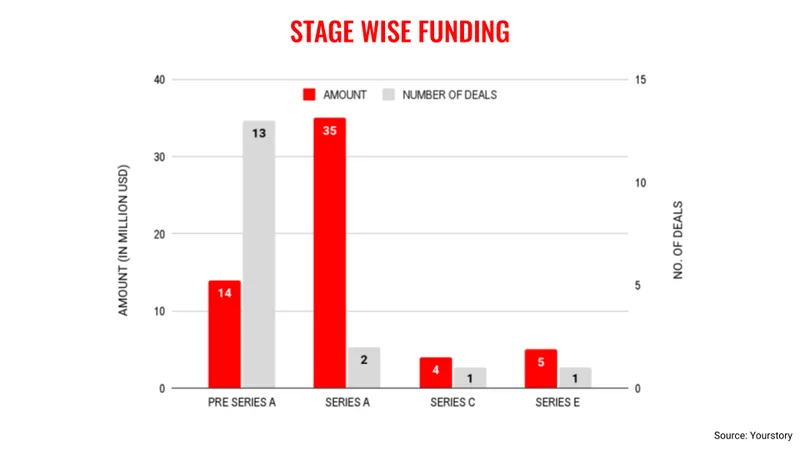

Investors believe this is a period which will test the resilience of the startup founders as they will navigate through this downturn, though they added that “good” entrepreneurs will continue to receive funding. In the current environment, only the early stage category of funding continues to see traction.

The only positive news in the present situation has been venture capital firms like B Capital and Nexus Venture Partners announcing new fund raises to invest in Indian startups. This gives hope that at least the future remains bright.