Emerging in Amrit Kaal: How MSMEs in 2023 will define the roadmap for Atmanirbhar Bharat

From IPOs to brand building, MSMEs in 2023 will shape India’s vision for Atmanirbhar Bharat.

‘Amrit Kaal’, as defined by Prime Minister Narendra Modi, is the journey of new India for the next 25 years. “It is just the beginning of the golden era,” the PM has reiterated on several occasions, adding that micro, small, and medium enterprises (MSMEs), will be a major driver of this growth.

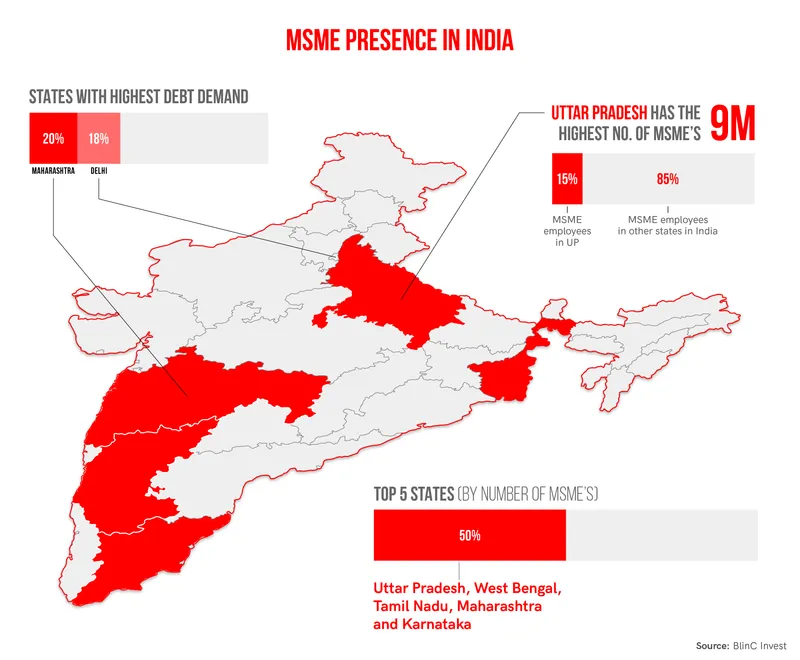

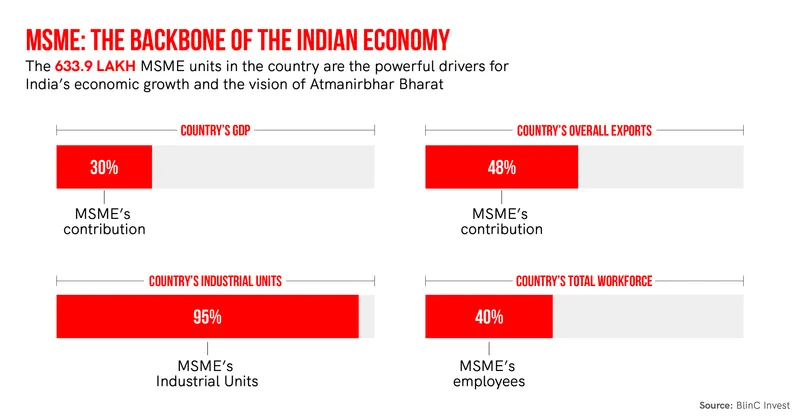

MSMEs form the backbone of the Indian economy, accounting for 30% of the country’s GDP, 48% of overall exports, 95% of the country’s industrial units, and 40% employment of India’s workforce. Thus the 633.9 lakh MSME units in India power the country's economy.

Unlike the other business sectors, including startups and large legacy family businesses, MSMEs, for years, have lacked ‘glamour’. Although they have been slow in adapting to the changing industry needs, they have played a crucial role in shaping the development of Indian industries. The COVID-19 pandemic, which threatened their survival, forced these units to move out of their comfort zone and transform in the emerging business world—the Amrit Kaal.

Experts say 2023 will see MSMEs become stronger, both technologically and financially.

Here are 5 key trends the MSME industry will witness in 2023 and define the roadmap for Atmanirbhar Bharat.

Image Credits: YS Design

The year of IPOs

Unlike startups and large enterprises, small and medium businesses listing themselves in the public forum sounds unfamiliar. However, more than 10,000 companies are expected to list on the SME Exchange in the next five to ten years, says Amit Kumar, Founder of MSMEx, a micro advisory platform providing business advisory and consulting services.

“There are around three lakh businesses in India operating in the revenue range of Rs 5 crore to Rs 250 crore but only around 690 are listed. And out of these, around 97 companies got listed in 2022 itself. So you see, there is a huge potential for listing. Every issue is getting oversubscribed and in 2023 we can expect more than 200 companies to get listed,” he says.

While a significant number of IPOs can be expected in the MSME sector, Saket Dalmia, President of PHD Chamber of Commerce and Industry, believes this trend will continue only when the government takes proactive steps, such as campaigns to increase awareness of such IPO platforms and financial incentives. The government should handhold MSMEs to adopt such funding channels via providing some kind of financial assistance, he says. “It must strengthen the working and reduce regulatory burden for the Fund of Funds created for such IPOs."

Digital penetration

Digitisation is a key driver for the growth of the MSME industry. While the adoption rate is slower compared to other sectors, Saket says the PayPal 'MSME Digital Readiness Survey 2022' revealed that 52% of small businesses saw a favourable influence of digitalisation on their business once economies reopened after two years of the pandemic.

“The year 2023, therefore, will be about sustaining the momentum and future proofing the business with relevant technologies,” says Harsh Pokharna, Co-founder and CEO of OKCredit.

Rural India has become a potential target market for MSMEs with a digital presence, says Harsh, adding that MSMEs like small shops and small businesses in rural India can leverage the digital solutions offered by fintechs to run their daily business operations.

Services offered by digital platforms help businesses manage their operations, maintain digital records, and inventory, make timely payments, and collect receivables. This leads to generation of alternative data, which can provide an in-depth understanding of merchants.

“Data analytics will help have a deeper understanding of the borrower profile to avoid NPAs,” Harsh highlights.

Talking about digitisation, Amit touches upon the inception of ONDC (Open Network for Digital Commerce). He says ONDC will revolutionise the whole ecommerce ecosystem, which, at some point, was a pain point for MSMEs. Thus, 2023, will open more avenues for the micro and small units to reach more customers.

Lending will increase

Recently, venture capital firm BlinC Invest released its MSME Lending Report 2022 which stated that the sector has a total demand of ~Rs 69.3 trillion with only a fraction of the demand being catered to by the formal lending segment.

MSMEs have a huge demand for working capital requirements. While NBFCs and fintech companies are coming up with a lot of initiatives such as collateral-free and minimum documentation loans, the lack of awareness in the sector is a challenge.

The government is bolstering MSMEs through various schemes. However, a majority of the MSMEs are unaware of these benefits, says Mukesh Mohan Gupta, President, Chamber of Indian Micro Small and Medium Enterprises. This gap can be addressed via awareness programmes.

Lending in 2023 will be driven by favourable regulations, advent of digital technology and increasing contribution of MSMEs in the overall growth story of the country, says Harsh of OKCredit.

He says MSMEs in India will have a stable environment to expand their businesses due to the continuous growth of the Indian economy. A conducive atmosphere and an enabling framework will continue to accelerate growth in MSMEs, thus leading to an increase in lending.

“SMEs do not want to lose control of their business nor do they understand the language of investors and thus, they prefer lending as the best option. With the growth of MSMEs, the lending industry will grow too,” says Amit of MSMEx.

Image Credits: YS Design

Brand building will be in focus

MSMEs have been too conventional for long in their business operations. However, during the lockdown, while their businesses suffered losses, they understood the potential of brand building.

Mukesh Mohan Gupta of Chamber of Indian Micro Small and Medium Enterprises says businesses can fix up the pricing of their products through branding, and this can help the sector to operate and survive in the competitive market.

He the government had earlier launched support schemes for MSMEs for brand building but these are currently non-functional. Banks and governments can launch some initiatives on these lines, which can boost MSMEs' confidence in their products, he adds.

Imports substitution

The vision of Atmanirbhar Bharat calls for reducing imports and increasing exports. Saket of PHD Chamber of Commerce and Industry says the government's vision for becoming atmanirbhar and complementing the Make in India Scheme is encouraging MSMEs to build capabilities and access domestic markets.

“In the upcoming year we are likely to see import substitution by our MSMEs. Also, given the procurement support extended by the government and the Vocal for Local Campaign, MSMEs will dominate the domestic markets.”

Here, it is interesting to note that, with the opening up of defence procurement, more and more MSMEs are entering the arena of defence manufacturing, and this trend will increase further, he adds.

Addressing the PHDCCI’s States’ Policy Conclave 2022 recently, Union Minister of MSMEs, Narayan Rane, said that as global recession clouds loom around the world economies, India can shield itself by strengthening the MSMEs sector and making it more resilient. “Atmanirbharta can only be achieved with the MSMEs leading from the front,” he said.

With MSMEs shouldering the responsibility of making India a 10-trillion economy, the government’s support and handholding is crucial.

Edited by Affirunisa Kankudti