How Logo Infosoft's Vyapari app makes GST billing and compliance easy for MSMEs

Vyapari is a cloud-based billing and accounting solution with multi-interface access points (mobile, web and desktop). Users can access it from any location.

When Goods and Service Tax (GST) was rolled out, the micro, small, and medium enterprises (MSMEs) were still maintaining physical books. And it was time-consuming to create invoices for customers and follow GST norms.

Navi-Mumbai based software vendor Logo Infosoft quickly capitalised on this with its Software as a Service (SaaS) Enterprise Resource Planning (ERP) products.

Vyapari is one such product, offering a business solution that helps MSMEs with GST compliance, e-invoicing, and process streamlining.

Although it was started in India, Logo Infosoft has Turkish roots.

Vinod Subramanian, CEO, Logo Infosoft, tells SMBStory:

“India’s GST rollout in 2017 provided an opportunity for global software vendors to enter the Indian market. Parent company Logo brought its robust European GST experience to start Logo Infosoft in India in 2016.”

1563874718888.png?fm=png&auto=format)

Vinod Subramaniam, CEO, Logo Infosoft

Today, Logo Infosoft has thousands of MSMEs in India using its software to streamline the GST process, he says.

In an exclusive interaction with SMBStory, Vinod explains more about the company and how MSMEs can use the GST software.

Edited excerpts:

SMBStory: Why did Logo start a new company in India ?

Vinod Subramanian: Logo is uniquely positioned, being one of the only software products company which offers ERP software and GST/TAX solutions. Turkey is a developing economy, similar to India, and is the Europeean base for several manufacturing operations.

Turkey rolled out GST in 2010 and has grown to become a 2 billion e-invoices market in 2018. India’s GST rollout in 2017 provided an opportunity for global software vendors to enter India.

SMBS: What is the Vyapari app?

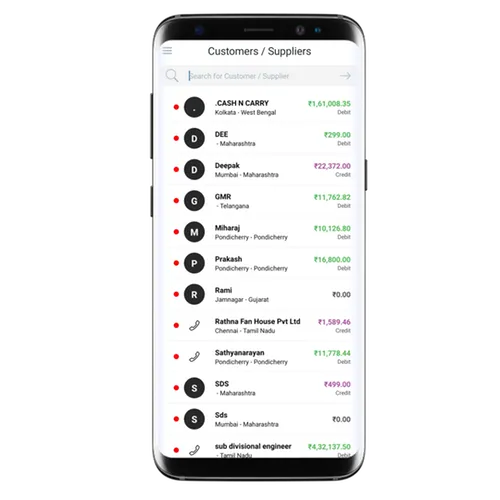

VS: Vyapari is a cloud-based billing and accounting solution, with multi-interface access points (mobile, web, and desktop). Users can access it from any location. The product has both sales and purchase functionalities, in addition to maintaining stocks and prices.

It has a subscription model currently priced at Rs 499 for five users. Partnering with GSTN, we are also offering one user with basic functionality for free to the MSME (below Rs 1.5 crore turnover) working closely with IRIS GSP.

An MSME can simply download the app on mobile and register the business. Users can enter the GSTN number, then the system authenticates the details from GSTN. The accounting setup is automated, taking into consideration whether it is a Private Limited Company or an LLP.

Vyapari app interface

SMBS: How does Vyapari app help MSMEs streamline GST process?

VS: With a few clicks, the entrepreneur can populate party data from previous filings with GSTN. Without investing in hardware or storage, the entrepreneur can do transactions, give access to his/her CA to check the accounts, and generate GST reports in one click.

Generating a sales bill is easy: the user needs to pick the party and the item, and the prices and related taxes are auto calculated. The invoice can be shared through email or WhatsApp or printed through a connected device.

In addition to regular cash transactions, collection through debit or credit cards are auto reconciled when used in a mobile POS device. Since the complete accounting is real-time and automated, the user can generate GSTR-1 reports anytime and it will fully reflect the sales, including Invoice sequencing number, HSN-based summary, B2B/B2C classification etc. The same applies for all GSTR reports.

SMBS: How was the product designed?

VS: Simplicity of user operations is the key design driver. SMEs do not understand complicated accounting and GST rules. There are no technical terms- it is always the business language. The product is designed keeping in view the local business requirements which are unique to India and the GST reporting requirement.

As much as possible, the master data is pre-populated, which avoids data entry errors. The software is fully integrated to GSTN and compliant to ever-changing dynamic requirements of GST. It has complete data privacy and security.

SMBS: What is the impact on customers and how many SMEs are using this?

VS: As per the recent government data, there are six crore SMEs in the Indian ecosystem, which contribute 29 percent of India’s GDP. Out of this, 1.22 crore SMEs are under the GST system.

Both the government and GST Council have announced many decisions to boost the growth of small businesses. One of the significant announcements is making available the accounting and billing software free of cost to small taxpayers by GSTN. Logo Vyapari is one of the recommended packages.

We are expecting a large number of SMEs to take advantage of the scheme and go digital. In the first few weeks we have seen a few thousand Indian SMEs leveraging this initiative.

The Logo Infosoft team

SMBS: What are the future plans for the company in India?

VS: The next set of GST reforms in India includes e-invoices and reconciliation. As a pioneer in the segment, we can switch on these functionalities for our customers and provide a seamless transition to create an integrated business ecosystem.

We are also integrating Vyapari with banks and lending institutions and Android-based mobile POS.

1563874718888.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)