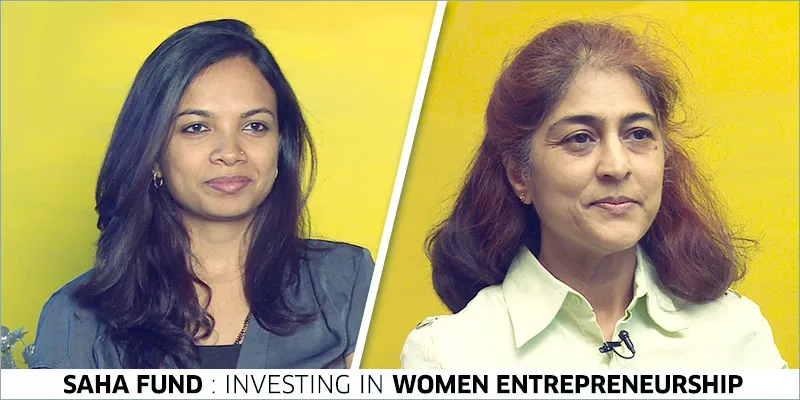

For, by and of women entrepreneurs – SAHA is India’s first women’s venture capital fund

The 2015 Gender Gedi Female Entrepreneurship Index ranks India a dismal 70 out of the 77 countries included with a score of 25.3 per cent . This index measures a country’s potential to encourage and fuel the development and growth of female entrepreneurship. India also received the lowest score in terms of Labour Force Parity on an institutional level.

In the first half of this year, Indian startups have raised $3.5B funding. According to data compiled by YourStory, startups had raised USD 1.7 billion in Q1 2015 alone. The number of deals in Q2 2015 has increased by 50 per cent from the previous quarter. However, when we look at businesses with women at the helm —startups founded and run solely by women, the number is small and when we talk of the ones who have received funding, it does not even cross single digits.

Creating a women specific venture fund

Looking at this parity Ankita Vashistha launched Saha Fund, a venture capital fund for women centric businesses that is run by women. An electronics and communications engineer, Ankita went to Cranfield School of Management in UK and did her masters in Finance. She has worked in organisations like Aureos capital Abraaj group, Tholons Capital and Tholons Consulting. Ankita is Managing Partner at Tholons Capital which focuses on seed and Series A rounds.

She joined the India Angel Investors to understand the ecosystem better. Ankita has been in the investment space for eight years now in India, UK, US, Singapore and Philippines. Early on she noticed a trend that despite companies having women co-founders, and even in key management roles, women founders rarely ever spoke up when it came to pitching.

Breaking the glass ceiling

Ankita says, "On the investors side there few women investors and on the portfolio companies side there is a sense of hesitation. Many times investors are hesitant in investing in a women centric organisation. And the women find it uncomfortable speaking openly to an investor. This is because a lot of times investors do ask sensitive questions that are generally not asked."

Citing an example, Ankita adds that these could be questions like –‘if you get married will it affect your work life, will you be able to reach your targets.’ Also Ankita believes that women have an intuitive perspective to things and can bring different ideas to the table, which men cannot.

"We're missing out on a skill set, and traits when put into business can not only transform the ecosystem, but even aid in further economic development of the nation,” adds Ankita. To ensure this Ankita wanted to create a platform where women could step up and speak. One of the essential funding requirements of SAHA is that there has to be a woman founder or a woman in a key management role. It means that the woman has to take the first step and put out her ideas and thought processes. Saha Fund aims to create a new balance and a new normal.

Also Read: 60 per cent of Series A companies in India have founders from IIT/IIM and all of them are males

Building the team

The fund has investments from Mohandas Pai and Kiran Mazumdar Shaw. Ankita shares an interesting anecdote that led to the birth of SAHA. She knew Mohandas Pai, and the two of them happened to be a part of a higher education delegation to China once.

They got talking and Mohandas Pai told her that he was interested in working with her if she could come up with a fund that targets a niche sector. "That's when we decided to work on a for profit fund for women entrepreneurs. Mohandas Pai was our anchor investor," adds Ankita.

Through him Ankita met her co-founder, Usha. Avinash Vashistha, past chairman and managing director of Accenture and Chairman Emeritus, Tholons, too has invested in the fund. Avinash says, "Diversity brings in more creativity, innovation and addresses the significant gap among knowledge workers. Saha fund is a great platform for women entrepreneurs and leaders to explore the new world of innovation, digital and disruption."

While she already has big names backing her, Ankita believes that it's important for the investors to feel involved. She adds that she is looking for the investors to work as mentors and advisors to the startups. It could also be possible for them to take in a board seat in the portfolio companies.

Mohandas Pai believes that venture funding has played a vital role in fuelling and scaling the impact and value generated by of some of the industry's brightest and most ambitious minds. "However, a large section of our best entrepreneurs - women - are underrepresented, not just in the space of entrepreneurship but in venture capital as well. The Saha Fund will bring resources and expertise to help women entrepreneurs and founding teams reach their true potential" adds Mohandas Pai.

He says that as a fund led by women, it will also lay down a fresh new template for inclusive growth and set an example as a fund that makes a difference. "I am extremely happy to be part of this mission, and I'm looking forward to working with this team," he adds.

Kiran Mazumdar Shaw believes that women need to focus on business building with confidence and competence. "I think the Saha Fund will provide a very vibrant and interactive platform for women led businesses to share ways of overcoming challenges, manage risk and deliver growth," she adds.

Portfolio companies

Saha Fund, is looking to invest in women led companies across different sectors. Added to this, the fund is keen on companies that use technology to scale. Some of the companies Saha has backed include - Fitternity, Kaaryah, Stelae Technologies and Joulestowatts. Fitternity founded by Neha Motwani is a one-stop-destination for fitness enthusiasts looking to find and book fitness activities. It is supported by credible fitness content, community platform and an e-store. Stelae Technologies, founded by Aruna Schwarz is a software vendor providing an automated conversion solution for multiple categories of content.

Neha says that being a women entrepreneur herself, Ankita has an understanding of what women entrepreneurs face. "She is open to feedback and is completely involved. It was through her that we met Mohandas Pai. They have a strong ideology that now we've funded you, we are with you for the long run," adds Neha.

Kaaryah, founded by Nidhi Agarwal, is a brand of western, non-casual wear for Indian women focused on providing the best possible fit with its 18 sizes. The brand focuses on bridging the gap between western formals and the Indian silhouette. Nidhi says that Ankita and her team had an intuitive understanding of the problem she was looking to solve.

"I didn't even have to explain it to Ankita, she got it in the first go. Saha Fund intuitively understands consumer needs and perspective. Being run by women it brings in a completely new and different perspective into the business and it brings in unique insights," adds Nidhi.

JoulestoWatts provides IT solutions, GIC Consulting and Solutions, Talent Collaboration Solutions, and Sales and process outsourcing among others. Priti Sawant of Joulestowatts says they’re thrilled to have Saha Asset Advisors and Manipal Global Education Services (MAGE) as key partners and investors. She says with leading industry luminaries like Mohandas Pai, Kiran Mazumdar Shaw, Mr Avinash Vashistha and Dr. Ranjan Pai backing these funds, they’re confident that the association will allow JoulestoWatts to chart an aggressive growth path and become an industry leader within three years.

Priya adds, “We will certainly be looking at leveraging strengths of the entire group to build unique, compelling service offerings at a global scale. I personally look forward to working with Ankita Vashistha and Usha for making this business venture a global success story. Guidance and support provided by Ankita and her team from SAHA/MAGE will enable JoulestoWatts to become the business leader in the staffing industry”.

Saha Fund has a 'Mentors Circle’ that consists of industry stalwarts to help mentor and guide the women entrepreneurs. Ankita adds that even if they don't invest in the portfolio company, they can create equity to the companies. She adds that there are several stereotypes that need to change. And that change is possible when there’s gender parity in entrepreneurship and management rules.

"We at SAHA are focused to partner with passionate women, with great and diverse ideas, with a committed and synchronising team, reachable, scalable, and deliverable. We value our teams with trust and transparency as the motto," adds Usha.

Video Editor: Anjali Anchal

Cameraman: Rukmangada Raja