Easy Guide to TDS TRACES Website Register And Login Information

TRACES website mainly integrates all the stakeholders/deductors, i.e., taxpayers, deductors, and pay account office, of the Income Tax Department for the overall work procedure based on TDS/TCS. The full form of the TRACES is TDS Reconciliation Analysis and Correction Enabling System.

TRACES website stands for TDS Reconciliation Analysis and Correction Enabling System.TRACES online portal connects all the stakeholders/deductors, i.e., taxpayers, deductors, and pay account office, of the Income Tax Department engaged in the implementation and administration activities related to TDS/TCS. The website is also widely used by the stakeholders of the tax department to download a variety of Forms, e.g., Form 16A, Form 16, and Form 26AS.

TRACES Website and its Uses

A range of activities can be carried out by both the taxpayers and TDS deductors on the TDS TRACES website. Some of the key services offered by TRACES are mentioned below:

- Form 26AAS Download Facility

- View Challan Status

- Refund Facility

- Filing of TDS Statements online

- Online Correction facility for OLTAS Challan and previously filed TDS returns

- Download consolidated file, Form 16, Form 16A, and Justification report (TDS deductors can use this only)

- Default resolution

TDS TRACES website offers a hassle-free online system for carrying out the tax-related activities for both the deductors and taxpayers. The legacy pen-paper systems have been replaced by this online TDS/TCS system as it is more accurate, reliable, and faster. Activities like PAN details and challan corrections can be easily made with this online rectification system. TRACES can also enable the deductors/taxpayers to see TDS /TCS credit along with PAN verification.

Key Services offered by TRACES Website

Here is a list of key links/services that are available to the registered TDS TRACES website users:

- Dashboard summary for deductor’s account

- TAN (Tax Deduction and Collection Account Number) online registration

- Default Resolution

- Viewing and Downloading Form 26AS

- Grievance resolution and registration

- Online filing of TDS statements

- TDS statements online correction

- Grievance registration and resolution

- TDS refunds

- Aggregated TDS compliance report

- Digital TDS certificates

The facilities/services provided by TRACES can be largely categorized into three distinct services:

- Tax Payer services

- PAO (Pay and Accounts Office) services

- Deductor services

Registration Procedure on TRACES for TaxPayer

Taxpayers/deductors/PAO can register on the TDS TRACES website for accessing varied online services available on the TRACES (TDS Reconciliation, Analysis and Correction Enabling System), Here are the key steps that should be followed for registration on TRACES:

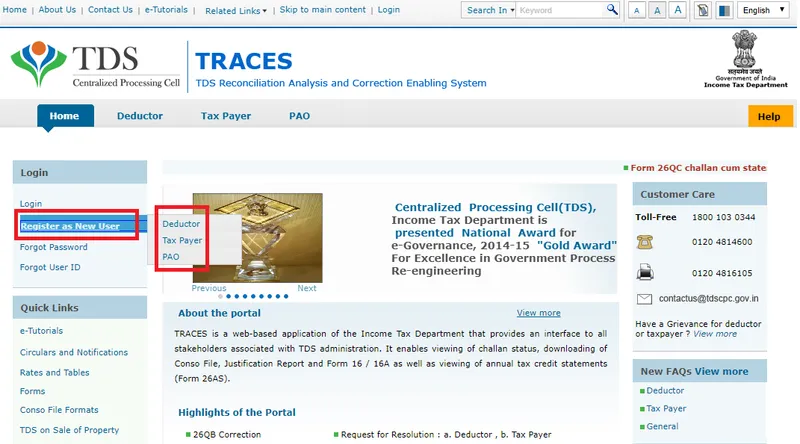

Step 1: Visit TRACES website and click on the register as a new link to open the option of registering as taxpayer, deductor or a PAO.

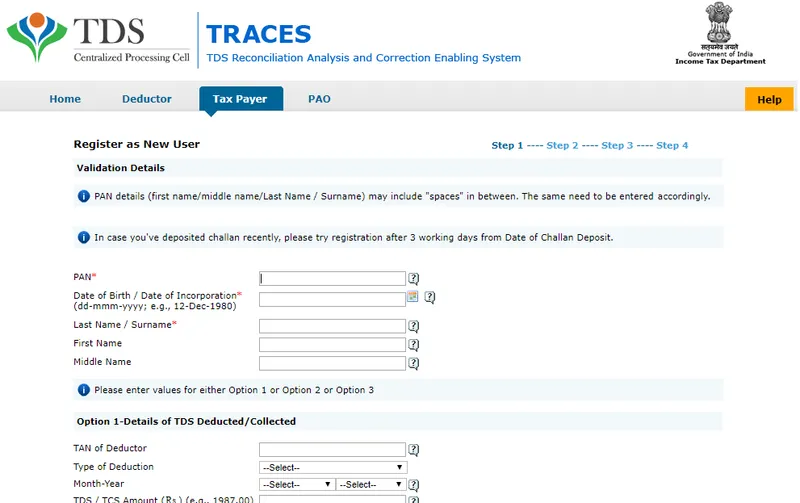

Step 2: If you click on the taxpayer option, then you will be directed to the page as given below:

Necessary details that must be filled by a Taxpayer for complete TRACES registration include:

- PAN Details

- Name of Tax Payer

- Date of Birth/Date of Incorporation

With the above mandatory details, any one of the following also needs to be completed by the taxpayer:

- Details of TDS deducted/collected

- Details of 26QB Statesmen

- Challan details that are used to deposit the tax by the taxpayer

Step 3: After the input details are filled accurately, the taxpayer must click on ‘Create Account’ option. Edit option can also be used by the taxpayer shown on the confirmation pop-up window in case if he/she want to make correction in submitted details.

Step 4: Once the confirmation is given, the account will be created along with an activation link that will be sent to the taxpayer’s registered mobile number and email id.

List of Services that Tax Payer can avail on TRACES

A taxpayer refers to a person or entity from whom the tax has been deducted by the deductor. Any individuals who have deposited tax can register on TRACES. The facilities that are available for taxpayers on the TRACES include:

- Registration facility

- Download Form 26AS

- Verify TDS Certificate

- View / Download Aggregated TDS Compliance Report

- Download Form 16B

How can Taxpayer Download Form 26AS on TRACES?

The taxpayers can view their tax credit online with the help of Form 26AS, which include details like:

- Details of tax deducted by the deductors and collectors on behalf of the taxpayer

- Refund details for a particular, fiscal year

- Transaction details for Mutual Fund, Shares and Bonds, etc.

- TDS Defaults in relation to the processing of statements

- Details of tax deducted for the sale of immovable property

TRACES Customer Care

- The Toll-free customer care number is 1800-103-0344

- Alternatively, customers can also raise their queries related to TRACES website with customer care on (+91)120-481-4600.

- Customers can also write an email to TRACES online help center at [email protected]

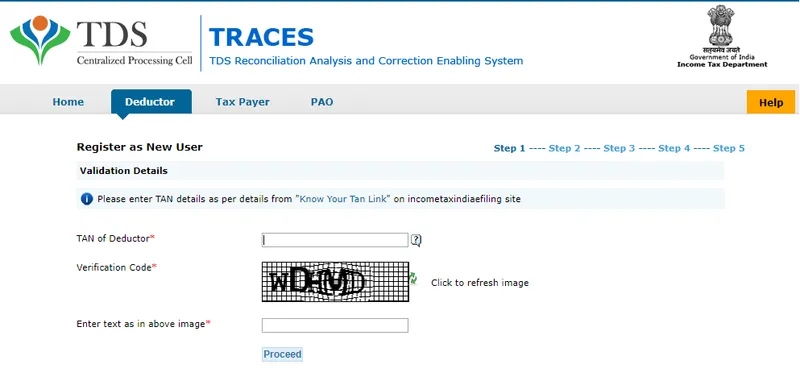

Registration Steps for Deductor on TRACES

- Visit TRACES website

- Select the ‘Register as New User’ link

- Click on the ‘Deductor’ option for user type.

- Fill mandatory details to register as deductor on TRACES website as given below:

5. Once the details are filled for each section, click on submit button to finish TRACES deductor registration.

6. An activation link will be sent on the user’s registered email id whereas separate activation codes will be sent to the registered mobile number and email id of the user.

7. Once the user receives the activation link, he/she must enter the user id along with the activation code

8. After activation, the users can easily log in to TRACES.

TRACES Services available to Deductor

A deductor under TDS refers to a person or entity, who is responsible for tax deduction at source on a specific payment date. Such tax deducted by the deductor is usually submitted to the income tax department in a pre-set time limit. The details of tax deducted also needs to be furnished to the income tax department in a statement by the deductor. The individuals required to file the electronic TDS are given below:

- Firms

- Government Offices

- Individuals must also get their accounts audited as per the 44AB of the Income Tax Act, 1961

- Deductors who are verifying records of more than 20 deductees for any given quarter for a particular fiscal year

Key activities that can be performed by the Deductor on TRACES include:

- Registration of Admin User for a TAN

- Creation of sub-users by Admin User

- Viewing of challan status

- Manage user profile and change password.

- Validate 197 Certificates

- Online Correction

- View PAN Master for the TAN

- View Statement Status

- Download Justification Report

- Download Form 16 / 16A

- View TDS – TCS credit for a PAN

- Provide feedback

- Offline Correction

- Declaration for Non – filing of Statement

- TDS Refund

Form 16/16A Download Facility on TRACES

The registered deductors on the TRACES website are also offered the facility to download Form 16/16A Via Gen TDS Software. These documents are used by the taxpayers to file their tax returns easily and also contain detailed information about tax deducted at source (TDS).

According to section 192 of the Income Tax Act, Form 16 is issued post-tax deduction by the employer on behalf of an employee in case the salary/income.

TRACES Justification Report and its use?

The details pertaining to defaults or errors identified by the income tax department (ITD) while checking the statements furnished by the deductors for a particular quarter are included in TRACES Justification report. This report also provides in-depth information about the errors that need to be rectified by the deductor. The deductor must file a correction statement along with the applicable interest/fee and other dues for rectification. Besides this, the information disclosed in the justification report can also be used by the deductor to give clarification in relation to the ‘errors’ picked out by the tax authorities.

Login Procedure for Registered TAN User on TRACES

If a particular user has already registered on TAN (Tax Deduction and Collection Account Number), then here are the key steps that he/she must follow for login into TRACES:

- VIsit the TDS- CPC Portal.

- Click on the ‘Login’ button.

- Enter the login ID, Password along with the TIN and click on the ‘Go’ button.

- Click on the profile menu

- Provide deductor details like PAN NO, DOB, etc. and click on the ‘Submit’ option.

- Confirm the details and click on the submit button.

- An activation link will be sent on the registered email id of the user whereas activation code will be sent on both the registered mobile number and email ID.

- Visit the activation link and enter the User ID along with the received activation codes.

- Once such details are entered, the user can successfully login to TRACES.

Role of Admin User on TRACES

When a TAN is registered on the TRACES for the first time, the admin user role is created. This role can also be created after furnishing TAN details to an assessing officer.

Role of Sub User on TRACES

Admin user registered on TRACES has the authority to create a sub-user role on TRACES. As per the rule, a maximum of four sub-users is allowed to be created by an admin belonging to a specific TAN. The admin can also delete Sub-users, but once it is done, the details cannot be recovered by the admin on TRACES.

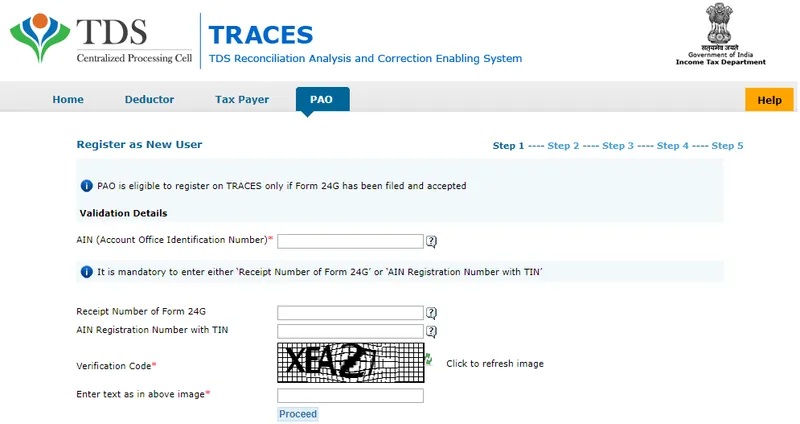

Registration Procedure on TRACES for PAO

PAO refers to Pay and Account Office who held the responsibility of maintaining the payment records for different government employees. Drawing and Disbursing Officer (DDO) belonging to a particular ministry or departments is a person who is allowed to withdraw money for specific payments that are made against a letter of credit account or an assignment account, which is opened in his/her favor in a particular branch of an allocated bank. PAO is generally required to file Form 24G for tax deductions made by DDO to the agency authorized by the Director General of Income-tax (Department) within a time-span of 10 days after the end of a given calendar month.

Here are the steps for registration as PAO on TRACES:

- Visit TRACES website

- Click on the ‘Register as New User’ option.

- Select ‘PAO’ in the user type.

- Fill mandatory details given in the TRACES Registration form of PAO.

5. Confirm details and click on the submit button.

6. After registration, an activation link will be sent to user’s registered email id along with the activation code on both the registered mobile number and email ID.

7. Click on the activation link and enter the activation code along with the user ID.

8. Post activation, the user can easily login into TRACES as PAO.

List of Services available on TRACES for PAO

- Registration on TRACES

- Dashboard view providing a summary of details related to their DDOs

- View statement status for TAN linked to their Account Office Identification Number (AIN)

How to Correct TDS/TCS statements on TRACES?

Different types of correction like change in personal information, deductee details, challan correction etc. can be made by the registered users on using the TDS TRACES online correction facility. Here are the detailed steps to make correction in Challan on TRACES:

- Visit TRACES Website

- Click on the ‘Request for correction’ option under the defaults tab.

- Fill details like form type, latest accepted token number, etc. and select category as ‘Online.’

- Once the change request is submitted, a request number will be generated.

- Request number can also be accessed using the “Track Correction Request” option, once the request status becomes ‘Active,’ click on the ‘available/in progress’ link to proceed with the correction.

- Fill the correction information with valid KYC.

- Click ‘Challan Correction’ as a type of category and make the required changes.

- Click on the ‘Submit for Processing’ button for correction confirmation

- At last, 15 digits token number gets generated and will be sent to the user’s registered email ID.

List of Online Correction Services Status Available on TRACES

There are different online correction services status available for a TRACES registered individual/entity:

- Requested: It indicates submission of correction request by the registered user.

- Initiated: CPC cell of TDS is processing the correction request

- Available: It indicates acceptance of user correction request, and the statement is available for correction. Statement correction can be started by the user.

- Failed: Due to technical reasons, correction request cannot be initiated, and the user needs to re-submit the request.

- In Progress: After user click on the hyperlink available on the ‘available’ status, the status transforms to ‘In Progress’. It simply means that the statement is being worked on.

- Submitted to Admin User: Correction statement has been submitted by Sub User / Admin User to Admin User.

- Submitted to ITD: It indicates that the correction request has been furnished to the Income Tax Department for processing by Admin user.

- Processed: It reflects that TDS CPC has processed the request received.

- Rejected: It articulates TDS CPC has rejected the statement after processing. ‘Remarks’ column is used to display the reasons for rejection.

How to obtain the Aggregated TDS Compliance Report?

This report is primarily used for identifying defaults in all TANs linked to entity's PAN. It is highly useful for effective TDS administration, control and compliance at the firm level. Here are are the detailed steps for availing TDS Compliance Report:

- Login as a taxpayer on TRACES platform.

- Click on the ‘Aggregated TDS Compliance’ tab.

- After clicking, two options will appear:

- Default based: Select the relevant Default type for which compliance report is required for all financial year.

- Fiscal year based: Enter the financial year for which the aggregate compliance report is required.

- Click on the submit button.

- After pressing the submit button, you can easily download the Excel File from ‘Requested Downloads’ link under ‘Downloads’ option.

Request Status Check Results on TRACES?

Following possible results can be seen by the user once the request status check is made on the TDS TRACES website:

- Submitted: It indicates the submission of the request by the user.

- Available: It articulates that the request is processed and can be downloaded.

- Not Available: It reflects that that request has been processed, but cannot be downloaded as the data requested is not available currently.

- Failed: Due to technical reasons, the request cannot be processed successfully, and the request re-processing will be made automatically by the system after some time.

How to make Resolution Request on TDS TRACES?

The facility of “Request for Resolution” can only be availed by registered individuals/entities by accessing the online grievances module of the TDS TRACES website. The taxpayer must upload all the relevant documents for request processing. Following are the steps for resolution:

- Login with registered user ID and password on the TRACES website.

- Select the ‘Request for Resolution’ tab.

- Click on the category for which resolution request has to be made along with the assessment year.

- Enter the required details and submit the request.

- After successful request submission, a ticket number will be generated.

- The user can visit the “Resolution tracking” link available under “Request for Resolution” tab for checking the status of the request raised.

TDS TRACES Ticket Status Check Results

Here are the results of ticket status check that can be seen on TDS TRACES:

- Open: Ticket is available to deductor/ Assessing Officer and will be acted on within the given time limit.

- In Progress: Clarification has been given to the requestor/Assessing officer.

- Clarification Requested: Tax authorities have requested clarification about the request. If clarification is not given within 30 days, the ticket status will be closed.

- Request for Closure: It means deductor has provided clarification and also sent to the assesses for closure. Such ticket will be automatically closed., If no action is taken on such request within 30 days.

- Closed: Requester/assessing officer has closed the request, or it is auto-closed by the system due to no action by designated authorities in the prescribed time-frame.

.jpg?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)