Budget 2022: A much-needed booster shot for the MSME sector

The Union Budget 2022 has not just prioritised MSMEs but has also given vital financial support, laying down the foundation of a long-term macro-economic vision for the country.

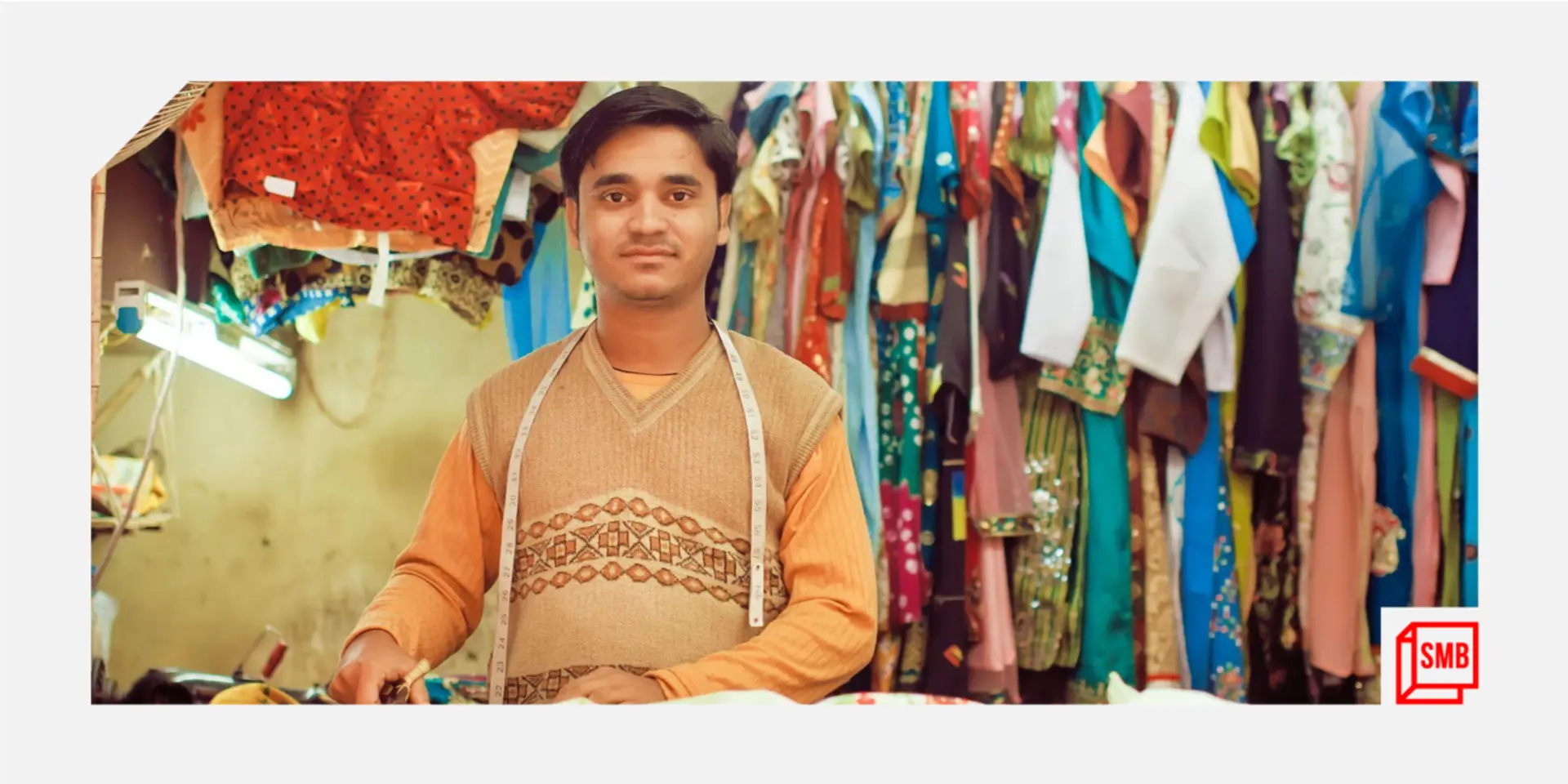

The Micro, Small and Medium Enterprises (MSME) sector is a major contributor to the socio-economic development of India. However, unlike large enterprises, they do not have an economic cushion to combat a prolonged stint of economic uncertainty or market depreciation.

The sector has suffered a great blow amidst the COVID-19 pandemic. With limited capital, lack of digital knowledge, and low credit rates, many MSMEs closed their operations permanently.

Yet despite this, small enterprises have turned towards digitisation, looking for new ways to transform their businesses in the coming times. This is a testimony to their resilience as they have innovated and come together to survive and even thrive in these difficult times.

The entrepreneurial spirit can help short-term survival, but if MSMEs want to thrive, many roadblocks will need to be cleared to pave the way to future growth.

With the help of various recent government initiatives and schemes, along with help from large corporations, the Indian MSME sector is witnessing a much-needed revival.

The 2022 Union Budget has not just prioritised MSMEs but has also given vital financial support, laying down the foundation of a long-term macro-economic vision for the country.

Bridging the gap with support

This year, the Union Budget 2022 focused on three pillars of inclusive welfare — financial aid, digital transformation, and upskilling — reiterating its commitment to creating a strong MSME and startup ecosystem.

By extending the Emergency Credit Line Guarantee Scheme (ECLGS) until March 31, 2023, the government has helped ensure MSMEs can avail themselves of the required credit to help get out of the economic slump brought on by the global pandemic.

The government has also provided credit support in the form of Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE), which will provide an additional Rs 2 lakh crore to MSMEs.

These initiatives can help provide last-mile financial inclusion, promote job creation in the sector, and also help to stimulate credit outreach for MSMEs.

With the Raising and Accelerating MSME Performance (RAMP) programme, the government is providing MSMEs with the much-needed acceleration to come forward with innovative solutions, which will also improve the competitiveness and productivity among them.

Increased fund allocation and access to digital services will directly contribute to an increase in the level of financial inclusion within MSMEs, propelling the sector’s resilience and operational efficiency.

The Budget’s recognition of the importance of credit and liquidity for MSMEs is evident, and these new policies can help make it easier for MSMEs to access finance and funding.

Digitisation is the way forward

Technology, a true enabler, can put Indian MSMEs ahead of the curve. There is a need to build a comprehensive technology-backed ecosystem, which provides digital end-to-end solutions for all requirements — from business management, finance, and staff management, to lending and payments, to improving the sector’s capabilities.

Combining the Udyam, e-Shram, ASEEM, and NCS portals will act as a digital enabler and a go-to-hub for small business owners. They stand to benefit from formalised skilling, credit facilitation, and recruitment services for MSMEs.

According to LocalCircles, almost 64 percent of startups and MSMEs have seen higher sales via digital or ecommerce channels in the last 12 months.

To provide an impetus to digital economic growth, the government has also launched various initiatives such as the DESH e-portal for upskilling and the Digital University initiative to upgrade teachers with the latest digital tools, building a dynamic, upskilled, and ready for the future workforce.

Many tech companies have also stepped up to provide skill development and upskilling programmes.

MSMEs: The vehicle for future growth

Overall, MSMEs have been on a strong path to recovery since last year. Many of them are still rebuilding while adjusting to the changing dynamics.

The government estimates the sector has the potential to generate six million new jobs over the next five years, creating immense potential for economic growth. In line with the government’s vision of an Aatmanirbhar Bharat, MSMEs have the power to transform the economic landscape of the country while doing well for themselves.

India has already put the wheels of action into motion with its various schemes, funding, and programmes, with results to be seen as time unfolds. With the Union Budget 2022 providing a much-needed booster dose, the MSME sector is further set towards the road to recovery and growth.

Edited by Suman Singh