Easy loans or debt traps: MSMEs’ complicated relationship with fintech startups

Fintech companies say they have revolutionised business lending over the past decade. For MSMEs, however, easy loans come with a price: higher interest rates and ruthless collection methods. Are fintech startups truly bridging the credit gap or adding to MSMEs' plight?

When Pulkit* was looking for capital to expand his cosmetics business, he turned to a fintech startup for a quick loan against his billings on popular platforms such as Flipkart and Amazon.

The process was simple enough and within a day, the startup approved a loan of Rs 25 lakh at a 16% interest rate per annum.

This was the beginning of Pulkit’s nightmare.

Pulkit, who is a seller on ecommerce sites, found himself at the mercy of collection agencies, which were acting on behalf of the fintech startup. Harassment and threats became a grim reality of his daily life, leaving him with no choice but to sell his wife's cherished possessions to repay the loan.

So, why do small business owners such as Pulkit choose fintech startups over traditional banks despite the risks?

The answer lies in banks' stringent criteria for unsecured loans, a challenge for countless MSMEs seeking financial support. Although schemes such as Credit Guarantee and Priority Sector Lending exist, navigating the complex process and requirements can be daunting for small businesses.

By offering innovative cash flow-based lending, and GST-based lending, fintech startups have made loans more accessible, requiring minimal paperwork. However, this convenience comes at a cost—higher interest rates and ruthless collection methods that have even been associated with tragic outcomes such as suicides.

This begs the crucial question: Are fintechs genuinely filling the credit gap or merely adding to the woes of MSMEs?

The credit crunch

The 63 million-plus MSMEs in India contribute almost 30% to the country’s GDP. However, only 14% of these companies have access to credit.

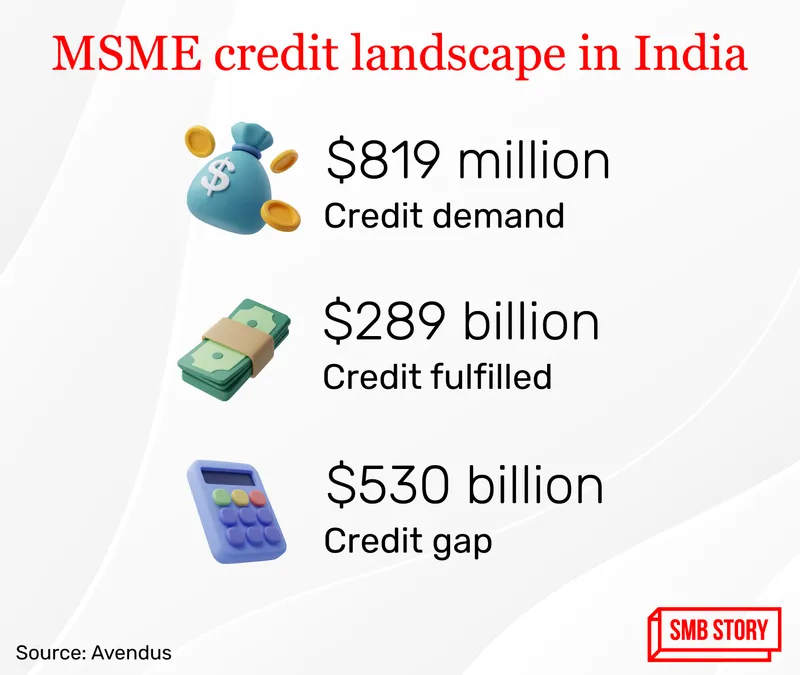

While MSME Minister Narayan Rane recently said in Parliament that no study has been undertaken to evaluate the MSME credit gap post-COVID-19, a study by investment banking company Avendus Capital estimates that the MSME sector faces a credit gap of $530 billion.

With more than 7,400 startups, India has one of the fastest-growing fintech markets in the world, according to a recent report by Boston Consulting Group. The country's fintech ecosystem is expected to reach a market size of about $150 billion by 2025, as projected by Invest India.

Nirav Choksi, CEO, and Co-founder of , a working capital tech platform, says that fintech startups are bringing agility to MSME lending. However, despite the progress, the credit gap remains largely unchanged in numerical terms.

Image credits: YS Design

On the brighter side, the unbanked are finally gaining access to banking services through fintech solutions, he tells SMBStory.

Working capital loans are credit facilities that help businesses manage their everyday operations and improve cash flow. CredAble says it enables more than $6 billion annually in working capital for India. Its platform hosts over 100 corporate customers, over 2,50,000 small business borrowers, and more than 35 large financial institutions and banks.

According to Hardika Shah, founder of Kinara Capital, a provider of collateral-free flexible loans for small business entrepreneurs, fintech companies have only begun tapping into the immense potential of bridging the credit gap. These startups are diversifying the financing landscape, offering innovative services like embedded finance, supply chain finance, and invoice financing, which traditional banks often overlook.

Founded in 2011, Kinara Capital has disbursed more than Rs 5,000 crore so far.

Unlike banks, which rely on strong balance sheets for loans and financing, fintech companies prioritise cash flow verification as a key criterion for lending money. This shift in approach has made accessing funds easier for MSMEs through fintech companies. However, the drawback comes in the form of a higher interest rate which often goes up to 36% and more, a significant challenge for MSMEs.

From the fintech players' standpoint, the higher rates stem from risk-based pricing to mitigate potential loan risks.

Mukesh Mohan Gupta, President of Chamber of Indian MSMEs, says that unsecured loans are “suicidal loans” and he doesn’t recommend any MSMEs fall for them.

"Typically, these unsecured loans are short-term in nature, spanning a maximum period of 2-3 years, or sometimes even shorter, tailored to the specific needs of each company," Gupta explains. He raises a valid concern for MSMEs: as small businesses require working capital to fuel business growth, how can owners manage to repay loans within such a brief timeframe, especially with high-interest rates?

According to Suresh Mansharamani, a business coach and founder of , a prominent business networking company in Gurugram, MSME owners often turn to fintech lending as a last resort out of desperation. He points out that traditional banks are hesitant to approve loans under schemes like Credit Guarantee Fund Trust for Micro and Small Enterprises due to the fear of potential Non-Performing Assets (NPAs).

The pressure on the bank's manager is significant, and any misstep with the loan can jeopardise their position. This is why banks exercise extreme caution in the loan approval process, relying heavily on a strong balance sheet as the primary criterion, he says.

Even a minor deviation in ratios could lead to loan denial, making it challenging for many MSMEs to secure funds from traditional banking sources.

The interest rate on business loans from public banks such as State Bank of India and Punjab National Bank typically varies from around 9% to 13% per annum while private banks such as HDFC Bank and IDFC Bank have an interest rate of 10% to over 25% per annum (depending on other factors like tenure and business type.)

Gupta and Mansharamani caution that fintech lending can lead MSME owners into a debt trap. While easy access to funds through fintech platforms can tempt business owners to take multiple loans, it could potentially lead to overfinancing. They emphasise that overfinancing can be even more detrimental than underfinancing, as it exposes businesses to increased financial risk and challenges in managing multiple debt obligations.

An MSME owner based in Amritsar, Punjab, who wishes to remain anonymous, recalls the challenges his business faced during the pandemic. While national banks offered moratoriums for existing loans, he encountered certain issues that prevented him from availing this relief. As a result, he turned to fintech startups for financial assistance, securing a loan at an exorbitant interest rate of about 32% per annum.

Although his business would pick up again, managing consistent EMIs with such a high-interest rate proved extremely difficult. His business teetered on the brink of closure, and he says he experienced deep distress due to the relentless and ruthless collection methods employed by the fintech platform.

The need for ‘responsible lending’

The higher rate of interest that gnaws away at MSME owners' finances is often a result of ignorance rather than genuine service, says CredAble’s Choksi. “Charging interest rates of 30% - 40% comes out of ignorance and this misleads MSMEs. And it is sad that we accept that,” he adds.

MSMEs seek loans from fintech startups out of desperation, points out Mansharamani. And, there are also cases where small business owners, due to lack of awareness, have fallen prey to fintech companies charging higher rates of interest.

Shah says that many MSME owners are unaware of NBFC-backed fintech companies or those that merely act as lending service providers. The regulatory framework for NBFC-backed fintechs is different as they are governed by RBI guidelines.

Regarding interest rates, Shah has a different perspective. She recalls the times when fintech companies didn't exist, and MSMEs relied on chit funds, gold loans, and private money lenders, who charged interest rates as high as 60% or even more due to risk-reward considerations.

The fintech ecosystem provides a more verifiable financing method, it is helping MSMEs bridge the credit gap, but to cater to the extensive market demand, fintech companies also require substantial cash flow.

Kinara’s Shah emphasises that "responsible lending" is of utmost importance for fintech companies. Over-indebtedness has been an enduring issue, and if fintech companies act responsibly as lenders, it can alleviate some of the problems.

(*Name changed to protect identity)

Edited by Affirunisa Kankudti