Agritech startup funding declines by third, deal count falls 42% in 2022: Report

Agri-business marketplaces and agri-fintech were the most popular upstream categories among investors; farmtech investments were also strong, according to the report by VC firms Agfunder and Omnivore.

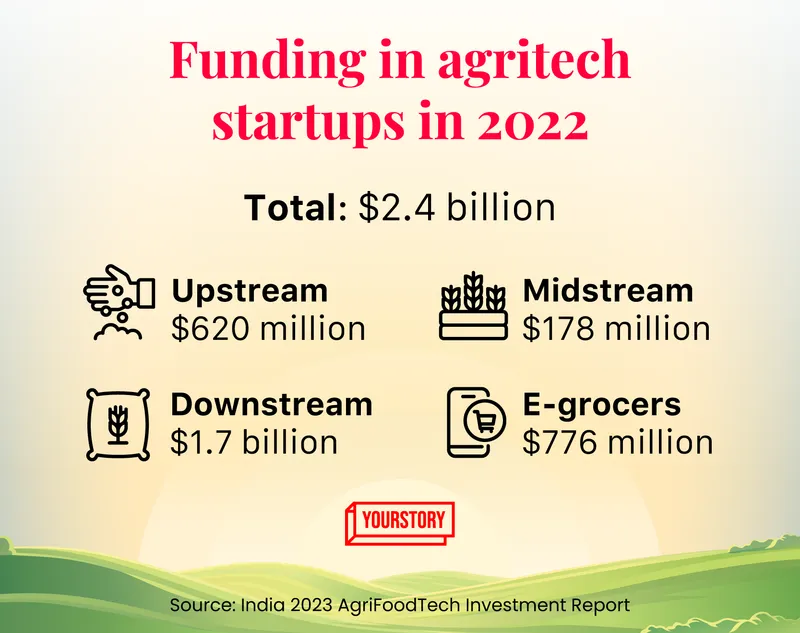

Agriculture and foodtech startups raised a total funding of $2.4 billion in 2022, a 33% decline from the $3.6 billion secured in 2021. The total number of deals declined to 133 last year from 230 in 2021, according to a report by venture capital firms Agfunder and Omnivore.

The decline in investments in the agritech space matched the fall in VC funding in other startup sectors including healthtech, fintech, and direct-to-consumer brands. However, investors are keeping a close eye on specific sectors, including those focused on farmers and climate change.

"Rising concerns around the impact of climate change on Indian agriculture have captured the attention of investors, catalysing efforts to deliver affordable mitigation and adaptation solutions for smallholder farmers," the report said.

Startups innovating upstream, closer to farmers and across the supply chain, bucked the downward trend witnessed globally, raising $620 million—up 50% from $409 million in 2021. Farmtech investments also remained relatively strong, raising $1.1 billion in 2022, which was a modest 15% drop from the previous year.

Agri-business marketplaces and agri-fintech were the most popular upstream categories among investors, the report said. Upstream startups provide resources including finance to farmers.

Downstream startups, which include companies offering products and services across the value chain—from farm to consumers—saw a 37% plunge in funding in 2022 compared to 2021.

Food delivery startups waned mainly due to consolidation and the lack of innovation, the report said. Once the pandemic lockdowns ended, many downstream ventures struggled to maintain the accelerated pace of growth created during the COVID-19 months in 2020 and 2021.

"A highly saturated home delivery market has further reduced investor interest. In the coming months, we expect fewer players to enter the downstream market and more M&A activity among existing companies," the report said.

Meal marketplaces and e-grocery were the most funded downstream categories yet again. The capital raised by these two categories accounts for 54% of total funding in Indian agri-foodtech, with e-grocery startups landing the highest number of late-stage deals. E-grocery startups raised $776 million across 20 deals, accounting for 32% of overall agri-foodtech funding in India, according to the report.

Food delivery firm Swiggy raised $700 million in January 2022 and has committed to investing heavily in its quick commerce vertical Instamart. Mumbai-based Zepto, which offers 10-minute grocery delivery, raised $200 million in May 2022.

Infographic by Winona Laisram

Midstream technologies deal activity decreased though the category remains active with $178 million raised across 14 deals. Midstream startups help the middlemen in the agriculture value chain, especially in distribution and marketplace functions.

"It is a challenging funding environment for startups globally and, as our report shows, India is no different. The relative increase in upstream financing is a welcome bright spot and reflects the urgency to fund technologies addressing the multiple inefficiencies in our food production and distribution systems that contribute to climate change and hunger," said Michael Dean, Founding Partner at AgFunder.

"Across India’s agri-foodtech ecosystem, 2023 will stress test startups while also being an ideal vintage for VCs who can enter promising deals at cheap valuations. Despite the transient headwinds, agri-foodtech in India will continue to surge ahead," said Mark Kahn, Managing Partner at Omnivore.

(The copy was updated for clarity and with an infographic.)

Edited by Kanishk Singh