'India is moving from low trust-anonymous country to high trust-identity verifiable country'– Nandan Nilekani

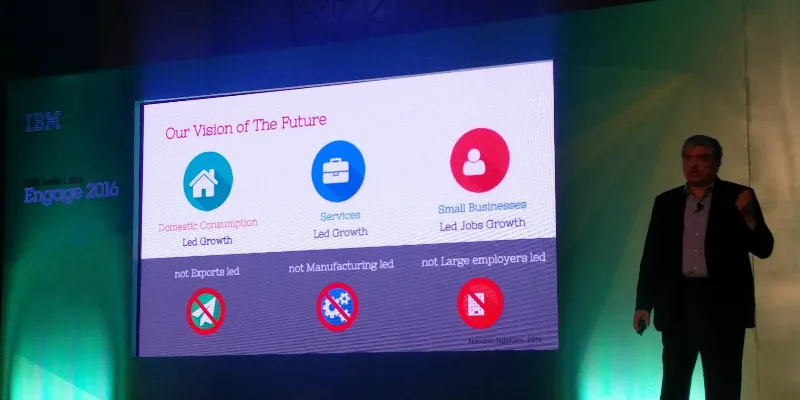

The general belief in India has been that growth will be led by exports, manufacturing and large employers. But what is happening in India today is different and I believe that India’s growth will be led by internal consumption, services-led growth and small businesses,

began Nandan Nilekani, Infosys co-founder, Chairman, EkStep and former Chairman, Unique Identification Authority of India(UIDAI), as he took the stage on Monday at IBM’s Engage 2016, in Bengaluru.

Nilekani explained that the digitisation of the Indian economy makes him believe in these trends. Mobile phones have become the world's first universal product and he sees this as a strategic advantage for a country like India.

While an estimated 100 million smartphones are sold a year, Nilekani believes that by 2020 India could see about 700 million smartphone users in India, with fundamentally every adult having access to them. India is currently the second largest (trailing behind China) Internet market ahead of USA, and the only country where it is still growing, while it is saturated or in decline in other countries.

Through grassroot surveys, researchers have found that Internet adoption is more widespread than thought and is currently being used for variety of basic activities. Another trend noticed was the concept of ‘offline Internet’, where users would download content when they have Internet access, to consume later on while they don’t have access. Nilekani noted,

The Internet usage is far more sophisticated than we think.

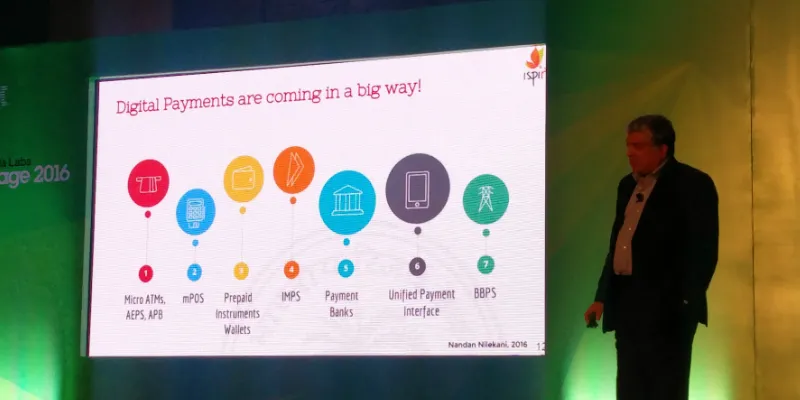

Drive towards a cashless economy

Nilekani believes that digital payments are coming up in a big way with initiatives like Aadhaar, payment banks, UPI and other initiatives. He said,

Aadhaar is unique digital identity, which now has more than one billion enrollments in five-and-a-half years. What is unique is that it is an online identity approved by the government and the system can currently authenticate 100 million transactions a day in-real time.

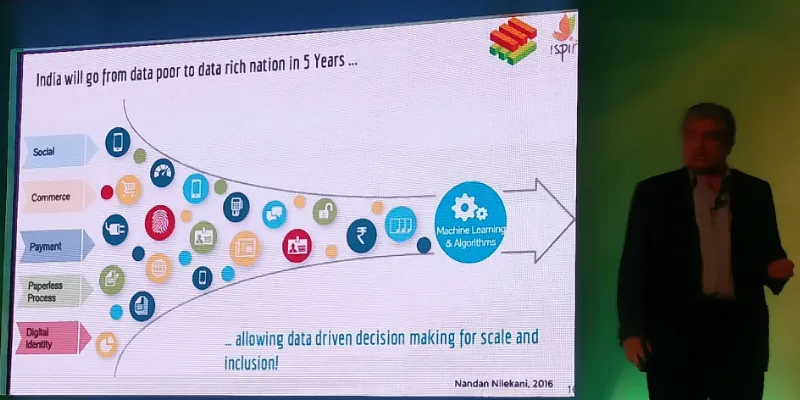

Nilekani also spoke about how smartphones with Aadhaar-compliant iris recognition will soon be available commercially, providing an added layer of security and ease of use. He noted that he is seeing platformisation and digitisation in every sector across all of India’s backend infrastructure. This will usher in growth along with a massive explosion of data in India. He said,

India is going from being data poor to data rich at a scale that people are not able to fathom. Leveraging Aadhaar, UPI and India stack along with the kind of cloud services that IBM has, like Dataworks, can create a whole new way of doing things, which was not possible before.

Related read: Nandan Nilekani has a BILLION likes in India, what’s next for him?

Global trends

Nilekani noted that because of recent developments, there is backlash against globalisation happening everywhere. Global trade is slowing down in volume and value, partly because of fall in commodity prices like oil and iron ore. India exports are down too. He said,

Future growth of economy won’t come from adding more percentage of GDP to export but from making Indian economy more vibrant through technology. While exports are down, domestic consumption continues to grow,

Technology such as automation has become a big driver in manufacturing and is affecting economies of scale. Now companies like Apple and Adidas are in the process of manufacturing their products locally, leveraging robots and automation rather than relying heavily on markets like China for factories and cheap labour.

While countries like Japan, Korea and China have been able to rely on manufacturing and building factories to drive growth, Nilekani believes that the game is over for India as it is unlikely that it would be able to build that kind of capabilities. But he believes that Indian growth will be led by services. He said,

We will see massive productivity unleashed in services by leveraging technology and have service-led growth across all sectors. Services like tourism have vast potential. India gets only about eight million tourists a year, while Thailand gets 25 million.

Data is going to drive formalisation of Indian economy

Nilekani estimated that only seven percent of Indians have jobs in formal sectors, while a vast majority don’t have social security and don’t pay taxes. Historically, there was no reason for them to be a part of the formal economy, as it is actually a pain because of bureaucracy and corruption.

But things are changing now because of rapid adoption of technology and ability to collect and gain intelligence from data. New-age startups are able to aggregate supply and demand and ensure business. Nilekani cited the example of how Ola and Uber are helping their driver partners join the formal economy by providing them access to loans and other benefits.

The driver partners are seeing benefits from joining the formal economy, but this opens up the need for skilling the workforce. While a partner joins the workforce, a company’s brand is at stake. Hence the focus is also moving towards improving skills and ensuring a minimum standard of skills.

Nilekani iterated that as a result of all of this, the notion of social security is also changing. Earlier, people assumed lifetime employment at a company, because of the monetary benefits and security involved. But soon there will be ways to digitise these offerings through apps, where users can access services like pensions and insurance policies online. He said,

Fundamentally, the way we deliver social benefits will change and this will create opportunities for young entrepreneurs. This completely upends normal thinking, so there is big opportunity.

“India is a single-services market like nowhere else”

Nilekani noted that India is unique in the sense that we have single entities controlling important portfolios, like only one banking regulator, and one telecom regulator. USA, on the other hand, has about 50 regulators each for different offerings and this creates a lot of paperwork. While India is currently a fragmented market, it has great potential as a single liquid market for services, with free migration. Countries like China, on the other hand, have restrictions on movement.

Another key difference is that the public technology stack in India is public and approved and controlled by the government. In countries like China, payments are not completely regulated by the government as players like Alipay and WeChat are the de facto modes of payment. On how this benefits India, Nilekani said,

What this does is it fundamentally changes innovation layer from public stack to a layer above that. Startups can’t innovate by controlling payments, but they can by providing a great payment experience.

So Nilekani believes that mimicking ideas from other countries won’t work. Hence, Indians need to innovate and build on top of the existing infrastructure that is available. He also noted that India’s public stack has been designed for scale and high volume transactions, and estimated that the new-age banking practices will create $400 billion in market capitalisation for India. Also, based on the quality of data being collected, Nilekani sees machine-based lending to be more accurate than human lending, which has a potential to disrupt the economy.

Trifecta for economic change

Nilekani believed that the new trifecta of a bank account, digital identity and smartphone for everyone will drive economic change. The nature of transactions, business and services will change and create massive amount of opportunity for India. Formalisation of the economy is also expected to happen at a rapid pace and India will see economic growth, once the tipping point is reached. Nilekani concluded,

India is moving from low trust, anonymous country to high trust, identity-verifiable country. Everything will have to be re-imagined for the new economy.

Related read: Why IBM and Apple chose Bengaluru to leverage enterprise mobility