[Weekly funding roundup June 24-30] VC investment hits another low

The month of June did not end on a positive note with venture capital funding touching another low.

The month of June ended on a disappointing note as venture capital funding into Indian startups dipped to another low amid the absence of large deals.

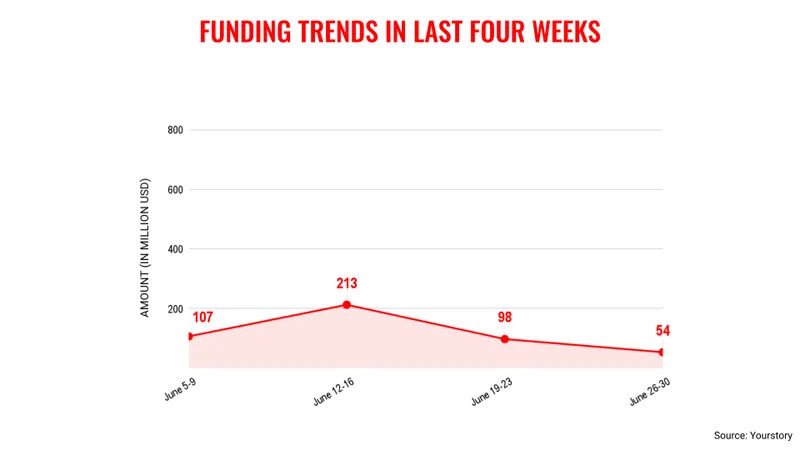

The last week of the month saw total venture funding of $54 million spread across 14 deals. In comparison, $98 million were raised in the previous week saw total funding of $98 million.

This dip in venture funding certainly comes as a disappointment for the Indian startup ecosystem. However, the optimist would say that it is a sign that VC funding is bottoming out and an upswing is in the near future.

The hope comes from the fact that venture capital firms have raised fresh capital from investors including RTP Global, Omnivore, Epiq Capital, and Good Capital.

Industry observers believe there is enough liquidity in the ecosystem but investors are still unsure of restarting an active fund flow given the prevailing negative sentiment.

The spotlight is on the developments concerning edtech unicorn . The company is battling the resignation of its statutory auditor, awaiting the release of debt funding, layoffs, and interest payments on the $1.2-billion term loan B among other things.

On the other hand, drone maker Technology had a stellar IPO and this may signal confidence to other startups planning to go public.

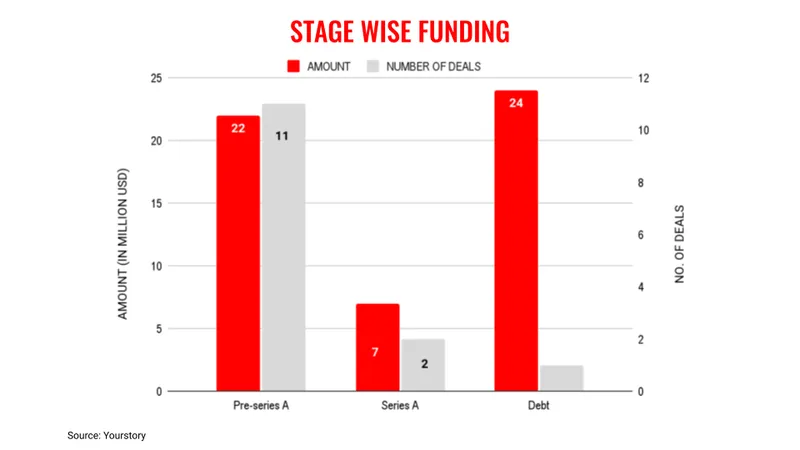

Overall, the funding environment still remains challenging. The large number of funding deals worth $50+ million and $100+ million as witnessed in 2021 are unlikely to come back anytime soon.

Key transactions

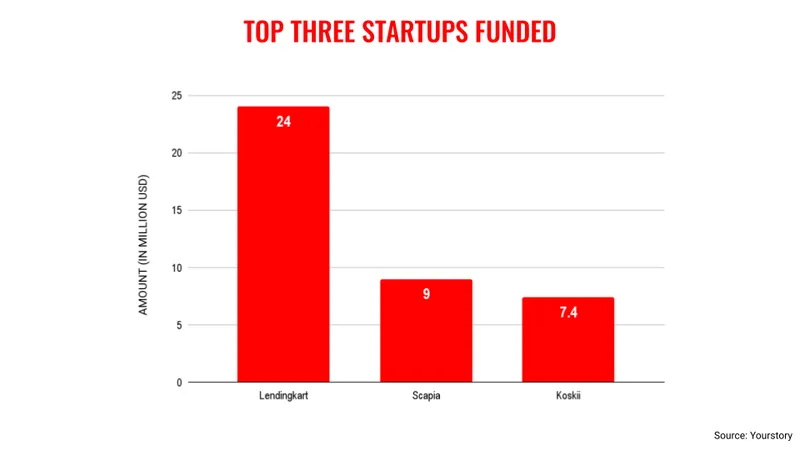

Fintech startup Lendingkart raised Rs 200 crore in long-term debt funding from the financing platform EvolutionX Debt Capital.

Credit card and travel rewards platform Scapia raised $9 million from Matrix Partners India, Tanglin Venture Partners, and Binny Bansal’s 3STATE Ventures.

Koskii, the Bengaluru-based women’s occasion-wear brand, has raised Rs 61 crore ($7.4 million) in a Series A round of funding led by Baring Private Equity Partners India.

Edited by Kanishk Singh

![[Weekly funding roundup June 24-30] VC investment hits another low](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)