How WealthTrust app is making wealth management easier and paperless

With a vision to help people save more and earn best returns at the lowest cost in a smart and hassle freeway, Nisarg Gandhi and Jasmin Gohil started a wealth management app ‑ WealthTrust. The app is equipped with features such as zero commission, paperless, and smart savings.

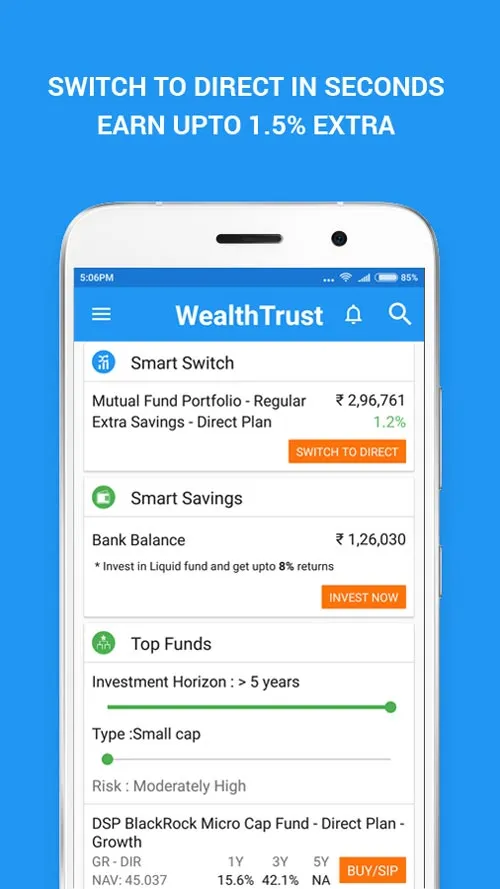

The founders claim that with the help of this app, existing investors can switch their existing portfolio of mutual fund investments to zero commission direct plans. As a result, they start saving up to 1.5 percent extra every year. Users can also start a new investment in any scheme of 25 different mutual fund houses in matter of seconds without any paperwork. The app also recommends top funds for different investment horizons and risk profile of users. Nisarg says “Our technical analysis team, led by Mitul Shah, does an unbiased research and brings out top funds from the universe of more than 6,000 funds.”

Birth of WeathTrust

While Nisarg was working in a FMCG company, he wanted to save some money so that he could quit the job and start up on his own. To do the calculation, Nisarg prepared an excel sheet to analyse his expenses, income and mutual fund investments. This entire exercise took about three to four hours. Nisarg discussed the idea with his friend Jasmin that evening over a cup of tea. They both then decided to automate this with the help of a mobile phone. This was their eureka moment.

During the beta testing of the app, the co-founders realised that just analysing, tracking portfolio and expenses does not solve the personal finance management problem. A user is also looking for opportunities to save more and build his wealth. This prompted them to build a seamless and zero commission wealth management platform WealthTrust.

In May 2016, they rebranded the Wealthee app to 'WealthTrust' and launched the zero commission mutual fund investment feature. WealthTrust claims to be the first wealth management app in India which provides seamless, paperless and zero commission mutual fund investments.

Nisarg is an ex-ISRO Scientist and IIT-B alumnus. Jasmin is a tech expert with more than eight years of experience in the IT industry. The platform now has a team of six members.

How does WealthTrust work?

An existing mutual fund investor can download the app, take a picture of his/her PAN card, click a selfie, fill basic details and then switch to zero commission direct plan. These funds are shown in the portfolio and can also be also tracked. The investment account opening process is completely paperless. Once this is done, the user can start making new purchases into any of the 6,000 schemes of 25 mutual fund houses through the app.

If an investor wants to invest for three to five years, he/she can invest in any one of the top three funds in the balanced funds category that will be shown.

Within 40 days of launch, more than 150 investors have signed up and they have started switching and investing through the WeathTrust app.

Market opportunity and others in this space

In January 2016, personal finance startup Fisdom raised Rs 3.4 crore from a clutch of angel investors which includes Taxiforsure co-founders Raghunandan G and Aprameya Radhakrishna as well as realty portal Commonfloor's Sumit Jain. This Bengaluru-based startup is an advisory and transaction platform for personal finance. Other players in this segment include TipBazaar, an analytical marketplace which offers stock market analysts a platform to list their tip packages; FundsIndia; MyUniverse.

Retail MF market in India consists of 10 million investors with $6 trillion ($90 billion) of assets under management. This market is growing at a rate of 20 percent year-on-year. Currently, around 8.7 million investors invest in regular plans.

WealthTrust has raised seed capital from IndiaQuotient. It manages assets/wealth of more than Rs 3 crore and more than 300 investors have opened their account with them. They have a premium plan of subscription of Rs 99 per month, which is free for first six months.

As far as future plans are concerned, WealthTrust aims to introduce new features such as Quick SIP and Smart Advisory. The team is also working on strengthening its algorithms to help users identify more saving opportunities and earn better returns.