Nykaa's Q4 profit falls 71% YoY to Rs 2.4 Cr hurt by rising expenses

A tax expense of Rs 4.4 crore further weighed down Nykaa's bottom line, CEO Falguni Nayar told investors, adding that the quarter also saw lower consumer demand.

Beauty retailer Nykaa's profit in the fourth quarter fell 71% to Rs 2.4 crore, down from Rs 8.5 crore in the year-ago period, hurt by increased expenses, as well as a slowdown in consumer spending and stagnant demand for fashion and beauty products.

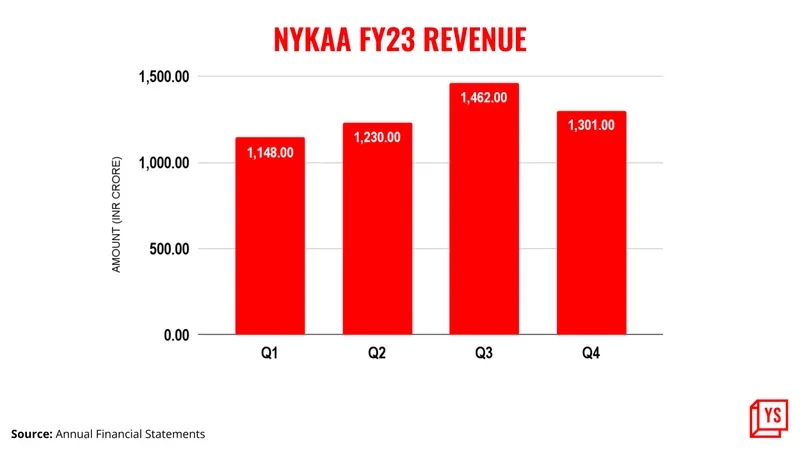

The Mumbai-based retailer's revenue rose 33% to Rs 1,301 crore in the same period.

For the financial year ended in March, the company reported a 36% increase in revenue to Rs 5,143 crore, while its profit more than halved to Rs 19.2 crore from Rs 41 crore last year.

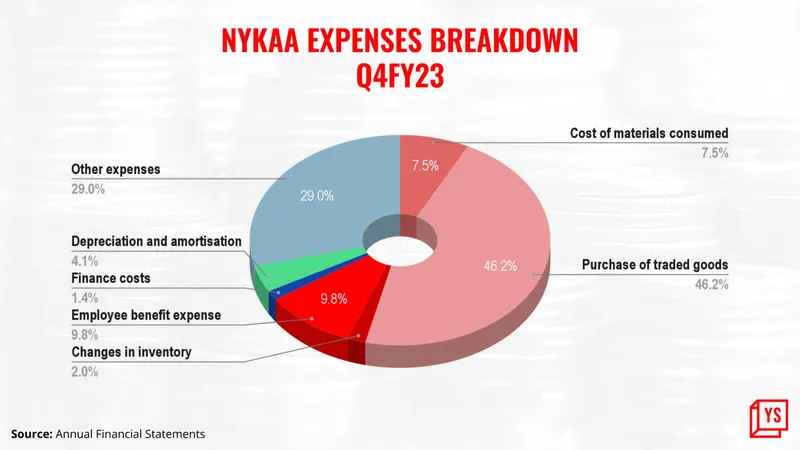

Expenses in Q4 shot up to Rs 1,302 crore, a 33% jump from Rs 978 crore in the same quarter last year, while reported a 36% increase in its FY23 expenses to Rs 5,135 crore compared with last year.

A tax expense of Rs 4.4 crore further weighed down the company's bottom line, CEO Falguni Nayar told investors on Wednesday, adding that this quarter also saw lower consumer demand than the last, which had been driven by festive discounts and events.

An increase in expenses related to offline expansion—including the cost of fulfilment centres and warehouses—also impacted the company's bottom line. As of March, Nykaa spent Rs 18.2 crore on setting up retail stores under its beauty and fashion brands while Rs 32.4 crore was used for expanding warehouses, the company said in a regulatory filing.

The purchase of traded goods was the highest expense for the retailer last quarter at Rs 601 crore, followed by other expenses and employee benefit expenses.

During FY23, Nykaa acquired three companies—an 18.5% stake in Earth Rhythm for Rs 41.6 crore in May, a 60% stake in Nudge Wellness for Rs 3.6 crore in June, and a 100% stake in Iluminar Media for Rs 29 crore in September.

The company's overall gross merchandise value (GMV), on the other hand, grew 36% YoY to Rs 2,445 crore in the fourth quarter, while the GMV for the whole fiscal stood at Rs 9,743 crore against Rs 6,933 in FY22. (GMV refers to the total worth of all the goods and services sold on the platform without factoring in discounts and other such aspects.)

Beauty and personal care

Beauty and personal care (BPC), Nykaa's biggest segment, recorded a quarterly GMV growth of 29% to Rs 1,628 crore, and a yearly increase of nearly 33% to Rs 6,649 crore in FY23.

Average order value (AOV) for FY23 stood at Rs 1,857, in line with last year, while order volume grew 31% to 3.4 crore. "Growth in the segment was driven by four main factors—increase in per-capita beauty consumption, shift in traction from personal care to beauty, shift between online and offline formats, and a transition to an organised system of ecommerce," said Anchit Nayar, CEO of Nykaa's BPC segment, told investors.

The segment has more than 3,400 brands listed on the platform, with about 31 FMCG and direct-to-consumer (D2C) brands forming part of the top 100, the company said.

Pink Love, Nykaa's flagship beauty products sale hosted on account of Valentine's Day every February, saw an annual rise of 131% in GMV. More than 2,000 brands participated in the sale this year, according to Anchit.

Nykaa also expanded its physical store footprint in the BPC segment to a total of 60 cities last quarter, which helped its offline retail GMV jump 67%. It is betting big on its house of brands model—similar to a private-label strategy—to help grow the topline, Anchit said.

Fashion

Nykaa's fashion segment witnessed a slow quarter and year with a marginal rise in its quarterly GMV to Rs 664 crore from Rs 482 crore while its annual GMV rose 47% to Rs 2,569 crore.

"At Nykaa Fashion, FY23 was a year of peaks in investments and losses," said Adwaita Nayar, CEO of Nykaa Fashion, adding that it is a 'natural part' of business and the team is now 'turning things around'.

The house of brands section—which includes Nykd, Kica, and Twenty Dresses—grew by 141% in GMV to Rs 331 crore in FY23. Additionally, the company expects its private-label fashion business to break even next year, CEO Falguni Nayar told investors.

On the other hand, while Nykaa's business-to-business vertical, Super Store, witnessed a 15x rise in the number of orders, it still contributes insignificantly to the firm's overall revenue.

In FY23, it received 72 lakh orders, up from just 4.2 lakh last year while the number of retailers on the platform rose to over 1 lakh from 18,000 in FY22.

Earlier this year, Nykaa saw a slew of senior-level exits, including Manoj Gandhi (Chief Commercial Operations Officer), Vikas Gupta (Chief Executive Officer of wholesale business), and Gopal Asthana (Chief Business Officer of the fashion division). In January, Nykaa appointed P Ganesh as CFO after Arvind Agarwal resigned from the post in November.

Nykaa's shares on Wednesday closed 2.6% lower at Rs 125 apiece. The stock, which was listed on November 9, 2021, at a price band of Rs 1,085-1,125 per share, witnessed its 52-week-low at Rs 114.25 earlier this year. Its 52-week high was at Rs 257.17.

(This is a developing story and will be updated with more information.)

Edited by Saheli Sen Gupta