Built by IIT graduates, this free business accounting app and software has over 5.5M MSME users

OkCredit is a mobile-based business accounting software for MSMEs and their customers to enable recording of credit/payment transactions digitally across India. It was started in 2017 by Harsh Pokharna, Gaurav Kumar, and Aditya Prasad.

If the COVID-19 pandemic and the lockdown has taught Indian MSMEs anything, it is that digital, contactless payments are here to stay. And this is followed by the need to record and account monetary transactions digitally.

Bengaluru-based startup OkCredit’s founders may not have predicted the pandemic back in 2017, but they were willing to place their faith in building mobile-based digital accounting solutions for MSMEs.

Frequently interacting with local grocery stores, IIT Kanpur graduates Harsh Pokharna, Gaurav Kumar, and Aditya Prasad noticed shopkeepers would do most of their accounting on paper. Tallying took long, the process was prone to human error, and the small slips of paper could be easily misplaced.

This led them to launch — a free, digital-based credit balance recording solution for small business owners — in 2017.

Harsh Pokharna, Co-founder and CEO, OkCredit, says:

“We provide a simple and secured digital accounting app for small business owners in 13 regional languages. We also added a new voice note feature for the convenience of users to record their transactions.”

Harsh Pokharna, Cofounder and CEO, OkCredit

Product offerings

OkCredit recently launched OkShop — an online store for small merchants — who can display their products and offers and reach out to customers. It has also built OkStaff — a staff and payroll management application for larger businesses that employ a workforce.

Harsh says OkCredit’s USP is that its products are simple, secure, and technologically advanced. They run on a basic smartphone and help automate business transactions of retailers with customers and wholesalers.

“Currently, we are at a pre-revenue stage. Our focus right now is to make MSMEs educated on the simplicity of digital accounting and making them comfortable with the technology and help them grow their business,” he says.

OkCredit, which has raised just over $84 million, claims to witness over three million daily transactions on the platform. It has 5.5 million active users and saw transactions worth $7.5 billion recorded in October 2020.

“By offering a self-serving onboarding experience, we acquire and activate users digitally. The product is simple to use, and the new features that help them to improve their cash flows and profits support us to retain and engage them,” says Harsh.

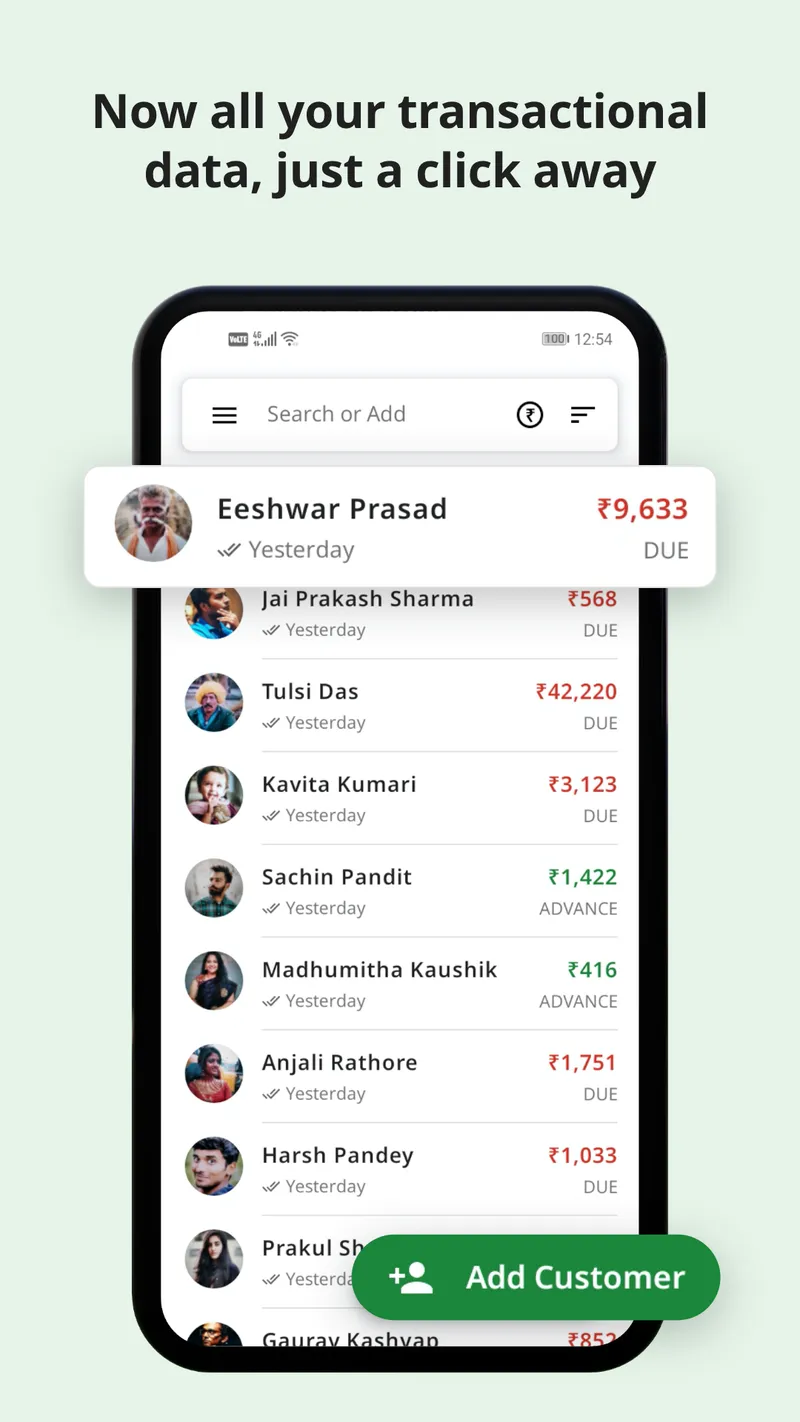

A snapshot of the OkCredit app

Challenges of solving for MSMEs

Working with MSME customers is an uphill battle, and challenges are prevalent, especially in the digital bookkeeping sector.

Businesses like OkCredit face the task of changing customers’ mindsets from traditional book-keeping habits to adopt technology and digital platforms.

“There is a low technology literacy rate, which makes it difficult for MSMEs to understand the benefits of such an app, and most of them have not used any such apps for business before,” says Harsh. “There is also diversity in the user base across categories, and retailers, as well as wholesalers, use OkCredit,” he adds.

He explains his team is surmounting these challenges by making the digital bookkeeping experience as user-friendly and efficient as possible.

It is an open secret that the key to acquiring MSME users at scale lies in the simplicity of the product, and OkCredit is not alone in this game.

Startups such as Vyapar and KhataBook have made significant in-roads in building simple accounting software for small businesses. Established players such as Tally, Intuit, and Zoho have also been in the game for some time now, and are all vying for an $85 billion overall opportunity for digitising Indian MSMEs.

Harsh maintains OkCredit is distinguishing itself through its intuitive and secure platform, and credit-tracking and payment reminder features.

COVID-19 impact

The timely payment reminder is especially useful for MSMEs in the current scenario, where creditors may be less willing or are unable to pay. Further, during the lockdown earlier this year, OkCredit observed merchants stopping and selling their goods and services on credit as they experienced a dip in business and revenues.

But, as the lockdown was lifted in stages, the business saw merchants throng WhatsApp to create catalogues and interact with and sell to their customers.

“This soon became part of the new normal and promoted contactless transactions. Our retention and revival have now grown and surpassed pre-COVID levels,” says Harsh.

OkCredit now plans to expand its services and reach out to MSMEs across India that may not be aware of such products and services. Harsh says this plan is in line with OkCredit’s corporate policy to help the “real India” benefit from digitisation. He urges more founders and entrepreneurs to solve for the digital bookkeeping and payments segment.

“I advise product builders to focus on a specific segment of a business category in solving a problem. They should start with a single user, and from there, work on ways to solve the problem in the most efficient way. They should focus on getting to know the user’s persona and get in-depth information about a user’s life,” he says, adding:

“It is imperative to understand that this market is just opening up, and there will be a lot of players who solve problems and go away. The key is to have a long term goal and solve problems sustainably.”

Edited by Suman Singh