Why do NRIs find it difficult to setup shop in India?

image credit: ShutterStockLast month, at our web portal we received 15 queries from Non-Residents Indians based in countries like UAE, Singapore, and United States; all of them wanted to start a business in India, either alone or in partnership.

These were the kind of queries we got:

- ”I am an NRI based in Dubai. I am interested in a new company formation online. Business would be based in India and then gradually expanded globally. Appreciate if you can provide your expert view on the relevant structure/company form.

“I am a US citizen; can I own 100 per cent equity in an Indian startup I want to do something in the technology sector, like OLX? Will I be still be liable to pay local service taxes to all the vendors and marketing or development services I hire to run my business in India? How is the profits taxation handled if I sell my company to someone? Please also share your document requirement to open up a company.”

These are just two examples of the kind of letters we have received and they give an overview of the questions and difficulties that a foreign national/NRI faces. The solutions we gave and whether they actually got down to forming companies in India is a totally different ball game; mostly thanks to the awkward laws of doing business in India.

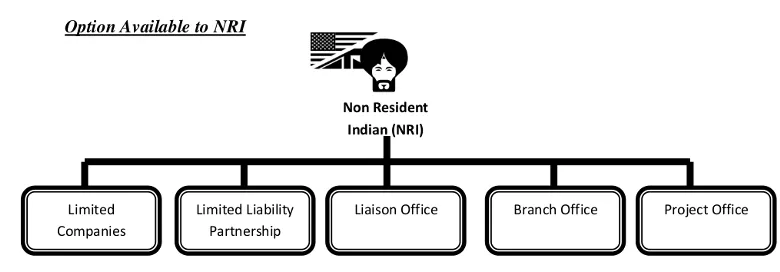

Let us understand what options are available to NRIs who wish to start a business in India.

As this article is based on the past experience of incorporating Limited companies with NRIs, so the main discussion is relevant to Limited companies but a glimpse of each option is necessary:

Most NRIs wants to start a business in India as a company and that is where the problems begin.

Difficulties faced by NRIs

- No single person can form a company:

With the coming of the New Companies Act, 2013, a new concept of one person company has come in but the restriction is that that one person should be a resident Indian. NRIs, PIOs, Foreign Nationals are not eligible for forming this type of limited company in India.

- Need of Indian resident:

Companies Act, 2013 permits NRIs, PIOs, Foreign Nationals and Foreign Residents to act as directors of an Indian Company. With the removal of OPC from the scene, there are two Limited options left Public and Private Limited and the difficulty in doing this is shown with the help of info graphic:

- Notarization of documents from Indian Embassy

In forming a company, the first step is to get the Digital Signature Certificates (DSCs) of the proposed directors and then apply for Directors’ Identification Number (DIN). In all these cases, the ID and address proofs of proposed directors are needed. In case of NR/NRIs, clear instructions have been issued by the government that if the present address of the NR/NRIs is outside India then each document of the person should be notarized from the Indian embassy of the country where the person presently resides.

- Non availability of address proof for registered office

For registered office of the company, the electricity bill/property tax receipts/gas bill, No Objection Certificate from owner will be needed. In

the initial stage, when a NRI/NR plans to open up a company in India he/she does not have a registered office address proof which is the last step in company incorporation because of their belonging to different nations.

Resolutions to some extent

- Availability of Indian residents: Many Indian firms help to introduce NRIs to persons who are willing to work in their company as directors in lieu of some remuneration which takes care of the problem of one resident Indian in the company.

- Single Person Company is not viable: For Foreign Nationals/NRIs, One Person Company is not a viable option as this concept has been introduced by the government to promote registered proprietorship in India and not with the aim to attract foreign nationals or NRIs to invest in India individually.

- Availability of registered office address: The concept of a virtual office in India is new but very effective. A Foreign National/NRI can resolve the registered office problem by opting for a virtual office presence in India. Many startup hubs, incubation centers and institutions provide this virtual office concept in lieu of some remuneration.

Conclusion

Although, the Indian government is making a continuous attempt to ease the process of doing business in India, there are some points which create disinterest in the mind of foreign citizens about the Make in India concept. The government should think of ways to promote and attract foreign investors by removing these difficulties in order to make doing business in India hassle free.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)