[Weekly funding roundup June 12-16] VC investments rise sharply thanks to Lenskart

The overall funding momentum in the Indian startup ecosystem remains uneven, and any boost is largely due to a single large transaction.

Venture capital funding into Indian startups is uneven this year given the uncertain investment environment, and this is reflected in the capital inflow this month.

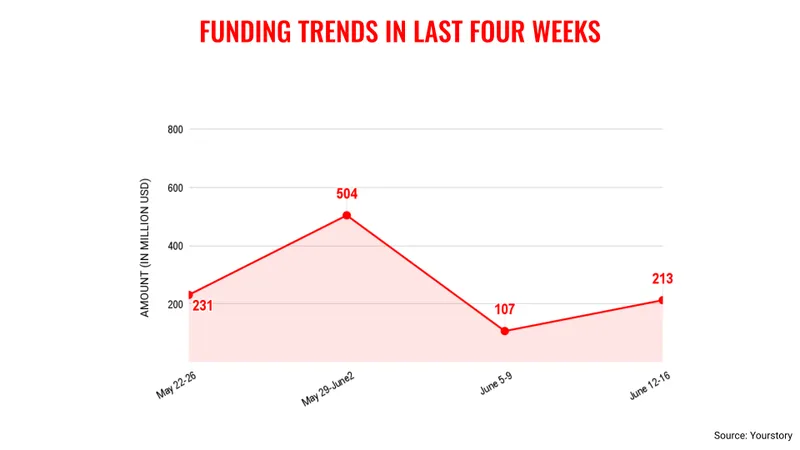

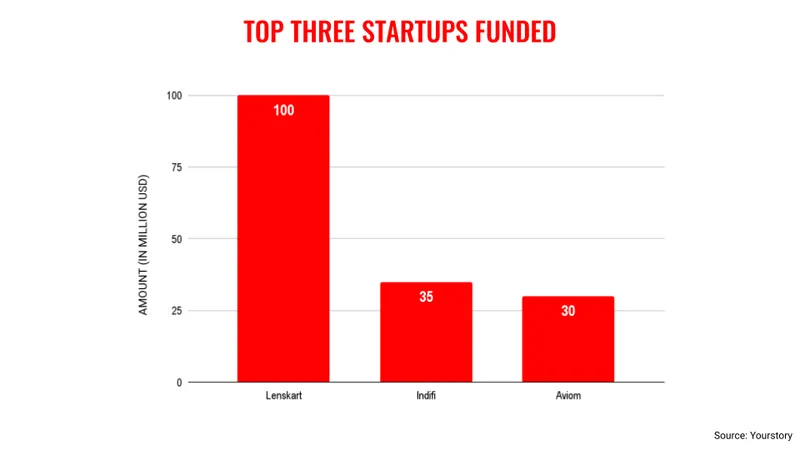

The third week of June saw venture funding totalling $213 million spread across 23 deals. The boost came largely from the $100 million infusion into . In comparison, the investment inflow in the previous week stood at $107 million.

With high interest rates, the Russia-Ukraine war and rising inflation keeping the macroeconomic environment tough, venture capital inflow has been uneven, to say the least. The majority of the transactions are in the early-stage category—high in volume but low in value. This is why there's a scarcity of unicorns emerging from the Indian startup ecosystem.

The trend is expected to continue for another six months, and any uptick in funding momentum may well start in 2024.

Meanwhile, the Indian startup ecosystem continues to take in the split of the global Sequoia Capital empire. Even well-known investor Chamath Palihapitiya of Social Capital expressed surprise over the decision of separating the India unit from the marquee VC firm’s ambit.

The India unit—now rebranded Peak XV Partners—is confident of remaining a top VC player in the country despite not having the backing of the parent company. Bejul Somaiah of Lightspeed Venture Partners remarked that 'India is a tough market and not for the faint-hearted though worth all the experience'.

Key transactions

Eyewear brand Lenskart raised $100 million in funding from private equity firm ChrysCapital, taking its overall capital infusion to $850 million within the past year.

Fintech startup Indifi Technologies raised Rs 290 crore (approx $35 million) from ICICI Venture, British International Investment, and OP Finnfund Global Impact Fund I.

Aviom India Housing Finance, a micro-mortgage lender backed by C4D Partners, raised $30 million led by Nuveen.

Mumbai-based fleet supplier Everest Fleet raised a $20 million funding round led by ride-hailing platform .

HomeLane, a home interior solutions startup, has closed a bridge round of Rs 75 crore ($9.1 million) from its current investors.

Edited by Kanishk Singh

![[Weekly funding roundup June 12-16] VC investments rise sharply thanks to Lenskart](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-roundup-1670592545805.png?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)