Despite global economic slowdown, M&A activity in GCC on the rise

While global M&A deals have slowed down, the Middle East has been an exception, with a series of $1 billion-plus transactions taking place across different industries, according to PwC report - Transact Middle East.

Mergers and acquisitions (M&A) in the Middle East continued to rise in 2022 despite global headwinds, according to the PwC Transact Middle East report.

Calling the phenomenon ‘Gulf Exceptionalism’, the report said that the region saw a series of transactions worth more than $1 billion taking place across different industries.

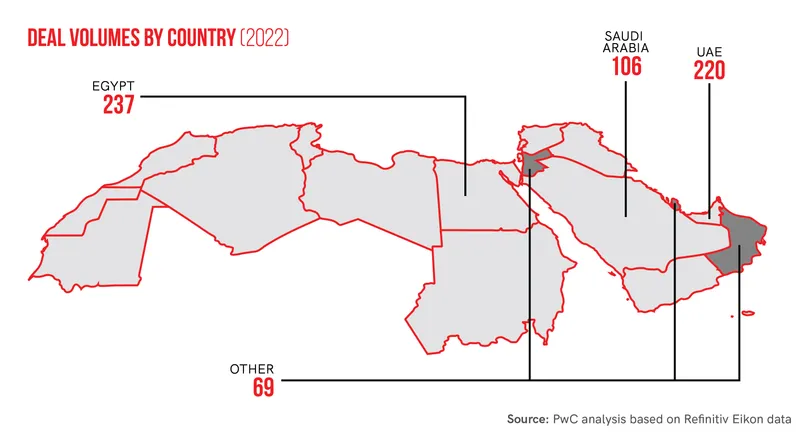

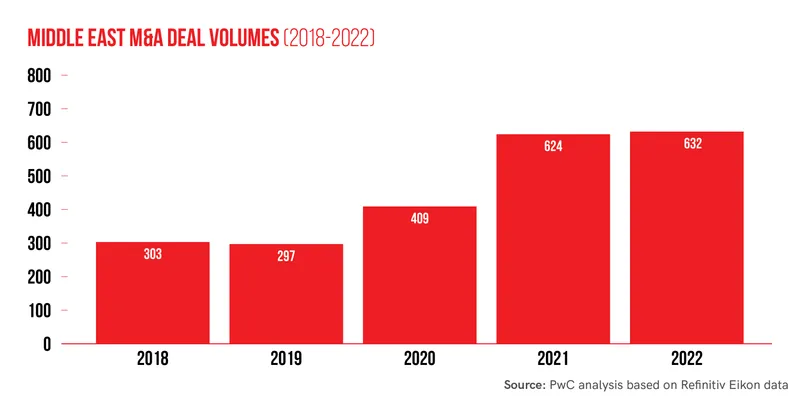

By the end of 2022, the Middle East had over 632 M&A deals. While the figure is only a marginal year-on-year increase of 1.3% in deal count, it is more than double of the total in 2019.

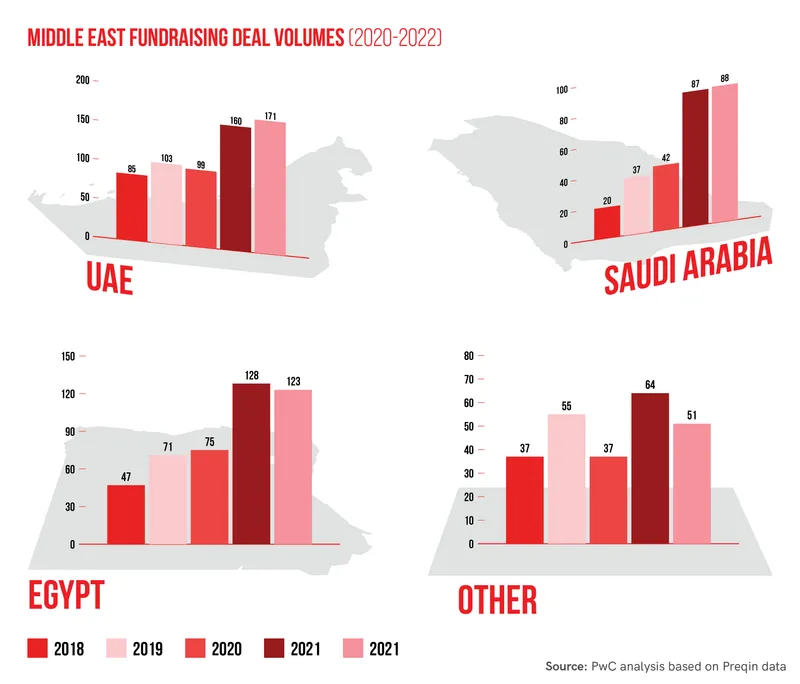

Of these, UAE, Saudi Arabia, and Egypt recorded over 563 deals or close to 89% of the region’s total deal volumes. Although Saudi Arabia and the UAE witnessed the highest year-on-year increase in M&A activity, it was still at a lower level than in 2021. The deal volumes for Saudi Arabia and UAE rose by 9% and 6%, respectively.

SWF-driven activity

Private equity investors and sovereign wealth funds were the main drivers of deal activity in the region, according to the report. This was further pushed by historically high oil prices and improved liquidity thanks to multiple fiscal reforms.

In the UAE, the deal activity focused on consumer markets, technology, financial services, and industrial services with a push to drive diversification away from oil and gas.

Canada’s Caisse de Depot et placement du Quebec (CDPA) pumped in $2.5 billion investment with a combined 22% stake in the DP World assets—Jebel Ali Free Zone, Jebel Ali Port, and the National Industries Park.

Also, UAE investment company Q Holding closed the largest local deal in the country with 100% acquisition of Reem Investments for $1.6 billion.

In Saudi Arabia, the PIF (Public Investment Fund) recorded significant deals in 2022, including $1.5 billion for a 17% stake in Saudi Arabia’s Kingdom Holding Co; a $150 million acquisition through its Egyptian affiliate of a 34% stake in Egypt’s BTech consumer electronics company; and a $250 million acquisition of 30% of the district cooling provider Saudi Tabreed, a subsidiary of the UAE-listed National Central Cooling Co.

“We expect a further pick up in M&A activity in Saudi Arabia during 2023, despite a strong pipeline of IPOs, as the gap in valuation multiples between these two exit routes narrows for investors looking to sell assets. Meanwhile, the sovereign Public Investment Fund will continue to spearhead outbound Saudi cross-border transactions, as well as fuelling domestic deals,” said Imad Matar, Transaction Services Leader PwC Middle East in the report.

Cross border push

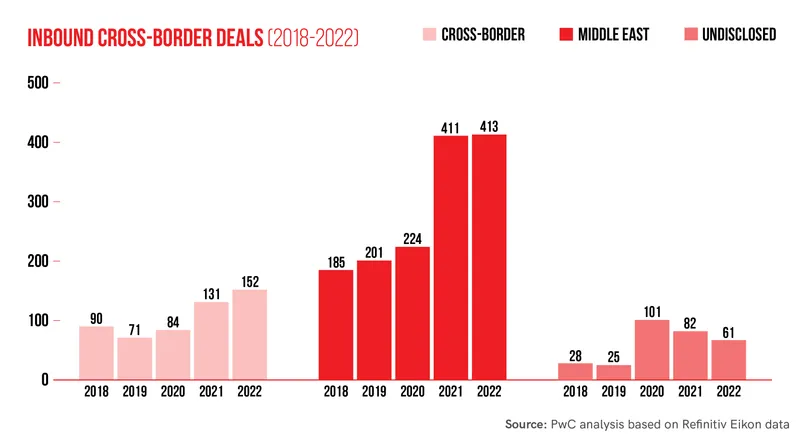

The Middle East continues to attract foreign direct investment (FDI), primarily because the region is looking to diversify into areas such as services, technology, and manufacturing.

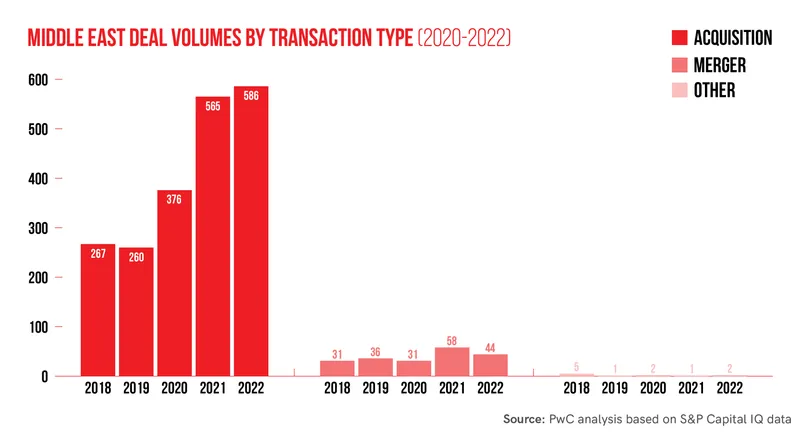

In addition, local governments are increasingly focused on socio-economic integration and business-friendly policies, enhancing the region’s appeal to investors. Like the previous years, the M&A landscape in the Middle East was dominated by acquisitions.

Over 586 acquisitions were completed in 2022, 565 in 2021, and 376 in 2020, the PWC report said.

The region also remained an attractive target for VC funds. Over 433 deals were completed in 2022. Fintech continued to be a favourite in The UAE, Saudi Arabia, and Egypt. This was backed by a strong interest in tech investments. - Some of the largest deals were Tabby’s $58 million in Series B funding led by Sequoia Capital India IV and STV. Saudi’s Tamara’s $00 million in Series B funding led by Snail Investments.

The UAE led the way when it came to fundraising rounds in 2022, with the number of successful deals growing again, even after the strong bounce back in 2021. Particularly notable was a series of digital acquisitions by telco and successful fundraising rounds for fintech companies, confirming growing investor interest in the Middle East’s technology sector,” Zubin Chiba, Corporate Finance Leader PwC, said in the report.

Another sector that saw an uptick was the foodtech space. Dubai’s restaurant technology company Kitopi raised $415 million in 2022. Sustainable energy too saw investment last year, with UAE based solar developer Yellow Door raising $400 million.

Increased funding activity

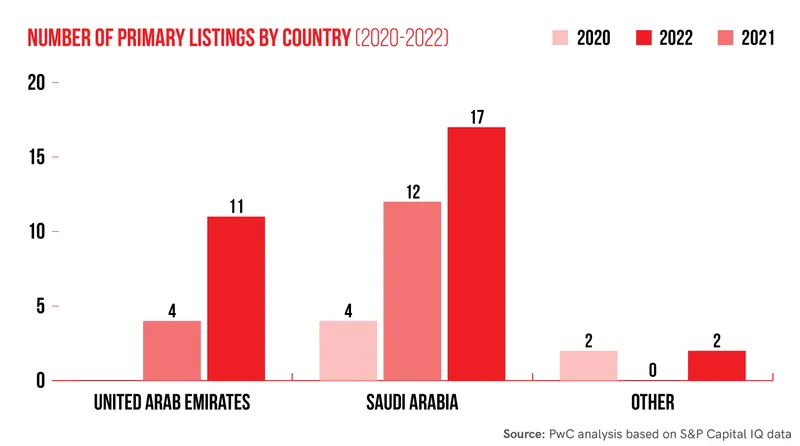

In terms of capital markets and IPOs, factors like supply chain pressures, energy crisis, Ukraine war, and high inflation weighed directly on the valuations in the Middle East. While many companies across the world postponed or even scrapped their public forays, firms in the Middle East displayed resilience. Again, Saudi Arabia and UAE were top in the space. Saudi Arabia’s thriving IPO market witnessed a particularly strong surge in listings in 2022, with 41 primary listings compared with 12 in 2021.

The PwC report expects this momentum to continue in 2023. However, much of this depends on whether the GCC can escape the worst impact of the global slowdown, and also enabling SWFs and other Middle East investors to use their competitive advantage to invest in the US and Europe and help drive the region’s transformation.

International Monetary Fund (IMF) estimates that oil-producing Middle Eastern countries could earn an additional $1.3 trillion in oil revenues over the next four years, meaning they have enough capital to deploy, the report said.

Technology will likely be the focus area of many of these investments. About 84% of Middle East respondents to PwC’s latest annual CEO Survey said they plan to invest in automation processes and systems over the next 12 months, while 66% said they expect to deploy cloud technology, artificial intelligence, and other advanced technology in operations.

“We also expect deal volumes in the tech sector to be supported by the increased interest in fundraising rounds by the region’s own tech start-ups, which were far above pre-pandemic levels in 2022,” the report noted.

(Image and graphics credit: Nihar Apte)

For any press related queries or to share your press releases, write to us at

[email protected].

Edited by Affirunisa Kankudti