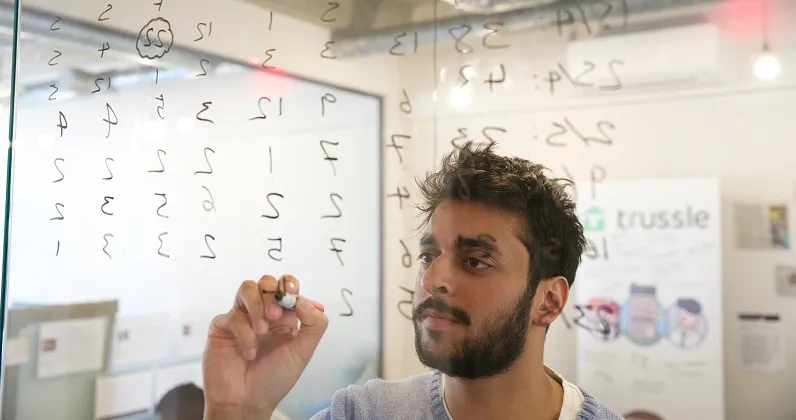

London-based Trussle helps users compare and pick the best mortgage to meet their individual needs

Trussle is a digital platform that helps users find the most convenient mortgages considering their specific requirements. It was born in December 2015 out of founder Ishaan Malhi’s own frustration with existing solutions. One month later, it received a seed round of funding of over £ one million.

Thirteen under one roof

Ishaan says his desire to start a business dates back to the 1970s, when his parents moved to London from Punjab and, without any qualifications, set up a retail clothing business. “I used to live together with other 13 relatives in one house and we needed a safe income flow to sustain such a large family. My father and grandfather then opened a clothing retail store on the high street. Products for the Indian tastes were largely available because the area was for the most part populated by migrants from the subcontinent. So, my family took the risk and decided to start selling western clothes. Soon it became so popular, it became the go-to brand in the area."

The broken brokerage

Ishaan says his family upbringing taught him the importance of self-help. That is why, when he learnt the mortgage broker he had consulted lost all the sensitive information he had given him, he decided to take up the initiative and find the best option for himself.

He consulted comparison sites online but did not find any better options there. “It gave me no context. It requires the knowledge of an expert to pick one among a list of 1,000 options and I just had no idea which one was right for me. I didn’t even bother to go to a bank because then I’d need to go to all of them,” he says. Ishaan worked as a Mortgages and Real Estate Analyst at Merril Lynch and yet, he confesses, “Although I had all the kind of vocabulary and context for getting a mortgage, I still had no idea what I was doing. I spent two years working in real estate and if I cannot navigate the process getting a mortgage how will a person who is less familiar go through the process themselves?”

Spot the gap, build a bridge

And that is how Trussle took shape. The platform gathers information on 11,000 mortgages from over 90 lenders and finds the perfect match based on the user's circumstances and requirements. The service is completely free to the user but Trussle makes money from the banks who pay them a very small percentage of the mortgage amount. Ishaan adds, “Once you have the mortgage, we continue to monitor it and make sure you’re always on the best deal so you never pay more than you should. Basically, we constantly update you on ways you can save money and switch deals.”

Ishaan shares that out of a market worth £220 billion of mortgage landing, their main target are people who want to re-mortgage. “There’s people looking at getting a mortgage to buy a home. However, what’s is going unnoticed and unmanaged are the 11 million outstanding mortgages. We did a survey among these people and found that 60 percent of them are paying significantly over the odds through not carefully managing their mortgage and switching when they could save money,” Ishaan exclaims.

The team

The team of 13 (funny enough, it is the same number of people he used to share his house with during his childhood) has been put together carefully by Ishaan, who holds people to be the main focus of the team in the next future. “We define Trussle ‘enabled by technology, powered by people’,” says Ishaan, “In the next 12 to 24 months people would be absolutely the most key asset that defines the business.” Ishaan does not share when he expects to be profitable but says that he aims to grow to 25-30 people by the end of the year.

Challenges

Brexit is the question that naturally emerges when talking about real estate in the UK. There are discording opinions about the topic, but many predict a drastic drop in prices once the UK leaves the European Union. Yet, Ishaan is very optimistic, “Honestly I think a lot more positive will come from it than you expect. Firstly, the price is not going to change overnight like foreign exchange which, vice versa, is going down a lot more. A lot of foreign buyers (mainly Russians, Chinese, Middle Eastern) will come in and will balance out any shock because it’s 10 percent cheaper for them to buy London property now.” He argues that Brexit will not affect Trussle much, “Because the greatest impact so far has been the drop in interest rates that landers charge for mortgagesWe might not have that many purchase enquires but we predict a lot more re-mortgage enquires from people who want to take advantage of that.”

Rather, Ishaan says the challenge is to educate users about what Trussle is about. The platform has no competitors as such in the UK, but it could be easily mistaken for a comparison site like the many existing ones. To cope with this, he says the team is investing into costumer development calls to explain that, unlike comparison sites, Trussle matches the specific user’s circumstances with the mortgage offers available. “We’re trying to hear how customers themselves describe the problem and figure out the right marketing strategy.”

Bright horizon

Trussle has partnered up with Zoopla, one of the largest online portals for property search in the UK focussed on the residential market. Ishaan is very positive about this partnership, but he remains grounded and talks about his business. “In the next two years we are really going to focus on people and getting our name establishes,” he says. Although Trussle aims to be a UK-focussed business, Ishaan keeps an eye on the global scene. He points on diversity as core value and the team counts nationalities, which span from Pakistan to India, France, and Italy.

The big house

Now Ishaan, who got his mortgage, can look back to his 27 years of life and trace all the different meanings that the word ‘house’ has had for him. While a single roof was once the perimeter that delimited a large family, houses became boundary-less opportunities for an innovative business.