Cashfree’s Akash Sinha on RBI rules, reverse flip, offline entry

As payments and API banking solutions provider Cashfree awaits for RBI’s go ahead to resume onboarding new merchants, it looks to roll out multiple tools in 2023, including a B2B BNPL product, besides picking up plans to enter offline payments market.

The growth trajectory of SBI-backed hit a snag late last year when the Reserve Bank of India (RBI) asked it, along with other payment gateways, to pause onboarding new merchants until it received its full Payment Aggregator licence.

That was five months ago.

Payment gateway providers, which had obtained in-principal approvals for a payment aggregator licence last September, are still waiting a final clearance of their licence. Along with payments and API banking solutions provider Cashfree, Razorpay and Stripe were sent the notice to pause onboarding while Paytm and PayU were asked to submit fresh applications for licence.

Despite the uncertainty, Cashfree’s Co-founder and CEO Akash Sinha remains unfazed as the startup is focussing on non-payments products and new services.

“It’s a once-in-a-lifetime event for payment companies. From a long-term perspective, we don't anticipate a lot of damage. We are confident to be back in a stronger way, just waiting for things to start,” Sinha tells YourStory.

“There was some audit requirement which companies were supposed to undergo. We have done the work,” he says. “As of today, we are waiting to hear back from the RBI on the next steps. We are trying to engage with them.”

Bengaluru-headquartered Cashfree, which is backed by SBI and Y Combinator, also has hit a pause on fundraising plans as it says it has enough capital to sail through the uncertainty. The startup has raised over $42 million since its inception in 2015. It last received an undisclosed infusion from SBI in June 2021.

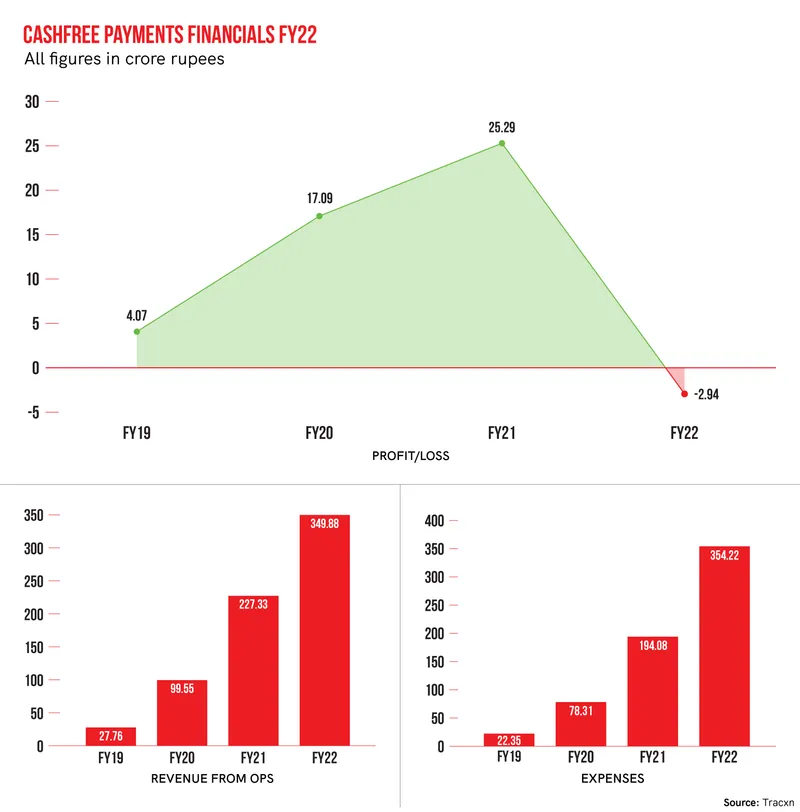

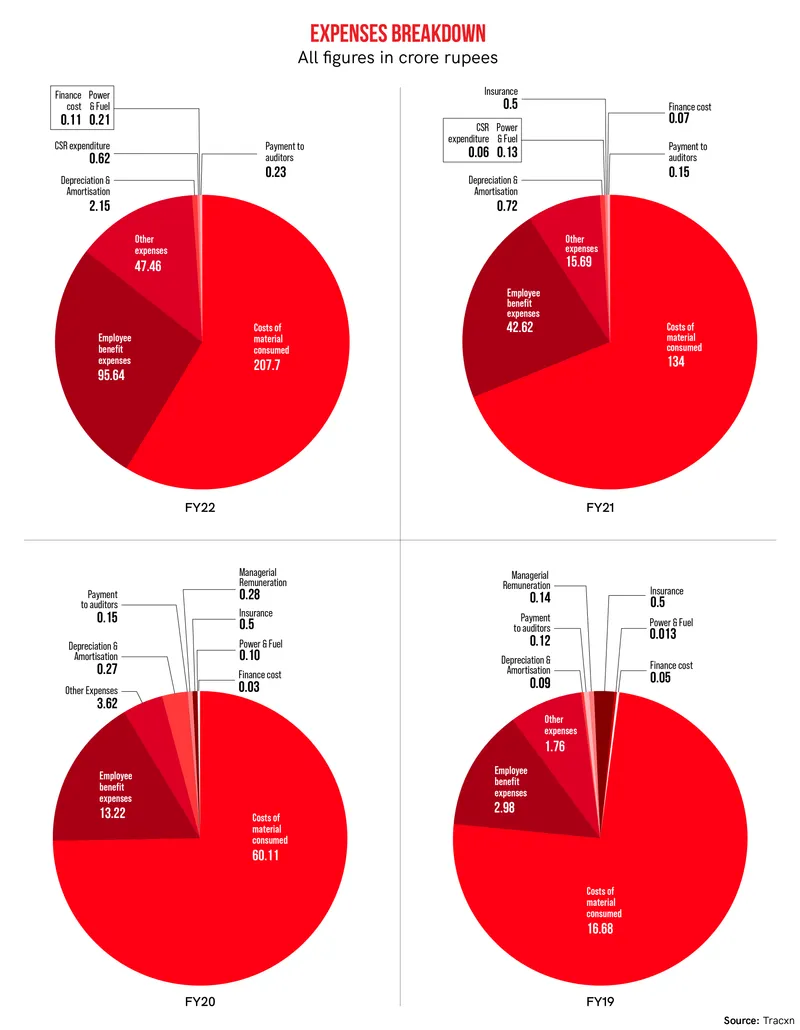

The startup posted a profit for five consecutive years. Last financial year, however, it registered a loss of Rs 2.94 crore, even as the revenue grew by over 53% at Rs 349.8 crore from Rs 227.33 crore in FY21.

Cashfree declined to comment on the loss.

The full impact of RBI’s order will be visible in the fintech's upcoming FY23 results.

Besides payment gateway, the seven-year-old fintech firm today offers a bouquet of services to merchants, including payouts, collections, verifications services (for banks), reimbursements, loyalty and rewards.

With over three lakh merchant clients, it processed 1.6-2 billion transactions last year. Its clientele includes brands such as CRED, Nykaa, Shell, and Zomato.

In the last year, Cashfree has expanded its offerings—launching a global collection service for exporters, a card issuance stack for fintech companies, along with a BNPL (Buy Now, Pay Later) suite, besides other tools for digital lending like escrow management and tokenisation solution, many of which clocked over 3X growth since launch, says Sinha.

Even its second acquisition in February, Zecpe, a one-click checkout startup, is in line with the company's goal of strengthening capabilities for D2C (Direct-to-Consumer) merchants. Earlier, Cashfree had picked up a majority stake in UAE-based PSP (Payment solution Provider), Telr to build a presence in the MENA (Middle East and North Africa) region.

“There was a lot of momentum last year. We have been able to grow 80-100% roughly on top-line numbers. A lot of scaling has been done in terms of both processes and technology which is reflected in growth. We have merchants who process 18,000 orders per minute. We hit a position where we can manage up to 40,000 leads a month,” the co-founder added.

Offline market aspirations

Payment gateway startups are increasingly trying to become omnichannel providers—offering a single platform for businesses to accept online as well as offline digital payments, such as PoS (Point of Sale) machines, tap and pay and QR codes.

Sinha says the startup wants to focus on online payments for now.

“We have been trying to make headway in the offline market by trying new products, but they are still not fully ready. It is something we want to do, and we have done things in the past but not at a large scale to make that bigger stride,” he adds.

In 2022, Cashfree launched a beta version of ‘softPOS’, a PoS solution for businesses including grocery stores, retail shops, food delivery apps, automobile industry, and NBFCs.

Next mission: Embedded payments

This year, Cashfree wants to introduce ‘embedded payments’ solutions for developers, which will help companies streamline payments integration.

Currently, developers struggle with integrating payments into the tools (say an accounting tool or a reservation system) they build for online businesses due to limited knowledge of compliance.

As a result, online businesses or merchants separately integrate payment systems themselves. “We are building tools for developers to make these integrations easy, and offer a full product, with embedded payments systems. We are going to build the SDKs and APIs, and some partnerships are already in place,” the CEO says.

Reverse flipping: Joining the bandwagon?

The trend of “reverse flipping”—Indian startups moving their domicile back into India from more tax-friendly countries like the US, Singapore, and the UAE—has been the talk of the startup town.

After PhonePe, the latest to join the list include RazorPay, Cashfree’s direct competitor, and investment tech unicorn, Groww—both backed by US accelerator Y Combinator.

Also controlled by its US-based holding entity Cashfree Inc, the Indian subsidiary Cashfree Payments may not be joining the bandwagon, at least for now.

“We haven’t given a very strong thought to it, maybe because we are not at that stage. It depends on the companies and the kind of market they want to focus on, and it makes sense to be in that market,” Sinha says.

B2B BNPL, expansion and IPO

Apart from strengthening its existing consumer BNPL suite, Cashfree is also working on building a Business-to-Business (B2B) BNPL product.

The company expects 4-5X growth in the BNPL segment. In December last year, Cashfree introduced a BNPL suite for online merchants for them to offer financing options to customers at checkout. It claims to have partnered with about 18 players, including ZestMoney, Homecredit, KreditBee, Simpl, LazyPay and Freecharge, and banks for various financing modes.

“This product is also helping us target a certain category of merchants. We are looking at a lot of growth this financial year once we start onboarding new merchants,” says Sinha.

Cashfree is looking at a mix of "build and buy" strategy to boost its product suite for merchants.

As for regional expansion, Cashfree plans to build a presence in the SEA (South East Asia) market next. For now, it says it is observing the market.

“We will wait for six more months and then start being more active. Right now, we are in a bit of passive mode in these markets because they are also evolving with local developments. So we are watching the changes,” says Sinha.

A public listing is not on the company’s current to-do list either.

“The focus is on getting more market share. IPO is a few years away. We are trying to be number one players in the payments industry and that’s the near term goal. Once we achieve that, then we can give the IPO plan a thought,” Sinha says.

As for the larger payments gateway ecosystem, the CEO says that fraud, risk management and compliance are the next big focus of the startup even as they build new products to cater to the growing digital payments market.

Edited by Affirunisa Kankudti