Good Capital launches $50M second fund; to invest in startups leveraging AI

Good Capital has already raised $22 million as the first close of the second fund with the participation of limited partners largely from overseas.

Good Capital, the New Delhi-headquartered venture capital firm focused on seed-stage funding, launched its second fund with a target size of $50 million, along with a greenshoe option of $25 million.

It has already raised $22 million as the first close of the second fund with the participation of limited partners largely from overseas.

This second fund will focus on investing in startups that leverage AI for distribution, personalisation, or business operations.

Good Capital General Partner Arjun Malhotra said it aims to invest in about 25-30 startups from various sectors from the second fund. It had invested in around 20 startups from its first fund.

It will invest in the range between $100,000 going all the way up to $1.2 million, taking the position of a lead investor in any startup.

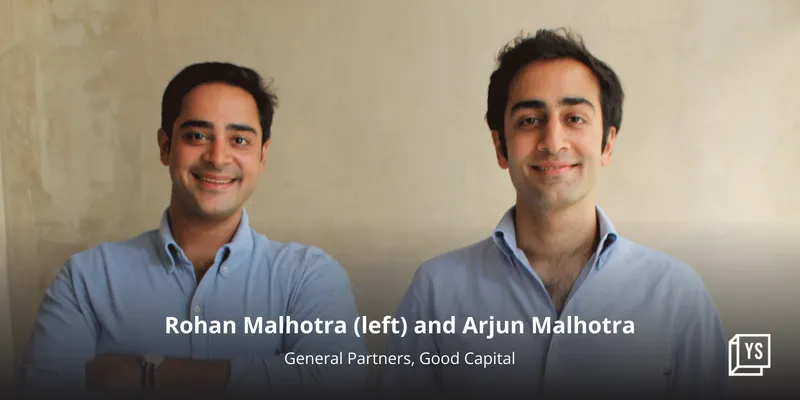

Founded by Arjun Malhotra and Rohan Malhotra in 2019, Good Capital raised $25 million in its first fund. It has many notable startups in its investment portfolio, including Meesho and LEAD School, among others.

According to Malhotra, a few of its portfolio companies have raised capital from leading VC firms. For instance, OrangeHealth raised Series A funding from General Catalyst and Accel Partners, SimSim, which was acquired by Google, and SolarSquare, which raised a $13 million Series A funding led by Lowercarbon and Elevation Capital.

“Integrating AI is now table stakes for any startup. Much like the platform shift to mobile in the past, the success of tech businesses will depend on how they leverage AI”, said Malhotra. “This isn’t an AI-focused fund as much as a recognition of a land-grab moment, where startups leveraging AI in intelligent ways will have the right to win.”

Edited by Suman Singh