Startup Stock Exchange opens up with VIPOnly as the first listed company

Yes, the Startup Stock Exchange is an exchange for startups. We wrote about the idea close to an year ago and it has now taken shape properly and opened up. Co-founded by Ian Haet and Brian Niessen, they themselves raised private funding from US and European investors including Greg Kidd, a first round angel investor in both Twitter and Square.

SSX operates via the Dutch Caribbean Securities Exchange (DCSX) in Curaçao. The DCSX is an international exchange for the listing and trading of domestic and international securities, similar to the NYSE or London Exchange. Curaçao is a constituent of the Kingdom of the Netherlands and abides to Dutch and European laws. SSX opened up on June 10th and the first company to be listed is VIPOnly- the first online shopping club in Morocco and North Africa offering exclusive daily deals on desirable brand-name clothing at a fraction of the retail price.

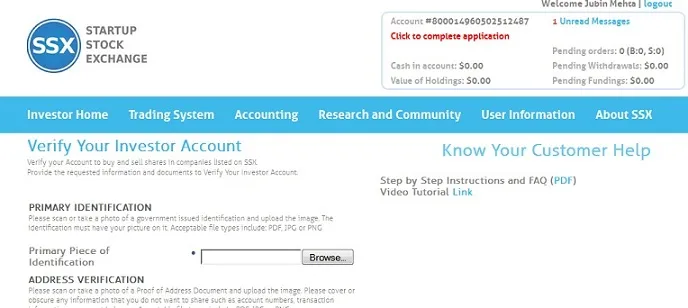

“Unlike other funding marketplaces, SSX allows anyone to become an Angel Investor”, says Mr. Haet. “Using their online brokerage account, they may purchase 1 share, 100 shares, or any amount of shares.”

For investors, SSX provides access to vetted companies worldwide. SSX performs a review of the company, investigating material facts, potential liabilities and the professional backgrounds of the management team. A company profile page including share prices, shares, shareholders, trading activity and historical data, as well as company reports every two weeks ensure total transparency.

Other benefits for investors include no minimum income or investment requirements; a liquid market; 24/7 real-time transactions; and government regulation.

For companies, SSX offers a fee structure specifically designed for the capitalization of startups and small businesses. Founders can concentrate on growing since there is only one application and they retain control of their capital. Other benefits for companies include the acceptance of companies worldwide in any business sector; easy access to SSX’s global base of investors; receiving mentoring and feedback; and reducing the time required for funding.

SSX has received application from across the globe and plans to have 40 companies for IPO in the next 6-8 months. A really audacious plan, it'll be really interesting to see how the stock exchange shapes up over time.

Go, trade here.