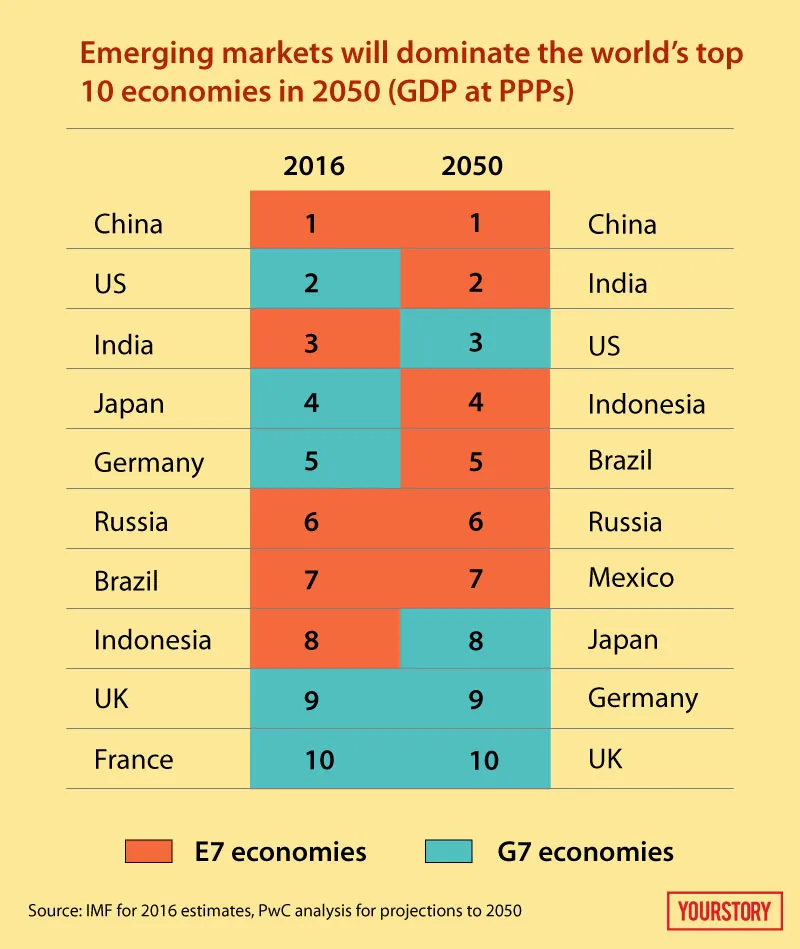

India predicted to be second most powerful economy by 2050, ahead of US

By 2050, India will be ranked second, ahead of the US, as one of the most powerful economies of the world.

A new study by PricewaterhouseCoopers released its long-term growth predictions for 32 of the largest economies in the world, accounting for 85 percent of the world GDP.

The report, titled ‘The long view: how will the global economic order change by 2050?’ ranked countries by their projected global gross domestic product by purchasing power parity. Economists use PPP to determine the economic productivity and standards of living among countries across a certain time period.

The world economy will more than double in size by 2050, far outstripping population growth, and emerging markets will grow twice as fast as advanced economies. The report attributes this to the impact of continued technology-driven productivity improvements.

The report says six of the seven largest economies in the world are projected to be emerging economies in 2050 led by China (first), India (second), and Indonesia (fourth). It says, “The US could be down to third place in the global GDP rankings while the EU27’s share of the world GDP could fall below 10 percent by 2050.”

The report predicts that the UK could be down to 10th place, France out of the top 10, and Italy out of the top 20 as they get overtaken by faster growing emerging economies like Mexico, Turkey, and Vietnam respectively.

It, however, had a word of caution that the emerging economies will need to significantly enhance their institutions and infrastructure if they are to realise their long-term growth potential.

Big opportunity for business

The report points out that as the emerging markets mature, they may no longer remain attractive only as low-cost manufacturing bases, but will be more attractive as consumer and business-to-business (B2B) markets.

To make use of this opportunity, international companies will need strategies that are flexible enough to adapt to local customer preferences and rapidly evolving local market dynamics.

Commenting on the volatile nature of the emerging markets, the report states that international investors need to be patient to ride out the short-term economic and political cycles in these countries.

Challenges for policymakers

Highlighting the key challenges for policy-makers, the PwC report states that emerging markets should “Avoid a slide back into protectionism, which history suggests will be bad for the global growth in the long run. Ensure that the potential benefits of globalisation are shared more equally across society. Develop new green technologies to ensure that long-term global growth is environmentally sustainable.”