Subsidy mess has pushed electric two-wheeler makers into the ICU, says Hero Electric’s Sohinder Gill

The deadlock between the government and a handful of electric two-wheeler makers over the distribution of subsidies has led to a massive financial crunch, and many players are unsure if they can keep the lights on for another day, says Hero Electric’s CEO.

Key Takeaways

- Sohinder Gill says Hero Electric is in the process of raising Rs 2,000 crore in funding and is looking actively for strategic investors.

- Blockade of subsidies has led to investors losing confidence in India's EV story, he says.

- According to him, 10,000 people could be laid off if the subsidy issue isn't resolved.

- EV two-wheeler sales hit their lowest in 12 months in June 2023, as per e-governance platform Vahan.

Hero Electric’s Sohinder Gill is fervently vocal about the Indian government’s handling of the electric vehicle (EV) subsidies, guaranteed by the FAME II scheme. He says the distribution of subsidies by regulators to manufacturers has been “inadequate”, especially after manufacturers have already passed on the benefits to customers, digging into their own pockets.

Although he wants to cling to the belief that the government has honourable intentions for the FAME II scheme, the last few months have been tumultuous at , leaving him quite jaded and worried about the company’s future.

“We’re in the ICU now, this is the dire straits, and we’re barely hanging on,“ laments the company’s CEO, talking not only about Hero Electric but the wider electric two-wheeler (E2W) manufacturing sector as well.

Hero Electric was founded in 1998, but it began to really ramp up operations only around 2007-2009 when it launched a lead battery e-scooter. Its best-selling e-scooters today are Optima CX 2.0 and 5.0, which retail for Rs 1.06 lakh and Rs 1.29 lakh, ex-showroom, respectively.

Despite being from the stables of Hero Motocorp, a leader in the two-wheeler segment in India today, the company has been struggling financially.

In fact, Hero Electric has been searching for strategic investors to participate in its $250-million fundraise, which it hopes to close by the end of September this year. So far, it has been able to drum up only around $46.2 million.

Localisation caveat and its impact

The lead-up to the troubled times began in 2019, when the government put together the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, aimed at boosting EV adoption for personal and commercial mobility.

From a total capital outlay of Rs 10,000 crore, the scheme set aside Rs 2,000 crore for E2W manufacturers. However, nearly Rs 1,200 crore is yet to be paid out, points out Gill.

What really led to this “inadequate” distribution of subsidies—as Gill describes it—was the caveat related to localisation of the supply chain.

The government wanted at least 50% of E2W parts to be sourced from vendors and suppliers in India, in the hope that EV makers would continue to localise their supply chains, leading to a flywheel EV ecosystem of sorts.

Manufacturers hailed the decision too, postulating that it would lead to the highest level of quality control. Their only supplication to the government was that the deadline for reaching localisation be extended by 12-18 months.

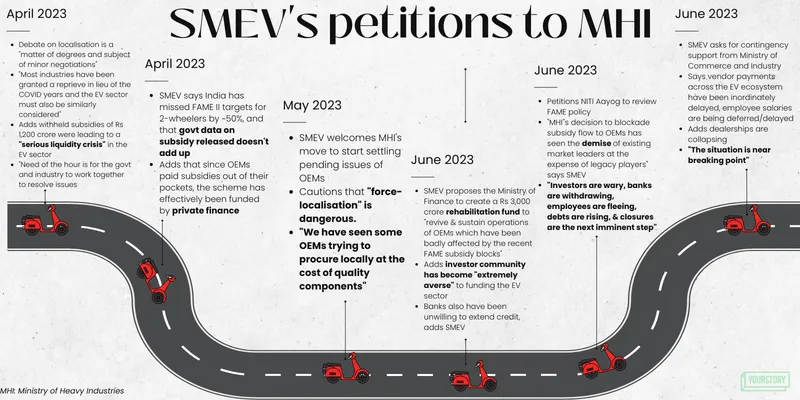

Industry body SMEV (Society of Manufacturers of Electric Vehicles), which is made up of players such as Hero Electric and Bajaj Motors Ltd, said in its petition, which requested an extension, that the supply chain for E2Ws in India had just started to take shape and achieving 50% localisation would take time.

In 2020, the government conceded, but it refused to entertain further requests for extensions beyond September 2022.

Gill says Hero Electric and several other manufacturers weren’t able to meet the localisation requirement by the government’s deadline. So, the company—and several other manufacturers—wrote to the government asking for its approval to let them keep working on setting up local supply chains, while they continued to offer discounts to customers.

They hoped that, when they reached the 50% localisation cutoff, the government would refund the subsidies they had already extended to customers.

“We took permissions to pass on subsidies to our customers and we disclosed to regulators that we were still working towards the prescribed level of localisation. The government green-flagged it,” says Gill.

However, several months after the government began distributing subsidies to eligible companies, there were media reports that the disbursal had been paused and an official investigation into alleged misappropriation of subsidies and non-adherence to localisation requirements had been launched.

There were also indications that some companies under the government scanner might be asked to return the subsidies they had received till then. These manufacturers are reportedly said to owe the government a refund cheque for Rs 500 crore.

Hero Electric has refuted the charges levelled against it, saying it is fully compliant with the law and that the issue was really a matter of “difference of opinion” pertaining to the interpretation of laws.

Gill also alludes to the presence of a ‘lobby’ that has been influencing and misleading regulators. “They have everything to lose with EVs becoming the dominant choice of transportation because it threatens traditional business models."

The two camps—the OEMs and the government—are still in talks with each other, and Hero Electric has said it welcomes all future discussions around its supply chain.

Struggling to stay afloat

The subsidy distribution mess, coupled with the recent decision by the government to slash FAME II subsidies on E2Ws from 40% to 15%, has acutely dented the ecosystem, says Gill, who is part of SMEV’s management committee.

Last month, when the subsidy reductions kicked in, E2W sales declined. Data from e-governance platform Vahan shows that sales in June 2023 were the lowest in the last 12 months, and down 57% from last month.

“It’s no secret that India is a price-sensitive market. The sticker price outweighs all buying decisions for the consumer, which is why the subsidies were important to make EVs affordable,” Gill says.

In a recent conversation with YourStory, Sudhendu Sinha, NITI Aayog’s adviser on infrastructure connectivity, transport, and e-mobility, had also said that, for India to realise its electric mobility goals, EVs have to become cheaper and cost-competitive—to the point where they are on par with combustion engine vehicles.

The absence of rebates for subsidies that have already been passed on to customers, coupled with the recent slashing of these incentives, have forced EV makers such as Ather Energy, Ola Electric, and Matter to hike vehicle prices.

Gill, who decided not to raise the price of Hero Electric vehicles, points out that a majority of companies had incorporated the subsidy discounts into the retail prices at their own expense.

If the reimbursements don’t materialise, these companies could face the prospect of having to shut shop or employing drastic cost-cutting measures to stay afloat, he adds.

“We could witness a significant loss of around 10,000 jobs in both large and small electric two-wheeler companies. Smaller, regional players may even face the unfortunate fate of shutting down entirely, and that could severely hamper consumer confidence in electric vehicles.”

Penetration into rural India by smaller players, in particular, is also likely to take a hit, he adds.

Hero's battles

All these developments seem to have affected Hero Electric’s financial stability and shareholder confidence, not just in the company but in the wider ecosystem as well. By Gill’s own admission, the company is in a cash crunch.

“Even though it may seem like we have a big name behind us, Hero Electric is a small company. Hero Motocorp has been supporting us, but we have to become sustainable by ourselves too, and that has been difficult the last year or so… It’s not just us… several others are worried about financials too.”

On the surface, it appears as though the EV mobility ecosystem is the flavour of the season among investors. While larger companies such as , and have raised big rounds of funding, smaller EV makers and ancillary services have also bagged lucrative deals—$5 million and above in pre-Series or early-stage rounds.

However, the run may not continue for long if investor confidence in the ecosystem dwindles.

Gill says that, in his conversations with foreign investors, he had sensed that they may be slowly losing interest in the India EV story.

“There’s a feeling that the government is not very serious about its India EV goals, even though we know that is not the case. The intention [to electrify mobility] is there, but investors are unsure of policy for EVs in India and don’t know how it will evolve,” he says.

Roadmap for the future

What does Hero Electric plan to do if the government does not sort out the subsidy issue?

The company will probably write it down as a liability, says Gill, but he cautions that this could spell doom for many others in the industry.

On its part, Hero Electric says it is considering the possibility of an accelerated initial public offering (IPO) to fulfil its capital needs as a “one-time reprieve” if things get too desperate; its IPO is currently slated for 2025-26.

Even as the company draws up other plans for the future, subsidies continue to be on its radar—for Gill hasn’t quite given up on this front.

Under his stewardship, Hero Electric is keen to initiate a dialogue with the regulators on the subsidy issue, along with the ten other manufacturers that have been under the government’s radar—including Okaya, Jitendra New EV, Greaves Electric Mobility, Avon Cycles, and .

(The copy was updated after a correction issued by the company.)

Edited by Swetha Kannan