Company registration for dummies: should startups choose Private Limited/OPC over LLP?

We, at Quickcompany.in, receive queries from startups everyday on what form of business they should go with. The other day we got a call from a tech startup in Gurgaon where the founder said they wanted to incorporate a legal entity but was confused on what would be the best option –One Person Company (OPC),Limited Liability partnership (LLP) or a private limited one?

As a startup, they are obviously conscious about saving costs and want to invest in something that gives them full freedom to do business yet doesn’t have very high annual maintenance cost.

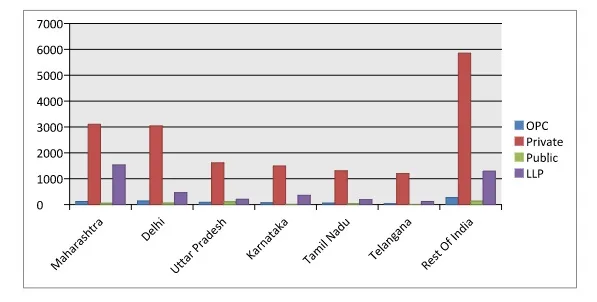

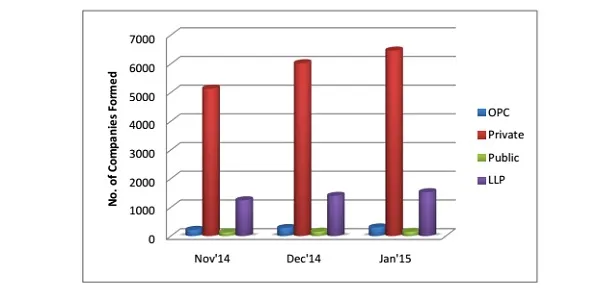

Out of 10 startups, more than five do not have any knowledge about legal terms . All they have is an idea, but are not sure how to and from where to start. In the last three months, we have seen that in the Incorporation of Legal Entities there has been an almost 26% rise in private limited company formation and also One Person Company (OPC) formation is also increasing. Every month more than 5,000 businesses are incorporated in India and, out of these legal entities, more than half are in three states only i.e. in Delhi, Maharashtra, Uttar Pradesh.

Let us look at the facts:

Also, please look after how much the growth of company formation in last three month is:

(Source for the above charts: mca.gov.in)

Questions to be asked while choosing which legal form to create:

1. Are we ready to bear the legal consequences/ Compliances? For a startup, it is best to first consider, whether they are ready to bear the legal consequences and compliances in the form of annual filings, balance sheet signing, that come with the formation of a company.

2. How many people will be‘promoter’ in the company? The first thing that will create value for the company is the formation of the core team structure and then choosing the best Form of Business.

3. How much Capital Contribution/Capital will be Introduced by the promoters? Seed funding is the first seed that a promoter sows to reap the startup tree. Capital is the seed fund and also the main factor of choosing the main form of business like what amount of contribution promoters are willing to introduce in the company.

4. Are there any Funding/Investment Requirements in the future? This, too, has to be decided at the very onset as it is the deciding factor for the kind of business to choose.

What factors make the Private Limited/One Person Company (OPC) more favorable than an LLP?

1. Sense of Ownership: Like in OPC/Private Limited, Shareholder contributes the amount and gets shares of the company 100% in OPC, and in proportion in Private Limited, but in LLP , everytime partners contribute the amount and do not come up with the result, there is conflict over who is the major partner or who is the minor one.

2. Acceptance of Foreign Payments/Investments Ina Private. Ltd. Company, any foreigner can become a shareholder and can easily route the money from a foreign country to India but in LLP there are many restrictions.

3. Atmosphere for Investors In the initial stage:Most startups, begin with the hope of a ROI in the near future, Investors always invest in the business in lieu of some stake which onecan get only in a Private Limited and not in an OPC. InvestorsIt is possible only fter conversion of an OPC into a Private Limited one by filingthe INC 6 form to MCA.

4. Going Public in Future: In the recent Budget and new notifications from SEBI, the government has plans to be lenientabout going public for startups.. In Private Limited companies, one can go public by converting Private limited into Public limited company, but in an LLP, the LLP Act does not permit the conversion of LLP into Private Limited or into Public Limited. One can choose to be aOne Person Company (OPC) in the initial stage of the startup if he/she is the single owner of the company, and later with the introduction of new persons in the company, OPC can easily be converted into a Private Limited one, but that can’t be possible in the case of LLP

Conclusion

While choosing the best form of business, keep in mind that this selection is as important, as the execution of the idea. Although, compliance cost and formation cost of LLP is much less than in One Person company (OPC)/Private limited but if your idea needs funding and in future you have the plan to grow big, then Proprietorship and partnership cannot not give the right plough back that your business needs

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)