What were the top 10 controversies of the Indian startup world in 2016?

Every year has its own share of controversies, whether in politics, movies, or business. This year, however, stood out because hardly a week passed without heated debates on some development or the other in the startup world — be it valuations, layoffs, shutdowns, speculations, or high-profile hiring and firing — you name it.

Although 2015 shocked many with the jobs lost in the likes of Housing, TinyOwl, and Zomato, among others, 2016 came with its own set of startling developments. Read to find out more.

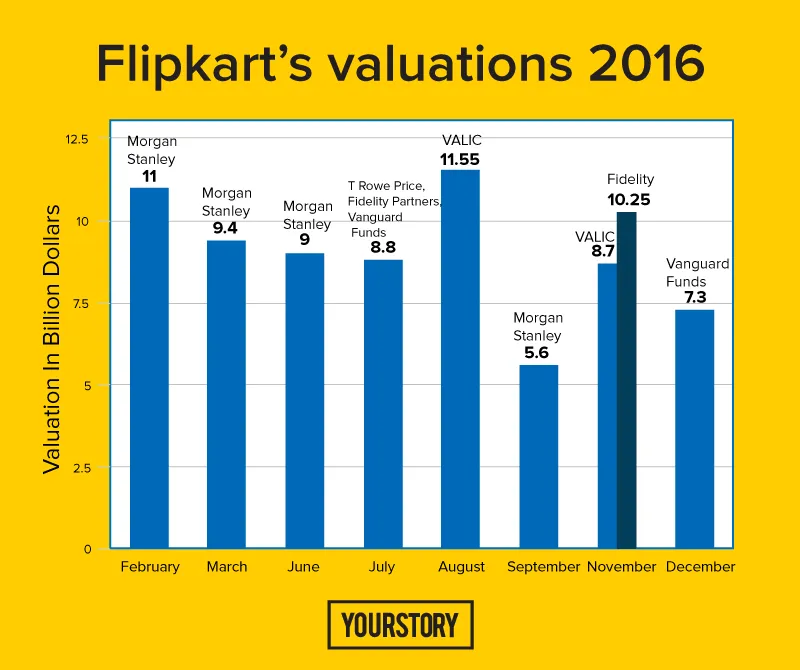

- Valuation markdown: ‘The year the startup bubble burst’ is what a lot of industry observers called 2016. Many, on the other hand, chose to see it as a correction rather than a bust — valuations, are, after all, often affected by unrealistic expectations about the market. When Flipkart — which was valued at $15.2 billion last year — was marked down to $11 billion by investor Morgan Stanley in February 2016, the immediate reaction was of the sky falling down. But it didn’t stop there — there were more devaluations to follow. Flipkart alone faced five more through the year — by Morgan Stanley as well as Valic, Fidelity, T Rowe Price, and Vanguard Funds — the lowest of which reached $5.5 billion a few days ago. In May 2016, restaurant discovery and food delivery provider Zomato’s valuation was marked down by 50 percent to $500 million by HSBC.

- Mass layoffs and shutdowns: With PepperTap’s being the most prominent, 2016 might just have been the year which saw the most shutdowns since the beginning of India’s startup boom a few years ago. However, the word which ruled more headlines than ‘shutdowns’ was ‘layoff’. Even the celebrated unicorns were laying employees off in hundreds — Snapdeal laid off 200, Flipkart 700 — all of which were said to be based on performance appraisals. Online grocery player Grofers laid off 10 percent of its workforce in June, following InMobi which did the same in April. In August, Ola shut down TaxiForSure, which it had acquired in 2015, laying off 700 employees off. Around the same time, Astro Entertainment Network Limited-owned AskMe Group shut down, leaving 4,000 people (who had anyway not been paid for two months) jobless. Quikr laid off 150 employees, all of them from CommonFloor, which it had acquired in January.

- The mass exodus from Flipkart: It happened immediately after Binny Bansal replaced Sachin Bansal as the CEO of the online marketplace at the beginning of the year. Old timers like Ankit Nagori(CBO)

- and Myntra Co-founder Mukesh Bansal (head of commerce) left in a few weeks, and by April, Flipkart’s most high-profile hire, ex-Google executive Punit Soni, left the company just a year after he joined as the CPO. The exodus of top officials continued with Manish Maheshwari (head of seller marketplace and ecosystem), CFO Sanjay Baweja, engineering head Peeyush Ranjan, and private label head Mausam Bhatt leaving in the last few weeks. Ex-Tiger Global Management and interim CFO at Flipkart Kalyan Krishnamoorthy is now believed to be the one in charge as the head of design, categories, and advertising.

- No more IIT recruitments for startups: It started with Flipkart’s deferral of placements for 17 IIM-A recruits by six months from the pre-decided date in May to December 2016. Although the issue was settled when Flipkart agreed to pay them each R.1.5 lakh, Flipkart is not going to IITs and IIMs for placements this year, as is the case with Snapdeal, Zomato, and Hopscotch [according to reports].Grofers, Runnr, and ClickLabs were also reported to have deferred or cancelled their placement offers at the time. In fact, six startups were banned by the All IITs Placement Committee (AIPC) in June 2016 due to deferral and/or reducing pay packages against their prior offers. Hugely funded startups have been hiring from elitist institutes — even on the first day of placements- — which gives them the advantage of hiring the brightest students.

- Nikesh Arora leaves SoftBank: With an annual salary of Rs500 crore, he was the world’s third highest paid executive. As the COO of SoftBank Corp, the 48-year-old IIT-BHU graduate was expected to be Founder-CEO Masayoshi Son’s successor. During his tenure from October 2014 to June 2016, he was in charge of the Japanese investment firm’s major deals in India, including Snapdeal, Ola, Housing, OYO Rooms, and InMobi. His departure from SoftBank, however, was not so impressive. Post accusations of conflict of interest due to his positions in other firms, an internal investigation was conducted. Although the accusations found no merit during the investigation, Nikesh was reportedly criticised for poor performance of the companies in which SoftBank had invested during his tenure.

- The divorce and future of Mu Sigma: One of India’s earliest unicorns, data analytics startup Mu Sigma, last valued at $1.5 billion, was in the news in May when Founder-chairman Dhiraj Rajaram and his wife (then-CEO) Ambiga Subramanian separated. A few months later, Dhiraj bought out her stake in the firm and replaced Ambiga as CEO, becoming the single largest stakeholder. The year has not been the best for Dhiraj, one could say. He was accused of misleading an investor (Patrick G Ryan) into selling shares for lower prices, and recently there have been reports of slowing revenue and top officials leaving. Despite this, Canadian investors like Ontario Teachers’ Pension Plan and Canada Pension Plan Investment Board are reportedly keen to buy a stake in the 12-year-old company which counts Microsoft and Walmart among its clients.

- PwC investigation into Jabong’s secret affairs: This cannot be described in any way other than ugly. Praveen Sinha, Co-founder and ex-chairman of fashion e-commerce portal Jabong, was accused of ‘violation of corporate governance’after Rocket Internet, the parent investor in Jabong, had done a forensic audit by PwC. The transfer of Jabong’s logistics arm GoJavas to Quickdel Logistics (now run by Praveen and a board of directors) was apparently fishy. Rocket Internet was then investigating Praveen, Jabong Co-founder Arun Chandra Mohan and former managing director of Rocket Internet India Heavent Malhotra on it. Praveen left Jabong in September 2015, soon after Arun’s exit.

- Uber and Ola sue each other: In March, Uber sued Ola for $7.5 million, alleging that the latter was using fake accounts to book trips on Uber and then cancelling them, interrupting their business. Reports stated that 94,000 fake accounts were used to make more than four lakh bookings. Ola replied that Uber’s petition “has been filed in an attempt to bypass the laws of the land by foreign companies who run their operations in this country for profit without due regard for the applicable laws.” Uber retorted saying that though they are established in San Francisco, they have a hyperlocal team solving problems that are locally relevant. “Like our competitors, we received most of our funding from ‘foreign’ investors,” Uber had added.

- Paytm accused of lobbying for demonetisation: This was more of a political issue than anything else. The day after Prime Minister Narendra Modi announced the demonetisation of Rs 500 and Rs 1000 currency notes, Paytm put out a full-page ad with Modi’s picture on the cover of newspapers, thanking the Prime Minister for “taking the boldest decision in the financial history of independent India.” Paytm’s traffic skyrocketed in the days following the currency ban, with 3x app downloads and a 200 percent increase in transaction value. Obviously, fintech in India was benefited by the government’s move which will push digitisation. However, Delhi Chief Minister Arvind Kejriwal created controversy when he tweeted: “Paytm biggest beneficiary of PM's announcement. Next day PM appears in its ads. What’s the deal, Mr PM?” to which Paytm Founder and CEO Vijay Shekhar Sharma cheekily responded by tweeting that the whole country has benefited, and that Paytm is just a tech startup trying to solve financial inclusion and make India proud.

- Snapdeal got no deal with GoJavas: It was a surprise for many because Snapdeal had already lost to the Flipkart-Myntra alliance in the race to acquire Jabong. Although Snapdeal had kept away from logistics till 2014, maintaining that it was strictly an online marketplace, it needed logistics support to fight Flipkart and Amazon, which had in-house support. Around the time when it picked up stake in logistics firm GoJavas, Snapdeal also set up Vulcan Express for logistics. Although there were rumours of the two merging, in August, Snapdeal’s deal with GoJavas fell through, despite its investment of more than $20 million in it, to the advantage of Bengaluru-based traditional courier services provider Pigeon Express which bought it for an undisclosed amount. However, Snapdeal kept its 40 percent stake in GoJavas, thus gaining equity in Pigeon Express.

To say that things are going downhill in the startup world might be an overstatement, but there has definitely been some correction, if not maturation. If 2015 was the year of food tech, 2016 was fintech’s year. Though demonetisation put another nail in the coffin of many small retailers and slowed down many industries, fintech startups laughed all the way to the bank. With speculations on newer deals and mergers already doing the rounds, 2017 looks like a promising year!