GCC sovereign wealth funds show increased interest in global startups in last two years

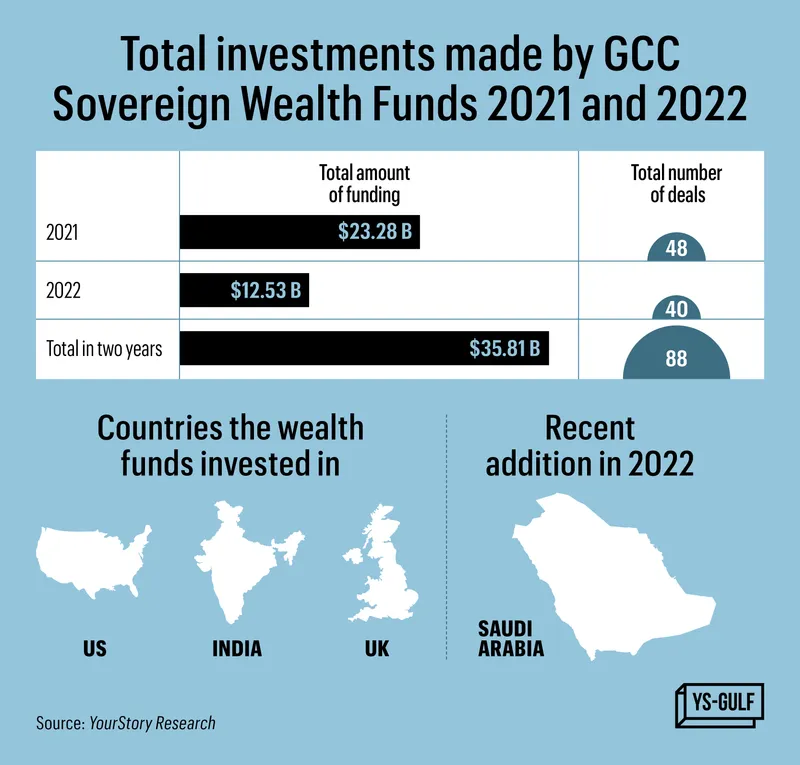

Between 2021 and 2022, GCC-based sovereign wealth funds made over 88 deals, amounting to a whopping $35.81 billion.

Despite the overall slowdown in investments in the global markets, sovereign wealth funds from the GCC (Gulf Cooperation Council) region have been actively investing in global startups in the last two years.

Between 2021 and 2022, GCC-based sovereign wealth funds made over 88 deals, amounting to a whopping $35.81 billion, according to YourStory Research data.

Of these, US-based startups were the favourites in 2022, raising $3.8 billion, across 14 deals. These were followed by startups in Saudi Arabia, which garnered $2.78 billion from four deals. UK startups raised $1.96 billion across five deals, while Indian firms grabbed $995 million from three deals.

In 2021, 17 US startups raised $7.64 billion, 11 Indian startups raised $7.08 billion, and four UK startups raised $2.9 billion.

The US and India continue to be investment strongholds for wealth funds.

A study by asset manager Invesco shows that India has emerged as a popular investment market for sovereign wealth funds and public pension funds, climbing to the #2 spot globally in 2022 from #9 in 2014.

The study states that, globally, sovereign investors now manage over $33 trillion in assets. In 2022, there was a rapid rise in allocations towards private markets, notes the study.

Image Credit: Chetan Singh

Investments in MENA

What’s interesting to note is that wealth funds have now started making investments within the MENA (Middle East and North Africa) region as well. For example, Saudi Arabia-based startups raised money directly from sovereign wealth funds in 2022.

“This is a small but significant shift in how these wealth funds operate. Historically, wealth funds have invested in startups globally; US and China have been the main contenders. While India has now replaced China, the money would rarely move within the (MENA) region,” says an investor, on the condition of anonymity.

“But with investments in Foodics, Tamara, Almosafer, and even the Kingdom Holding Company, there seems to be a slow but steady faith in the startups in the region.”

Apart from Saudi startups, UAE-based Okadoc and Trukker raised funding from ADQ, Mubadala, and Riyadh TAQNIA Fund, among others.

There is a significant push from MENA towards growing the economy beyond oil wealth. Dubai, Abu Dhabi, and Saudi Arabia are developing strong initiatives and improving the ease-of-doing-business norms to make it convenient for businesses to set shop.

“With the sovereign wealth funds investing across startups, it shows the region is taking the startup and tech landscape shift seriously,” says an analyst.

According to Sandeep Ganediwalla, Partner, Redseer, a consulting firm, investor interest has picked up in the region over the last two years and diversified across sectors. Foodtech, fintech, and ecommerce are some of the sectors that have attracted investments.

As per reports, in 2022, startups in the GCC region raised $3 billion in overall funding. Companies in the foodtech, fintech, and ecommerce sectors raised the most funding. The UAE continued to rule the roost in the GCC region with $237 million raised across 13 deals.

In October, startups in the UAE received $460 million, Egypt $113 million, and Saudi Arabia $70 million.

Digitising construction sector, Y Combinator-backed Tenderd helps rent, track equipment

Stakes in tech giants

In the last few months of 2022, wealth funds in the region were increasingly active in the global startup scene.

Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund, increased its investments in Alphabet, Google's parent company, and Meta, the parent company of Facebook and Instagram.

A filing with the US Securities and Exchanges Commission (SEC) shows that PIF raised its stake in Meta by 11% to over 3.26 million shares, valued at about $443 million. It also pumped up its investment in Alphabet to over 4.26 million shares in the three-month period ending September 2022. The value of the fund’s position exceeds $407 million. In the previous quarter, it had 2.13 lakh shares in Alphabet.

The sovereign wealth fund PIF manages over $620 billion in assets.

According to the US SEC, the value of PIF’s total investments in US equities in the third quarter of 2022 was over $36.8 billion, across a portfolio of 53 companies.

In December, the sovereign wealth fund acquired a majority stake in AR (augmented reality) developer Magic Leap. The acquisition deal was worth $450 million. According to reports, Magic Leap had raised $150 million in venture funding and $300 million in debt in 2022.

In 2021, oil conglomerate Saudi Aramco had signed a deal with Magic Leap for utilising the latter's AR tech for remote partnership and 3D visualisation. In 2018, PIF was part of $400-million Series D equity funding in Magic Leap.

When Elon Musk took over the operations of Twitter, Saudi Arabia's Kingdom Holding Company and the private office of Prince Alwaleed Bin Talal Bin Abdulaziz Al Saud took to Twitter to announce that they would be rolling over ownership worth $1.89 billion to the ‘new’ Twitter led by Musk.

In 2021, PIF and Abu Dhabi’s Mubadala invested $60 billion in SoftBank’s Vision Fund I, while Qatar Investment Authority’s investment in tech businesses touched $8 billion in the same year.

Dubai-based ShopDoc is trying to make healthcare a habit among children using the metaverse

Momentum to continue

The funding momentum is expected to grow in the MENA region.

A RedSeer report states MENA is approximately a $3-trillion economy, and GCC is the gateway to the region, where the Indian diaspora is widely present.

The digital economy will play a big role in the coming years. According to the report, $150 billion will be added to MENA’s digital economy in five years.

Edited by Swetha Kannan