Only 29% of seed-funded startups raise Series A capital: Venture Intelligence

According to Venture Intelligence, 2022 witnessed 801 seed investments, down 7% from 858 deals in 2021, but 35% above the average of 593 deals in the past seven years.

Less than one in three startups that secure seed-stage funding can manage to raise a follow-on Series A funding round, a report by Venture Intelligence noted on Friday. However, once a startup attracts a Series A round, its success ratio in raising subsequent rounds improves significantly.

The study titled “Series A Landscape Report” said, “Out of the over 2,500 startups that had raised seed funding between 2015-2022, only 29% (i.e., 734 companies) managed to raise a Series A round (typically the first round of institutional venture capital funding).”

The study noted that about 50% of the companies that raised a Series A during the 2015-2022 period succeeded in raising a Series B round. Similarly, 62% of the startups that attracted a Series B round also obtained a Series C round. Of these, 70% managed to raise Series D and beyond rounds.

“The total number of Series A deals is a good barometer of the ecosystem’s maturity and a lead indicator for the scale and quality of companies getting built,” said Ganapathy Venugopal, CEO of Axilor Ventures.

The number of companies raising Series A rounds grew at a CAGR of 8% in the five-year period from 2017 to 2022. Despite a funding slowdown in 2022, the number of Series A investments during the year (289) was up 7% compared to 2021 (which saw 269 investments) and 30% above the average of 224 deals recorded in the last seven years.

According to Venture Intelligence, 2022 witnessed 801 seed investments, down 7% from 858 deals in 2021, but 35% above the average of 593 deals in the past seven years. Seed investments grew at a CAGR of 13% in the five-year period from 2017 to 2022.

“The study highlights how the Indian early-stage funding ecosystem has matured tremendously in recent years. Despite the current slowdown, the number of funding options available to startups in the early stage is much richer compared to even three years back,” said Arun Natarajan, Founder of Venture Intelligence.

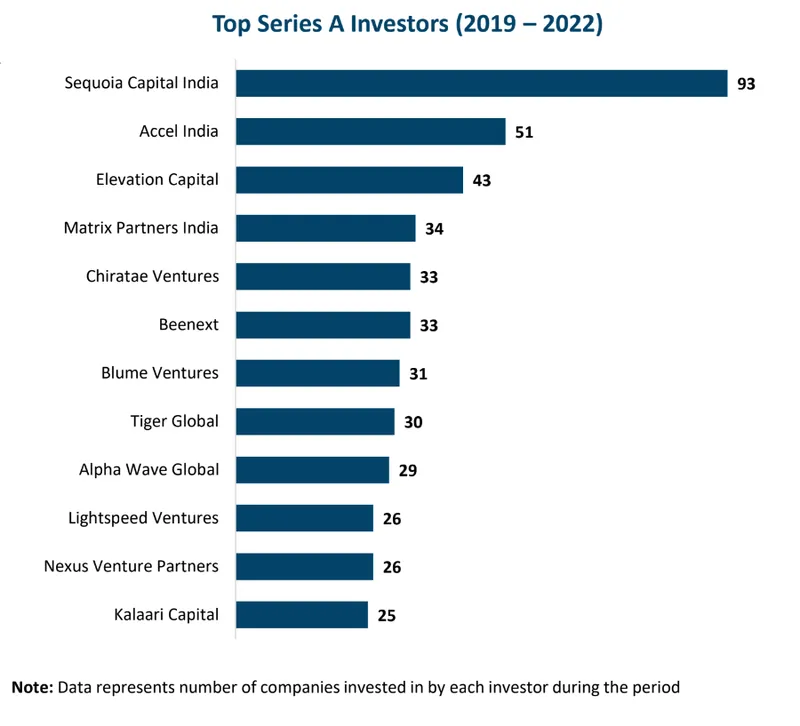

Sequoia Capital India topped the list of most active Series A investors during the four-year period spanning 2019-22, being a part of as many as 93 Series A rounds. In 2022, it made 24 Series A investments.

Besides Sequoia Capital India, Accel India and Elevation Capital completed the top three Series A investors list in both the 2019-22 period and calendar year 2022.

Edited by Suman Singh