A closer look at how Snapchat operates and why it probably isn’t bullish about India

Can Snapchat be the Snapchat of India or does it even want to? To understand this better, let us take a closer look at how Snap Inc. works and how it generates revenue.

Snap Inc., the parent company of popular camera app Snapchat, has been a hot topic of discussion in India over the last few days. It all began when a former Snap Inc. employee alleged that Evan Spiegel, CEO of Snap Inc., had made some rather harsh statements about the startup’s market focus, back in 2015. According to Variety, Evan is supposed to have said:

"This app is only for rich people. I don’t want to expand into poor countries like India and Spain."

When YourStory reached out to Snap Inc. for comment, its spokesperson in a statement said,

"This is ridiculous. Obviously, Snapchat is for everyone! It's available worldwide to download for free."

Let us take a closer look at how Snap Inc. operates, makes money and whether there is any merit in what Evan is supposed to have said.

Can Snapchat be the 'Snapchat of India'?

China boasts its own version of most global products – the Twitter of China is Weibo, Amazon of China is Alibaba, WhatsApp of China is WeChat, Uber of China is now the joint entity of Didi Chuxing and Uber China operations. This is largely because the Chinese government has a lot of stiff regulations in place that make it difficult for foreign companies to operate in China.

On the other hand, India is a more open market. But doing business is quite tough in India and hence both foreign and Indian companies have a hard time running their businesses. Some startup founders have even gone on record to request the goverment to protect them and 'level the playing field' against foreign entities, like how China does.

The Twitter of India is Twitter, Amazon of India is Amazon, WhatsApp of India is WhatsApp, Uber of India is Uber. While the above companies have competition from companies like Flipkart, Hike, and Ola, respectively, these foreign players have been able to make some inroads into India and create a strong enough brand presence.

Now looking at the bigger picture, can Snapchat be the Snapchat of India or does it even want to? To understand this better, let us take a closer look at how Snap Inc. works and how it generates revenue.

The different pieces of Snapchat’s puzzle

While Snapchat could be categorised as a media or messaging app, the Venice, California-headquartered company, thinks of itself as a ‘camera company’, as described in its recent SEC filing.

This broader definition is partly because Snap Inc. recently launched Snap Spectacles, a pair of aviators that cost $129 and can wirelessly add ‘Snap memories’ to a user’s Snapchat account. One of its other products is Snapcash, which allows for peer-to-peer transfer of money online.

The release also stated,

Our flagship product, Snapchat, is a camera application that was created to help people communicate through short videos and images. We call each of those short videos or images a Snap. On average, 158 million people use Snapchat daily, and over 2.5 billion snaps are created every day.

In September 2016, eMarketer had estimated that Snap Inc.’s revenue would be about $935.46 million in 2017. The report also noted that at that stage, Snapchat derived 95 percent of its ad revenues from the US market. Snap Inc.’s revenue sources are mainly spread across the company’s 'Discover' and 'Stories' features, where brands monetise through sponsored stories and custom filters, respectively. In its SEC filing, Snap Inc. shared some of its actual revenue numbers:

Our advertising business is still young but growing rapidly. For the year ended December 31, 2016, we recorded revenue of $404.5 million, as compared to revenue of $58.7 million for the year ended December 31, 2015, representing a year-over-year increase of more than 6x. Our global average revenue per user, or ARPU, in the three months ended December 31, 2016 was $1.05, compared to $0.31 for the same period in 2015.

More recently, eMarketer trimmed Snapchat's 2017 ad revenue forecast to $770 million, taking into account a higher than expected revenue sharing with its partners. eMarketer, however, expects that by 2018, a quarter of Snap Inc.’s ad revenues will come from outside the US. eMarketer states,

While the global market is saturated with mobile messaging apps, Snapchat has an opportunity to reach more users in different markets – especially ones where advertisers are spending heavily on mobile ads like China, UK, Germany, and Australia.

Where does India stand and what are the barriers to entry?

YourStory reached out to Snap Inc. to understand what percentage of Snap Inc.’s current revenues are from overseas markets and what markets Snap Inc. sees a lot of room for growth in. YourStory will update the story, if and when Snap Inc. responds. But here is an analysis from publically available sources.

Unlike Facebook and other social networks, Snap Inc. relies heavily on advertising to generate revenue. Snapcash is apparently yet to take off in the US. Cathy Boyle, Principal Analyst at eMarketer, stated in a recent report:

Other messaging apps are focusing on driving mobile commerce via chatbots, like Facebook Messenger, or official accounts, like WeChat. The downside of Snapchat’s entertainment approach is it increases its reliance on advertising as its sole source of revenue.

So for a company like Snap Inc. to sustain in markets like India, multiple things will need to fall in place. These include:

- Large volume of smartphones with access to high-speed data or Wi-Fi.

- Large volume of consumers interested in consuming video content.

- Big brands or advertisers interested in reaching out to the above consumers.

Let us look at each of these in detail.

Smartphone and mobile data growth in India

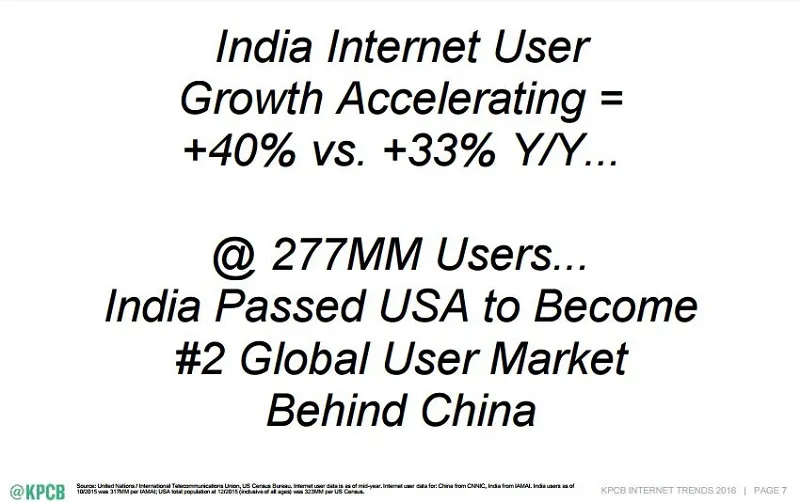

Evan is alleged to have expressed disinterest in moving to markets like India and Spain in 2015. But the Indian market has matured a lot over the past two years. In 2016, Mary Meeker, partner at venture capital fund Kleiner Perkins Caufield Byers, had cited India to be the only bright spot in her Internet Trends report 2016, in terms of smartphone adoption.

While India is mainly an Android market, Apple saw iPhone sales in India shoot up by 50 percent for the fiscal ending September 2016, fueled in part by partnership with Reliance Jio (more on this later). Apple has also been in talks with the Karnataka government and is expected to assemble iPhones in Bengaluru by June 2017.

Over the last six months, India saw the rise of Reliance Jio and prices of Internet data falling. All telecom providers have slashed data and voice charges to retain customers. So, compared to 2015, India is now in a much stronger position in terms of smartphone and internet data adoption.

Interest in video content

With access to much lower data plans, a lot more Indians are now consuming video content on their smartphones. Video streaming platforms like NetFlix and Amazon Prime entered India is 2016. A recent report from Experience commerce notes,

While time spent on the vertical screen (smartphones) is witnessing an inexorable rise, the platform choice is influenced by content, and behaviour is heavily skewed to messaging, social, entertainment and news.

Snapchat ticks all three categories in this – messaging and social entertainment in its stories feature, while it also covers live events and news from its premium content partners (mainly in the US) under its Discover section.

In January 2016, Vuclip’s Global Video Insights Report noted that 85 percent viewers in India consume short-form video content on smartphones. Now following the adoption of Jio and lower data plans, these numbers would have likely increased as well. Most of Snapchat’s user base in India are millennials, interested in new-age trends and brands. Most of the older population though prefers WhatsApp to communicate and consume video content through WhatsApp groups.

Advertising spend and ‘Digital India’ initiative

Digital advertising in India is forecast to breach the $1 billion milestone in 2016-17. Sandip Maiti, CEO of Experience Commerce, notes in his blog titled “Digital Advertising in 2017”:

There is a lot of headroom for growth, when you look at the rapidly growing smartphone consumer base over the next five years – projected to rise 4x, up to 820 million.

But in India, most of the advertising spend is heavily invested in mainstream TV ad spots, newspaper advertorials, and full page banners. Not too many brands currently allocate big budgets for digital advertising spends for niche platforms. The central government though aims to change this across different spheres with its ‘Digital India’ initiatives.

Snapchat requires their content partners (for Discover) to shoot videos in vertical formats (instead of horizontal) and hence there is a learning curve involved while exploring new markets like India. Advertisers too generally don’t want to invest their dollars unless they see a clear path for ROI on their efforts.

So what else is stopping Snap Inc. from entering India?

In the SEC filing, Snap also noted that due to the nature of their products and business, their ability to succeed in any given country is largely dependent on its mobile infrastructure and its advertising market. These factors influence product performance, hosting costs, and Snap's monetisation opportunity in each market. It also notes,

Our products often require intensive processing and generate high bandwidth consumption by our users. As a result, our users tend to come from developed countries with high-end mobile devices and high-speed cellular Internet. These markets also tend to have cheaper bandwidth costs, meaning that it is less expensive to serve our community in these countries.

While India, on the whole, may be a ‘poor country’ and come under emerging markets, it is still the fastest growing smartphone market in the world and is estimated to clock 340.2 million smartphone users by 2017. For comparison, smartphone users worldwide are estimated to exceed two billion by that time.

But since the Indian digital advertising space is still in its nascent stages and Snap Inc.’s revenue model heavily relies on advertisers, the company may wait a little longer before spreading itself thin and exploring other markets. Snap Inc. is anyway facing tough competition from Facebook Messenger and Instagram Stories in USA.

Instagram stories recently crossed 200 million daily users, while Facebook Messenger, which also has a stories feature, recently crossed 1.2 billion monthly users. Snapchat, on the other hand, has an estimated 160 million daily users. So, Snap Inc. has the tough task of deciding whether it should focus on its home market, which it understands or expand into unchartered territories, where it may not understand local advertisers needs. Jio Chat currently has a 'Discover' like feature from brands, while Hike recently announced 'Caught Behind', which features short-video stories around cricket and IPL.

While Snap Inc. has mostly been secretive about its global operations, the company issued a release in January 2017, in which it noted that while Snap Inc. has not set London as their global headquarters, but going forward Snap Inc. would be billing their advertising revenue from the UK (and a few other countries) through a UK entity. It also noted,

This allows us to pay taxes in the UK, which we believe is part of being a good local partner as we grow our business. We want to pay taxes in the countries where we sell advertising, and this is an important step in building the infrastructure to achieve that goal.

Given that the ease of doing business in India is still a pain point for many local as well as international companies, Snap Inc., which has been around a little over six years, may play the waiting game a little longer. But if Snap Inc. waits too long to expand into promising high growth markets, other local and international players may gain the first movers’ advantage and leave Snap Inc. a trail of ‘disappearing bread crumbs’ to chase after everyday.