MSME Registration In India (Eligibility, Registration Process, Benefits, Schemes, Documents Required)

“MSME” (Udyog Aadhaar) stands for Micro, Small, and Medium Enterprises. MSME is a success in our country’s economy. The provisions of MSME came to existence in accordance with Micro, Small and Medium Enterprises Development (MSMED), 2006.

“MSME” (Udyog Aadhaar) stands for Micro, Small, and Medium Enterprises. MSME is a success in our country’s economy. The provisions of MSME came to existence in accordance with Micro, Small and Medium Enterprises Development (MSMED), 2006.

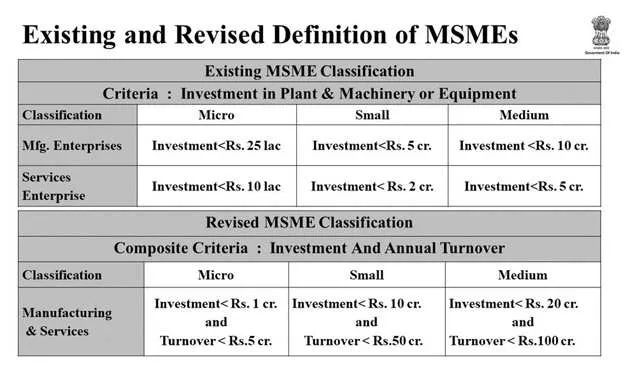

It is classified into two sectors –

- Manufacturing Enterprises

- Service Enterprises

Manufacturing Sector: Any company engaging in manufacturing or production of goods as specified under the First Schedule to the Industries (Development and Regulation) Act, 1951 or installing machinery in the process of value addition to the final product having a distinct name or character or use.

Service Sector: Any enterprise engaging in providing service.

Documents Required for MSME Registration / Udyog Aadhaar Registration

An entity has to submit the following documents for registration

- Aadhaar Card, PAN Card

- Partnership Deed / MoA and AoA (if applicable)

- Address Proof of Business

- Bank Detail

- Email Id, Mobile No

- Business Types

- NIC Code

- Investment Amount

- Total no of Employee / Man Power

GET MSME CERTIFICTAE / UDYOG AADHAAR REGISTRATION

How to Register MSME registration / Udyog Aadhaar Registration?

Step 1: Visit the Govt Website

Step 2:

- Enter the 12-digit Aadhaar Number and Name of the entrepreneur as given in the Aadhaar card.

- If the entered name doesn’t match, the applicant cannot proceed further. After that click on the “Validate & Generate OTP” button.

- The OTP will be sent to your UIDAI registered mobile number.

- Or click on the “Reset” button to clear both the fields and re-enter the correct details.

Step 3:

After successful validation, you need to enter “Social Category” – (General, SC/ST, OBC) you belong to.

- Gender – Fill the gender status

- Status – The entrepreneur applicant has to select the physically handicapped status.

- Name of the Business: The entrepreneur has to enter the name of the company. An entrepreneur can have more than one company. Each one of the entities has to be registered separately under the same Aadhaar Number.

- Type of organization: From the given list, the applicant has to select the organization type of his business.

- PAN Number: The applicant has to enter PAN if his business falls under a specific category :(Partnership Firm / Company / LLP).

- Location of Plant: He/she needs to enter the location details of all the plants.

- Business Postal Address: The applicant should fill the complete address of the business entity- District, State, Pin code, mobile number, and Email ID.

- Business Commencement: Date of Commencement of Business should be entered in the appropriate fields.

- Details of Previous Registration: Details of valid EM-I/EM-II as per the MSMED Act, 2006 should be furnished in the appropriate field.

- Bank Details: The applicant should provide banking details of the business account: (Account Number, Bank, IFSC Code)

- Major Activity: Here the applicant needs to choose the major activity – Manufacturing or Service, his/her business is engaged from Udyog Aadhaar. Even the entity involved in both manufacturing and service, the applicant has to choose the major business activity type.

- National Industry Classification (NIC) Code: The list of NIC code are prepared by the Central Statistical Organisation (CSO) under the Ministry of Statistics and Program Implementation.

- of Employee: The applicant has to mention the number of employee involvement and who are receiving payment/wages.

- Total Investment: The calculation of total investment involves the value of items purchased excluding R&D, Industrial Safety Device, pollution control and others.

- DIC – The full form of DIC is District Industries Centre. Based on the location of the business entity, the applicant has to fill the location of DIC.

- Submitting Application: The applicant must click on the “SUBMIT” button and OTP will be sent to the registered Email ID.

Enter the OTP and CAPTCHA code to complete the application process.

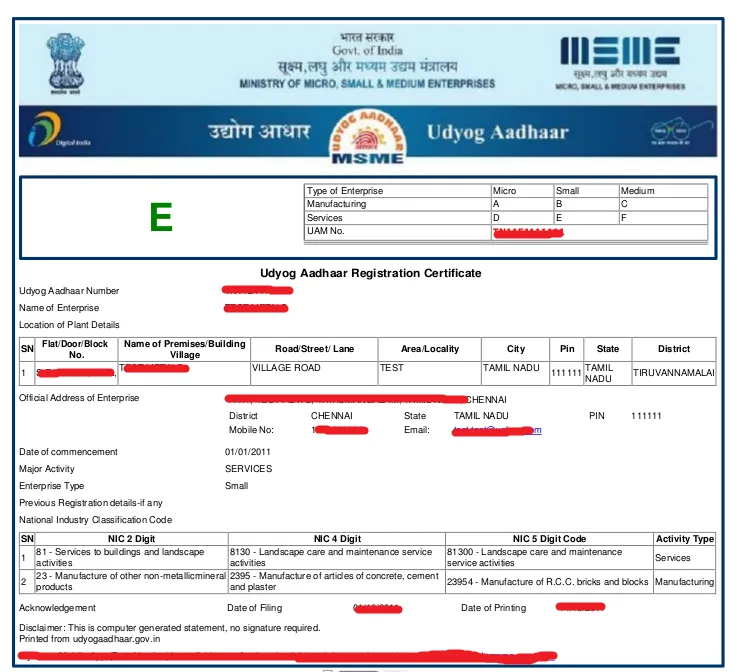

Udyog Aadhaar Sample Certificate

Benefits of MSME / Udyog Aadhaar Registration:

- Easy Clearance of Pending Payments

- Eligible for Mudra Loan Scheme

- Concession in electricity bills

- Reimbursement of ISO Certification

- Support from your state government

- Apply Government Tenders Easily

- Taxes Benefits

- Subsidy in Trade Mark Registrations, Bar Code and Patent etc

- Easy loan approval at low-interest rates- subsidized rate.

- Financial support to be part of Foreign Expos

- Government schemes

- Hassle-free current bank account opening

- For further assistance and registering your MSME, you can reach out to our experts.

MSME Schemes launched by Indian Government

- Udyog Aadhar Memorandum: To register under this scheme, entities need to furnish an Aadhar Card. It can be done both online and offline. Moreover, by registering for MSMEs, it can avail of finance for their business and government subsidies.

- Zero Defect Zero Effect: MSMEs that are registered for this leverage concessions for their exported goods.

- Grievance Monitoring System: Registering under this scheme is beneficial in terms of getting the complaints of the business owners addressed. In this, the business owners can check the status of their complaints, open them if they are not satisfied with the outcome.

- Quality Management Standards: Enterprises register under this and maintain quality standards by making use of new technology.

- Incubation – Under this scheme, MSMEs can get up to 75% to 80% of the project costs (design, manpower, machinery, and so on).

- Women Entrepreneurship: Women entrepreneurs can get benefits with capital, training, counseling.

- Credit Linked Capital Subsidy Scheme: Under this scheme, new technology is provided to the business owners to replace their old and obsolete technology. A capital subsidy is given to the business to upgrade and have better means to do their business. These small, micro and medium enterprises can directly approach the banks for these subsidies.

.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)