E-commerce is not a ‘winner takes all’ game

Who is the biggest e-commerce player in the world? Who are the e-commerce giants in the US and China? The most common answer to these questions is always Amazon and Alibaba. But are these two the only leaders in e-commerce market? Have they created monopolies in the markets they exist in? Is there a chance for other e-commerce companies to succeed in the markets where companies such as Amazon and Alibaba exist?

According to a research by eMarketer, e-commerce is the only trillion-dollar industry that is growing at a double-digit percentage each year. In another estimate by the US Census Bureau, e-commerce sales accounted for just ~6.5% of the total US retail sales last year.

Do you think Amazon and Alibaba will be the only winners in the e-commerce game? These numbers clearly suggest that room for bloom and growth of other e-commerce players is still pretty large.

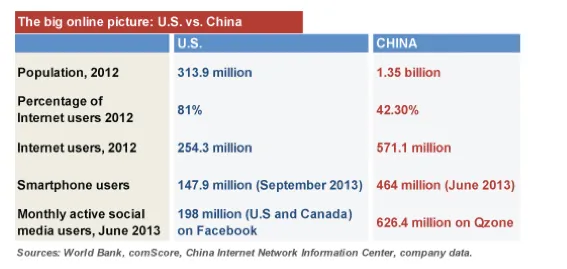

Closer home, today total Internet users in India are 240-250M, of this mobile Internet users in India is 130M; and is expected to grow to 190+ M by 2015. Over 35M transactions have happened on the Internet. Total Smartphone users in India are ~300M in 2013; India is the third largest smartphone user base after China and US; India will overtake US by 2015. E-commerce industry in India was $13B in 2013 (including travel); this is expected to grow to $70B by 2020. Currently ~10,000 pin codes are already covered in the country for delivery by e-commerce companies.

So what does these numbers indicate about the Indian e-commerce market opportunity? A daily of ~26 million unique visitors place ~1.5 million orders with a GMV of ~220 crores on e-commerce websites in India. Online travel holds a dominant ~70% of the e-commerce market share in India.

The share of e-commerce transactions from online retail & marketplaces increased from 10% in 2009 to 18% last year but it is still a miniscule 1% of the total retail transactions in the Indian market. (Source)

The Indian e-commerce game has just begun. Indian e-commerce companies are fighting hard for customer acquisitions & gaining market shares. Global e-commerce giants such as Amazon are trying to capture the Indian e-commerce market. The established retail business leaders are entering the e-commerce market too.

With large horizontal e-commerce players in India – have raised over $3 billion in total, with sales of $5b annually, the future of e-commerce looks bright. These companies are processing 300k orders a day. This is unprecedented growth in the industry.

The access to capital from outside India has increased for the e-commerce industry. Investors have started making strategic bets on Indian e-commerce. The latest round of $627 million funding that Snapdeal raised from SoftBank shows a positive sign for the industry on the whole. One of the most important things for e-commerce companies is the access to capital and this capital is mostly coming from outside India.

This is already influencing the growth of vertical e-commerce in India with startups such as Lenskart, UrbanLadder, Pepperfry, LimeRoad, Zivame, Healthkart and BigBasket etc. raising significant second rounds of funding.

Amazon is valued at 150+ billion USD currently. However, this is only a part of total US retail transactions. Even in the US, niche and vertical players such as Zulily, lululemon, OneKingsLane, and Bonobos etc. are building niche and unique online retail brands which are valued at tens of billions of dollars. So even in an evolved mature market such as the US, e-commerce is not a winner take all market. So how can it be otherwise in India?

With humungous markets to serve and the exponentially increasing internet penetration and access to capital in India, or for that matter anywhere in the world, e-commerce is not a winner takes all segment. We will see many more e-commerce success stories in the years to come not only in India but also globally, given the miniscule penetration of online retail as of today.