[Weekly funding roundup April 10-14] VC inflow into startups remains muted

The second week of April did not witness any uptick in VC funding as investors continue to remain cautious amid the prevailing macroeconomic uncertainty.

Like the preceding months, April has also been lacklustre when it comes to funding inflow. The month has not witnessed any major uptick in the flow of venture capital into Indian startups as investors remain cautious in light of prevailing macroeconomic uncertainty.

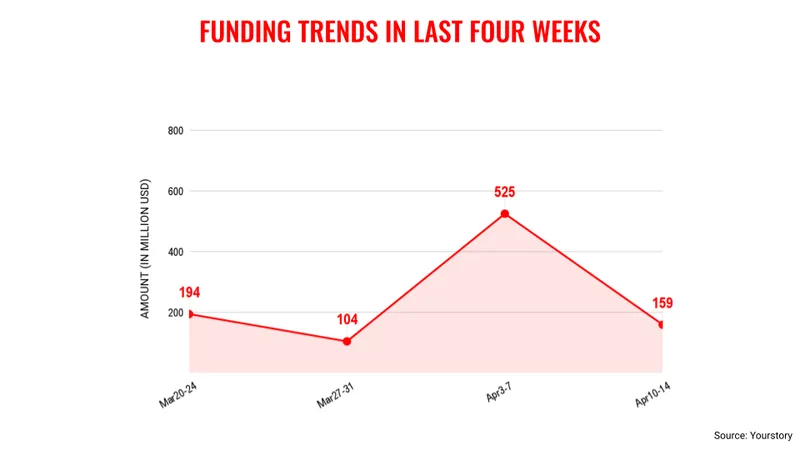

The second week of April saw the Indian startup ecosystem receiving $159 million in VC funding across 22 deals. The capital inflow crossed $100 million thanks to grabbing additional funding as has been since January this year as the fintech company has been continuously stocking up on funds, and this momentum is likely to continue.

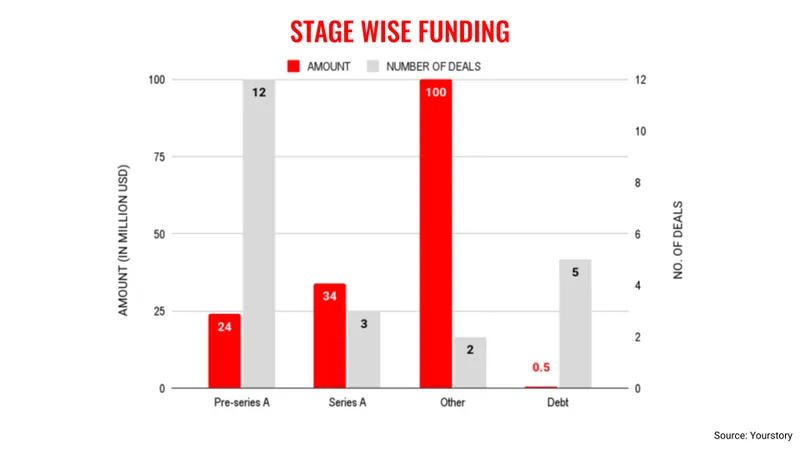

Large deals are now rare to find, and those Indian startups which score $100+ million deals are already in the unicorn league. This trend is likely to continue for some more time as much of the funding activity is largely centred around the early-stage category.

The global downturn and recession fears have led investors to play on the back foot, and many are even visibly spooked, with reports stating that Tiger Global might look at completely exiting from some of its key investments in India.

Globally, there are reports that SoftBank is looking at exiting Alibaba, the Chinese ecommerce giant.

Given the present environment, it is unlikely that there would be any quick turnaround in the situation as the macroeconomic headwinds continue to remain strong. The muted financial results of Indian IT companies like TCS and Infosys are a direct consequence of a slowing economy in the US and Europe. This naturally has a bearing on the capital from these geographies into Indian startups.

Key transactions

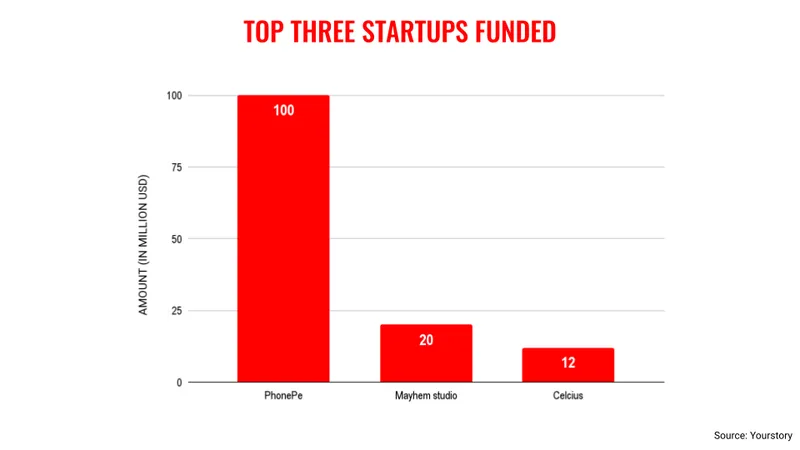

Fintech unicorn PhonePe raised $100 million from its existing shareholder General Atlantic and co-investors.

Mayhem Studios, a mobile game development studio, raised $20 million from Sequoia Capital, Steadview Capital, Truecaller, and others.

Cold chain marketplace Celcius Logistics raised Rs 100 crore ($12.2 million) from IvyCap Ventures.

Workspace interiors platform OfficeBanao raised $6 million from Lightspeed.

Edited by Kanishk Singh

![[Weekly funding roundup April 10-14] VC inflow into startups remains muted](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)