Why investors are betting big on Byju Raveendran

With $140 million investment in its kitty, Byju’s Think & Learn is now the largest funded edtech startup in India. What makes investors so bullish about this startup, and how is its founder Byju Raveendran able to balance the equation to come up with a solution that is win-win for both his business and students? As we'll see, with Byju, everything turns into mathematics.

It is just as well that the ubiquitous green and purple logo of Byju’s learning app screams for your attention on Bengaluru roads, for its founder Byju Raveendran will not say much.

Understandably, Byju prefers to let his products talk. But after he pocketed $50 million from the Chan-Zuckerberg initiative -- a philanthropy platform of Facebook’s Mark Zuckerberg and wife Priscilla Chan, Sequoia, Sofina, Lightspeed India Partners, and Times Internet late last year, he has been pressed to tell it all.

For a startup, carrying the title of ‘the largest funded edtech startup in India,’ can be a big burden. The spotlight and media glare can burn a hole and distract from the real task at hand. Though not for Byju.

As an entrepreneur who keeps his cards close to his chest, Byju has played it cool not making a big song and dance about it.

“I cannot talk about the details. As you know it is their first investment in Asia, so it was not as if we even thought of approaching them,” Byju tells me.

Our interview has been arranged in a big conference room, and we are sitting across each other at one end of a large table in his new office premise in IBC Knowledge Park in Bengaluru. The outside greenery from the glass windows is the only accessory in the otherwise stark, impersonal space. A space that inadvertently reflects the founder -- no frills attached. The fact that we are joined by the company’s media relations person comes as no surprise. Probably, it is a lesson for her on what and how to respond.

I prod further. But you must have met them (Chan and Zuckerberg)? What was it like? He smiles, an exasperated smile. “I am obviously excited about our association like anyone else would be. It is a good validation that you are doing something right,” he avers. Surely, now with the stakes so high, you must be feeling the pressure, I pursue. “I have more expectations from myself than the combined expectations of my investors,” he now gives me a confident smile.

He is in his zone. “You will never find me under pressure. I have given exams and played matches all without any pressure. My only competition is against myself,” he says.

“Your aspirations have to be high. I always feel that tomorrow will be better than today, that next year will be better than this year. And that is what keeps me going. If you think it is enough then the game is over.”

But of course, for Byju the game has just begun. Last year, Byju raised $140 million in three rounds from top investors, including $75 million from Sequoia Capital and Sofina in April, a $50-million round led by the Chan-Zuckerberg initiative (existing investors and others also participated in the round), and another $15 million from IFC, a financial institution that's part of the World Bank group, in December. The latest round of funding has pushed Byju's valuation up to around $500 million from $160 million in 2015.

Byju now has plans to expand to the Middle East and go deeper in India to smaller towns and cities. The content team is supercharged that they shipped a big consignment to Jammu and Kashmir recently.

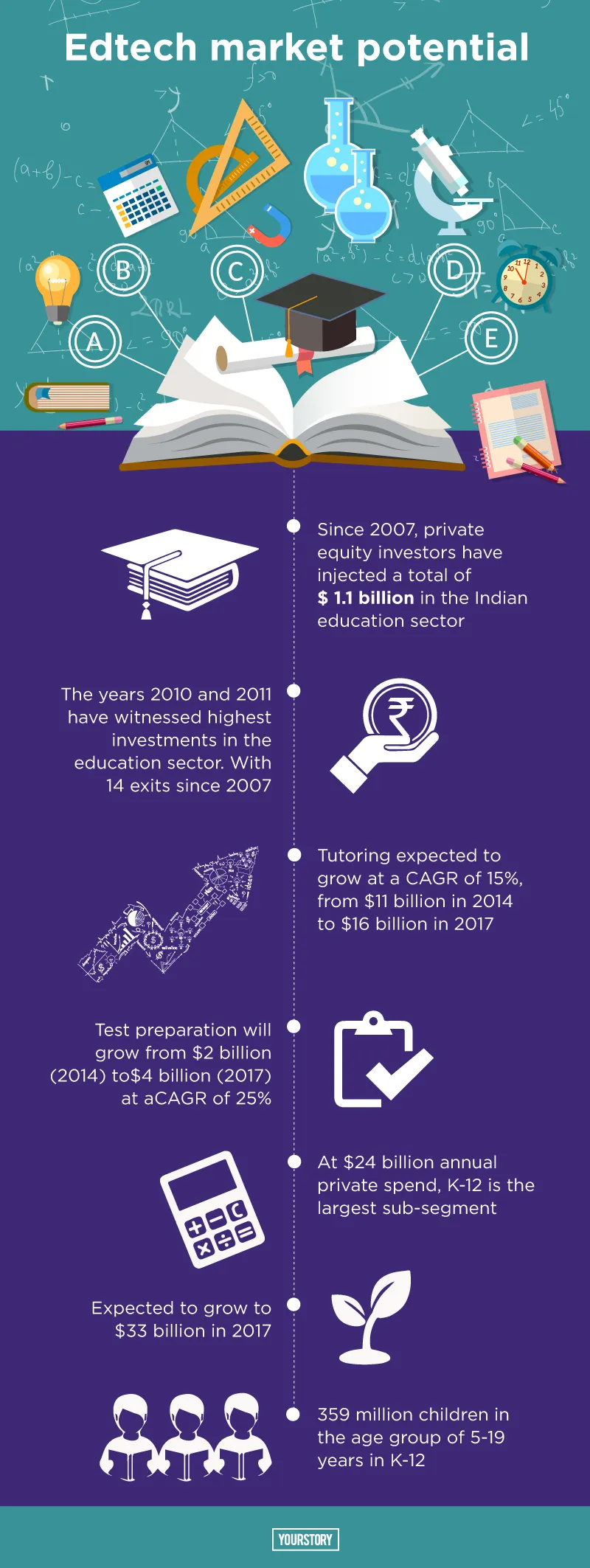

Since 2007, private equity investors have injected a total of US$ 1.1 billion in the Indian education sector, according to a report by Kaizen equity fund. Investors do not hesitate to bet on the edtech sector as it is recession-proof. The report says, “The years 2010 and 2011 have witnessed highest investments in the education sector. With 14 exits since 2007, private equity investments in the education sector have returned a healthy 21.5 percent IRR. Moreover, education has outperformed other counter-cyclical assets, such as gold (14.12 percent IRR). Most of these exits were secondary and strategic sales.”

Byju is now, in a sense competing with US-based global edtech companies like Coursera, Udacity, and Udemy, and HotChalk, which at $235 million is US’s highest funded edtech company that was started in 2004. The title of highest edtech company worldwide, however, goes to China. It’s iTutorGroup stands backed with $315 million funding.

Strategy for the whole edtech pie

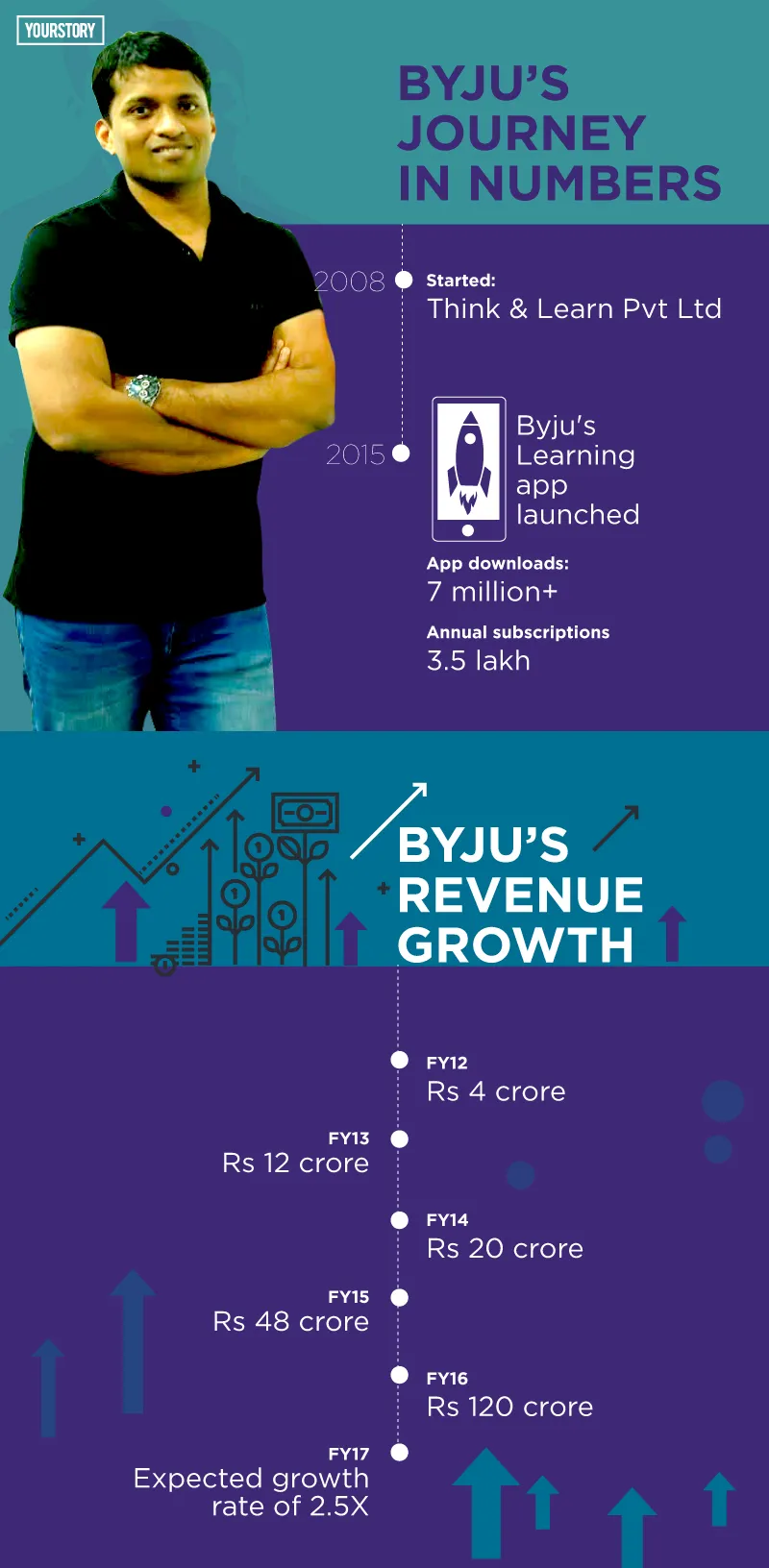

According to Byju, he has never gone after any investor. “We always had a solid business model, and we kept adapting it to the changing ecosystem.” Byju set up his company, Think & Learn Pvt Ltd, in 2008 by putting his own money, totalling Rs 2 lakh, and starting off with offline classroom lessons. In 2015, the company launched its learning app after a boom in the sale of smartphones and increased Internet accessibility.

The company has grown at a phenomenal pace when it registered a revenue growth of Rs 120 crore in 2015-2016 from Rs 4 crore in 2011-2012. Says Byju, “We have seen an exponential growth is revenue from Rs 4 crore in FY12, Rs 12 crore in FY13, Rs 20 crore in FY14, Rs 48 crore in FY15, and Rs 120 crores in FY16. We expect to grow at the rate of 2.5X in 2017.”

Byju’s first formal class had 35-40 students at Jyoti Nivas College. For his next class, he hired the college auditorium to accommodate 1,200 students who had signed up just by word of mouth. In fact, Byju -- adjudged an excellent teacher by students and naysayers alike -- started the trend of taking maths classes in large stadiums. “It is like a performance,” he says, the joy evident on his face. He conducts these large group classes almost every Sunday as a marketing exercise.

In fact, according to the ROC filings (2015-2016) of the company, Byju’s advertising spend was Rs. 1,92,96,632. Interestingly, his gross annual salary was Rs 68,52,040. Divya, his wife, who is a director in the company, draws Rs 31 lakhs, while Byju’s brother Riju, who is also a director in the company, draws Rs 42,12,706.

The company’s K-12 vertical targets classes IV-XII, and so far has recorded seven million plus downloads and has close to three-and-a-half lakh students on an annual subscription basis. “We are looking at the 270 million plus student population in K-12 in India. So you see, we haven’t even scratched the surface,” he says. They also target the test prep market that includes competitive exams like JEE, NEET, CAT, IAS, GRE, and GMAT. The K-12 vertical brings 90 percent revenue for the company.

Byju’s follows a freemium model. Though the annual average subscription for K-12 is Rs 10,000, a parent told me she paid Rs 80,000 for class XI maths, physics, chemistry, and biology for the offline course for her son last year. This package, according to the company, is only five percent of the business. “For those who had opted for offline classroom sessions, the online sessions were part of the package,” she says. Her son has since discontinued Byju’s classes and we’ll tell you why when we talk about the ground realities that edtech startups need to address, later in the story.

Byju says it is their personal and simplified learning videos that are their biggest draw and the key to their growth. They follow two metrics to determine their success -- one is engagement, which he calls the short-term validation. “We have found that students spend 40 minutes per session. It means they find it interesting. This gets converted into a subscription when parents see value in the engagement.” The second metrics is retention. “Close to 90 percent of students continued from last academic year to this year. It is what we call the long-term validation effectiveness indicator,” he adds.

“We did not raise funds to create a business model. We already had a solid business model, we raised funding to accelerate the product development process,” he says. The content development team is 500 strong and no part of the video development work, including the background music, is outsourced.

According to sources, the funding has also helped in the acquisition of startups. Byju’s is strong in content, but as they depend on tech for the delivery of that content, they have lately made some acquisitions to cover that. When I ask him about his strategy to acquire other edtech startups, he brushes it aside, saying, “We have not made any major acquisitions. They have all been acquihires.”

Byju says he receives many pitches on a regular basis from startups so they do not have to actively go scouting for good tech talent. The company recently acquired Vidhyartha, a learning guidance platform, to strengthen its stated objective of making learning more personalised. Though the deal was announced the next day after our interview, Byju did not give any indication despite my query whether he was planning any acquisitions. When I bumped into him a few days later in his office with an ‘entitled expression’ that said, ‘why didn’t you tell me,’ he just smiled and said it is no big deal and that they were not intending to disclose it.

Tough equation to solve

“He likes to downplay things. It’s his way to get a headstart,” says an ex-employee, adding, “no other edtech globally has been able to crack a revenue model like Byju’s has.” A source in the edtech space says that content business has high margins, but the question that needs to be answered is how can it be sustained. The startups need to answer how they can be profitable. In Byju’s case, right now they seem to have the subscription renewal under their control.

As someone who has the first-mover advantage, Byju has to be constantly on top of things and stay ahead of the curve. The company recently lost a very good resource and teacher to Khan Academy, which has partnered with Tata Trusts to create specialised, free online content for India.

Thus, it is not difficult to see why Byju keeps a laser focus approach to everything, and how this can come across as cold and calculating. Detractors say his strength is that he is a marketing genius and are surprised that he has managed to attract so much funding for nothing. “He is an extremely closed person, maybe with the media he will be forthcoming, but the fact is he does not trust anyone,” commented an ex-employee. Insiders say he has a core group that comprises his old students, including his wife, in whom he places his trust.

But Byju rubbishes such claims. “I am completely open with my employees, and I always give them an update after a board meeting,” he tells me.

“When you come from a village like I do, there is nothing to hide from anyone. There is nothing to lose.”

Byju makes it a point to stress that though people are impressed with the fact that he comes from a small village in Kerala and overcame hardships, “but I find it advantageous. You can come out of any situation. Unfortunately, today’s children are so protected and when they suddenly find themselves face to face with real-world challenges they accept defeat fast.”

Sahil Sheth, Founder of InfiniteStudent.com, which was acquired by Byju’s in 2015, and who now heads Byju’s B2B business, applauds Byju for his positive mindset and his high-risk appetite. “He makes aggressive growth plans. He had launched TV ad campaigns when the mobile app was not even a month old. He is very strategic and numbers-driven. He is not chasing growth blindfolded hoping it hits the bull’s eye, he has a detailed financial driven model,” Sahil tells me over a telephonic chat.

The company has tied up with all Army Public Schools and with Times of India’s NIE programme and has users coming to it from television ads and digital marketing.

Byju’s acquihire strategy involves being in the game of the entire edtech spectrum. According to the Kaizen report, “The Indian education sector is witness to four mega trends: 1) Individualisation 2) Massication 3) Collaboration and 4) Convergence. These, in combination, will mitigate the developmental challenges like quality, access, and relevance in education.”

Tutoring, the largest segment in parallel education, is expected to grow at a CAGR of 15 percent, from $11 billion in 2014 to $16 billion in 2017, while test preparation will grow from $2 billion to $4 billion at a CAGR of 25 percent during the same period. “Both tutoring and test preparation segments demonstrate students' willingness to pay for quality education and prepare for competitive examinations, whether it is to pass the 10th and 12th grades or to enter the graduate programs,” the report says.

At $24 billion annual private spend, K-12 is the largest sub-segment and it is growing at a CAGR of 11 percent. It is expected to grow to $33 billion in 2017, serving a population base of approximately 359 million children in the age group of 5-19 years.

Byju’s plan is to have a finger in every piece of the edtech pie, including digital content, games, apps, Massive Open Online Courses (MOOCs) and focussed learning. And one of the ways to do that it is looking at multiple acquisitions or acquihires.

I ask Mukul Rustagi, Co-founder and CEO of XPrep, a tutor-enabled platform that was selected by Facebook for its FBStart programme, if he ever considered offering their tech solutions to Byju’s. “It would be nice to meet the Byju's team and understand their viewpoint on the edtech space but we haven't been approached for any discussion regarding acquisition/operational synergy, so it would be difficult for me to comment on the same.”

Arastu Zakia, CEO of Ahmedabad-based CollegeBol, a social college selection platform focused on information and interactions for students, says, "For startups such as ours that specialise in areas such as social college selection, hyperfunded e-learning players like Byju's are very relevant for strategic exits going into the future, since both of us address the same audience and can complement each other very well."

Are edtechs really helping the cause?

The Indian education sector caters to nearly 640 million people up to the age of 30 years. It is one of the largest capitalised spaces in India with an annual government spend of $63 billion (approximately 3.4 percent of the country's GDP) and an annual private spend of $56 billion, says the Kaizen report. In addition, approximately 200,000 students travel to foreign countries every year and spend about $13 billion on education. This adds up to an annual education spend of $133 billion.

With this kind of market potential, it’s true that there’s place for every kind of opportunity, but whether the solutions are really making a student’s life better and enabling easy learning is a subject for another story.

Anita Arora, who tutors Class XI and XII students for maths and science subjects, captures the ground reality only too well. “Using technology is good. But it can never be a whole meal. Students need one-on-one interactions,” she opines. And even though the edtech startups claim they provide personal mentoring, Anita adds there is no way that they can create the atmosphere that a group brings in.

One of her students had enrolled at Byju’s offline classes before he joined her classes. His mother explains that though the teachers were good, her son could not keep pace with both his class work and tuitions. “The week he had class tests he would have to skip the tuition classes because the portions at his school and at tuitions never coincided.” As far as the video lessons were concerned, she felt they were just not adequate for him at that point in time.

High costs, low digital connectivity, a profusion of offline tutoring classes that promise engineering or medical seat, and mom and pop tuition classes -- the edtech startups have an entire education ecosystem to disrupt. There are many loose ends that they will have to tie up before a true picture of their impact is visible. For now, startups like Byju’s are just testing the waters.

It is all in the numbers

In the new office premise of Byju’s, the company occupies two floors. The second floor is packed with hundreds of sales reps drawn from colleges busy answering queries and making calls. Every year, the company hires around 500 college graduates as interns at a stipend of Rs 25,000, out of which only 250 are confirmed. They are confirmed at Rs 6 lakhs annual package with added incentives. The present strength of the sales team is 600.

The floor also houses the content team (500 people), which is the heart of the company. In fact, it would not be wrong to call it Byju’s factory (view video below), where engineers, graphic designers, copywriters, and musicians work in tandem to produce the video content. Divya Gokulnath, Director at Byju’s, says video production is an intensive and time-consuming process. And all of them double up as teachers as well.

Mind you, it is not as casual as it sounds, all the teachers are top rank holders from Indian and American universities. Divya herself is a topper and a teacher. She first came to Byju’s looking for a GRE course. “At that point, there was only CAT classes, so I enrolled for it,” Divya tells me. She cracked it and also managed a seat at Stanford University. But what do you know, she gave it all up to join Byju’s.

Whether it was love for mathematics or the teacher is anybody’s guess, but Divya ended up marrying Byju. They have a three-year-old, who, Diya says, is already showing signs of curiosity as far as learning is concerned. The company is now in the process of producing video content for students of classes I-III.

Vinay MR, Chief Content Officer, also gave up his IIM dreams to join Byju, his tutor. One of the first employees of Byju’s, Vinay had attended Byju’s CAT classes. He says he could not have made a better decision.

Son of teachers from a small Communist village in Kannur, Kerala, Byju’s meteoric rise is well documented. Stories of his maths wizarding traits almost have a folklorish tone -- he has cracked the math Olympiad and the CAT twice just for larks.

“I studied in a Malayalam medium school, and learnt English, maths, and science on my own. If you know how to learn to learn, you can do anything.”

This love for maths and passion for sports is what gives Byju the edge -- the knowledge that even if everything is gone the next day he will be able to build it all up once again just by the sheer strength of his tutoring skills.

“I capitalise on two of my strengths: I am crazy about maths and sports. That is what impressed my students, investors, employees, and you can say even my girl.” A sum that is giving him multiple X returns.