Yahoo’s ‘old wine in a new bottle’ strategy with their new publisher platform – Recommend

Yahoo has been experimenting a lot with the great in-house talent it has acquired over the past 2 years. ‘Native Ads’ is the next experiment at Yahoo HQ to boost their revenues in order to provide a platform for various 3rd party players in the market.

Traditionally, ads have always been the core revenue generators for search engines. With the rise in content generation and accompanied massive growth in content consumption, however, there’s a great new source of revenue for these players to be explore and perfected – Native Ads.

The ‘Native Ads’ plan

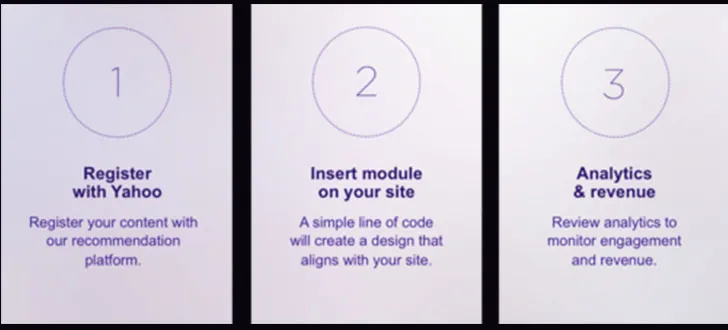

Yahoo plans to have its ‘Native Stream Ads’ appear on different publishers’ websites via their content recommendation engine, which also features sponsored posts.

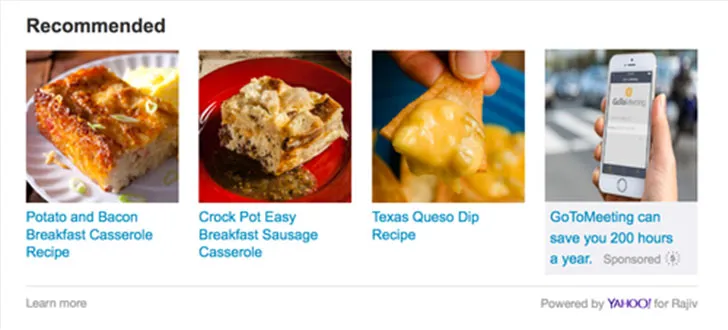

Yahoo’s differentiating its recommendation engine from the others like Outbrain that promote content on other sites. Yahoo ‘Recommends’ only promotes content on the publisher’s own site, along with Yahoo’s stream ads. Like other ad engagement networks, the host publishers share a cut of the click-revenue on those ads. Yahoo's ‘Native Stream Ads’ would look like Facebook's Sponsored Stories in that they adapt display ads as content links within its site’s content channels.

This is Yahoo’s first chance to extend the range of its ads beyond its own channels. It has already signed publishers like CBS Interactive’s GameSpot, TV Guide and Vox Media’s SB Nation onboard.

Israeli competitors

Today, both the Israeli startups Taboola and Outbrain have been globally helping hundreds of partners with their content partnerships, and churning millions in this business. It now definitely gets interesting with the entrance of Yahoo in this recommendation and native ad promotions business.

Started in 2007, Israel-based Outbrain has been rumoured to launch its IPO soon. It’s projected that they could raise over $100 million at a valuation of over $1 billion, while Taboola is in the process of raising a huge funding round to scale and diversify its product line. The growing craze of Buzzfeed and related websites that are trying to innovate with native advertorials coupled with its recent huge valuation clearly validates the potential of native advertisements.

The recommended content box from Yahoo would be visible on both the desktop and mobile properties in a in the same way ‘You may want to read more’ sections are usually found on content websites. The only difference is that this box would show the host publishers own content with few native ad content links from Yahoo.

Yahoo!

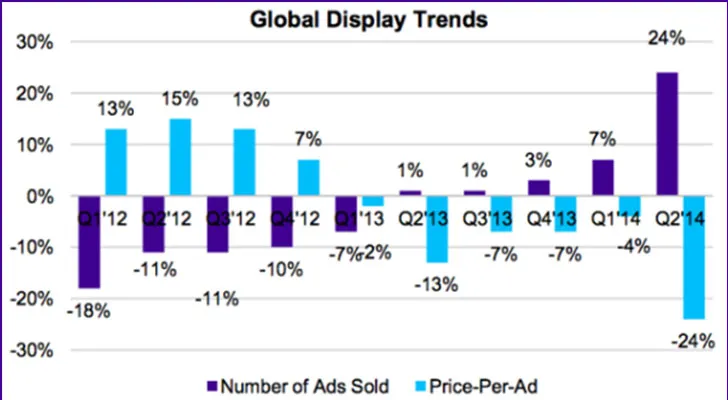

Yahoo has benefited from native ads since the past few quarters with volumes if not with the profits. It has earned close to 40% of its revenues for the last quarters from display ads. This is surely going to be a great monetization model for the company that has not been able to grow its revenue flow under the glamorous leadership of Marissa Mayer.

The company has suffered heavy losses over the past seven consecutive quarters due to the drop in revenues from Yahoo's display ads.

Yahoo’s ad-buying marketplace, Gemini, has given advertisers the platform to buy ads for mobile search and native ads since this February. Yahoo could further extend mobile ad analytics to these advertisers using Flurry’s platform that it acquired in the early part of this year.

Yahoo is hopeful that its mobile display and search business will surge fast on account of its early acquisitions of Aviate and Gemini. The intelligent android launcher, Aviate has been receiving a great response globally and smartly clubbing information for the end user. Its intelligence technology coupled with Gemini’s mobile search native ad platform could do wonders for Yahoo; it’s for the time ahead to speak for itself. The recent release of Yahoo Mail and News app are also receiving some accolades and the average time spent per user on Yahoo’s platform is spiking slowly, definitely a good sign for its ad business.

With every passing day, Yahoo’s focus on content and mobile is becoming clear. Post Alibaba IPO period is going to be an interesting period to see what Marissa Mayer does with Yahoo’s stakes.