This software engineer developed a simple business accounting app, got 1 million customers in 3 years

Started by Sumit Agarwal in Bengaluru, Vyapar is a mobile and desktop app to manage business finances, collect payments on time, keep track of inventory, generate GST reports, and more.

India’s MSME sector employs over 100 million people and accounts for 45 percent of the country’s manufacturing output. But most of them still rely on old practices such as making bills on paper.

In the modern era of digital accounting, helping MSMEs adapt is a business opportunity in itself.

Bengaluru-based entrepreneur Sumit Agarwal (35) identified this opportunity when he was working for Intuit’s QuickBooks, an accounting software package for small businesses.

With just Rs 8 lakhs savings, Sumit decided to set out on a mission to offer MSMEs simplified solutions to do their accounting and inventory management.

In 2016, he started Vyapar, a simple business accounting and inventory management application for small businesses.

“By using Vyapar, an entrepreneur can stay on top of his/her finances, collect payments on time, keep track of inventory, generate GST reports, and make smarter business decisions,” Sumit tells SMBStory.

Sumit Agarwal, Co-founder and CEO, Vyapar

Today, the app is available for smartphones and desktops, and has been downloaded by over one million MSMEs.

Sumit’s business has also reached Rs 3 crore annual revenue.

In an exclusive interaction with SMBStory, Sumit narrates why he started Vyapar and how the app works.

Edited excerpts from the interview:

SMBStory: What is the need for MSMEs to use digital accounting software?

Sumit Agarwal: Even today, 90 percent of businesses use paper and pen to make bills. They do not understand what's happening in their business, such as profits, receivables, stock adjustments, etc. They lose out on a lot of profits and also incur extra losses due to inefficiencies in their systems.

In today's day and age, it is imperative that Indian MSMEs should go digital. Using a simple software like Vyapar to manage billing, stock inventory, receivables, and payables helps Indian MSMEs stay on top of their business.

Further, filing GST is tedious for MSMEs if they don’t have a digital solution, as they end up wasting time in compliance work.

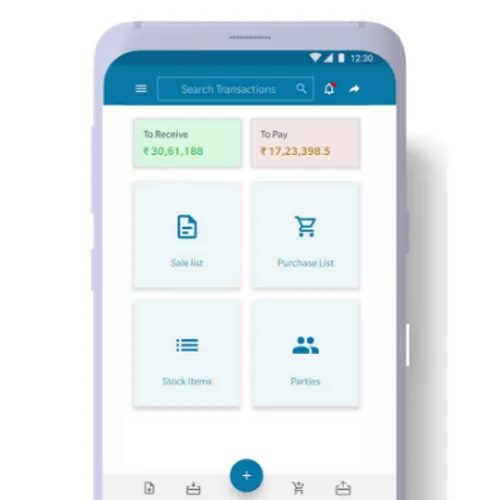

Vyapar's mobile app dashboard

SMBS: What inspired you to enter this space?

SA: I had seen how tedious and unhealthy the life of a typical businessman in India was. My father and brothers spent their weekends tallying their accounts and realising their losses only months later.

One day, they asked me to help find a simple mobile application to manage their business. I spent a lot of time searching and did not find a single solution which a layman could use.

So I decided to build an easy-to-use business accounting solution. For me, the most critical criteria was that any businessperson, even a 10th grade pass, should be able to use it.

SMBS: How did this idea come to fruition?

SA: My Co-founder Shubham and I started to learn Android app development and started writing the first few lines of code. The only resources we had were our laptops and our passion for the business idea.

Vyapar was first developed in our spare time, which was usually at night or on weekends. Soon, MSMEs started showing interest in the app and we started getting organic downloads. We then quit our jobs to do this full-time. We were joined by another co-founder, Ruqiya Irum, and started as a three-person organisation.

For the first six months, Vyapar had less than five employees and I was paying salaries from my savings of Rs 8 lakh. In the next one year, the company grew and became self-sustaining.

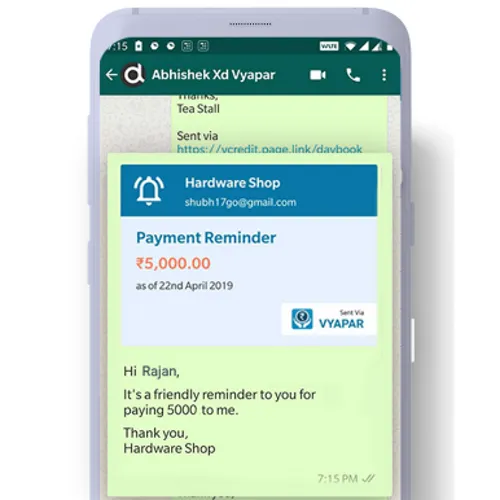

Vyapar's payment reminders

SMBS: How does the app work?

SA: The app allows MSMEs to make GST bills, auto-calculate totals, and update payables and receivables automatically. They can also print/share their bills on WhatsApp in a few seconds, send reminders, and collect payments directly online.

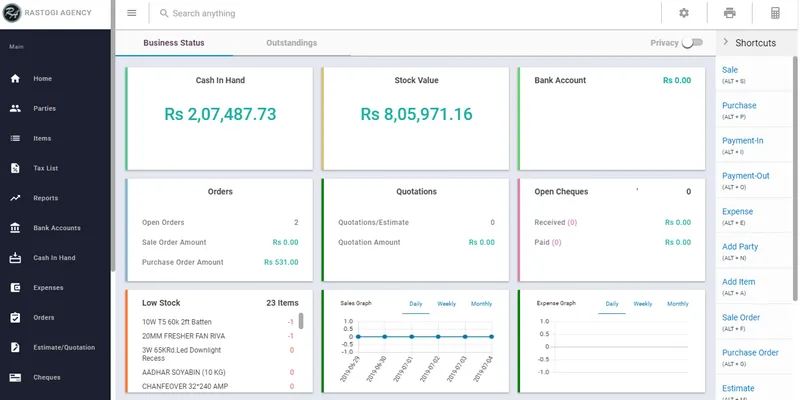

Further, Vyapar lets them check their inventory instantly. MSMEs can see their stock status, enable low-stock alerts, and track complete inventory quantity and stock value along with information such as expiry date, batch number, etc.

The app also lets MSMEs generate GSTR reports such GSTR1, GSTR2, GSTR3B, GSTR4, and GSTR9 for instant tax filing.

SMBS: What is Vyapar’s revenue model?

SA: Vyapar software is available on two devices: mobile and desktop. It follows a simple, subscription-based model where customers pay for the premium version on a yearly basis. This paid version gives them access to premium features. The mobile app also has a free version, but the desktop version is paid and comes with a free trial of 30 days.

For us, reaching the customer base through the mobile app and then selling the desktop service is a unique strategy to upsell the product and reduce acquisition cost for the premium desktop product.

Vyapar’s simplicity also makes it popular. Unlike many legacy software that are either too complicated or are not suitable for the way Indian businesses are run, Vyapar can be used by people who have zero accounting knowledge. It works with or without the internet, so an entrepreneur can carry his/her business in their pockets anywhere they go.

Vyapar's desktop view

SMBS: What are the toughest moments and challenges the company faced?

SA: We started at a time when there was no GST and digital awareness was not as high as it is today. Getting MSMEs to put their business details on digital software was a tough task. They wanted to keep their data on paper so that nobody else could access it.

It was a big challenge to build that trust on a new product. This has definitely changed over time and we now see it is a lot easier to gain customers.

When GST was implemented, a lot of MSMEs were worried and needed help. We had to work a lot harder to help them understand and comfort them that Vyapar will be with them through the tough times.

When growth stagnated and we needed capital, it was hard to convince investors to fund us in an unorganised market. But some investors were different and believed in our convictions.

The Vyapar team

SMBS: Who are the competitors? How is the company staying ahead of them?

SA: Vyapar is the only platform in the GST mobile billing arena. There are other applications that only help in keeping track of an MSME’s credit and debit, but there are yet no other complete mobile billing solutions.

However, accounting software Tally is competition. Chartered accountants often force businesses to use Tally. We will be working on integration in the future so that the life of business people and CAs become simple.

Another challenge is the mindset of businesses who want to continue with their old mechanisms and are not able to understand the value of using a software.

SMBS: What are the future plans for the company?

SA: Right now, Vyapar is a one million-strong community of MSMEs, and once they make the transition to Vyapar, they can't imagine going back to pen and paper. So, we want to enable more MSMEs to go digital and grow our customer base.

(Edited by Dipti Nair)