Startups will now benefit for 7 years under the new startup definition by Modi govt

The government has amended the definition of a startup, thereby making it easy to avail of incentives and promote entrepreneurship under the Startup India scheme.

The Department of Industrial Policy and Promotion (DIPP), the nodal body for Startup India, said in a statement that an entity shall now be considered a startup up to seven years from the date of its incorporation/registration, taking into account the long gestation period in establishing startups. At present, the period of consideration is five years.

However, in the case of startups in the biotechnology sector, the period will be up to 10 years from the date of incorporation/registration.

The DIPP statement said startups would no longer require a letter of recommendation from an incubator or an industry association for either recognition or tax benefits under Startup India.

The scope of the definition of a startup was also broadened to include scalability of business model with the potential of employment generation or wealth creation.

“As a constant endeavour to facilitate the startup ecosystem, the DIPP has been holding extensive consultations with stakeholders. The above changes are an effort to ensure ease of starting new businesses to promote the startup ecosystem and build a nation of job creators, instead of job seekers,” the statement said.

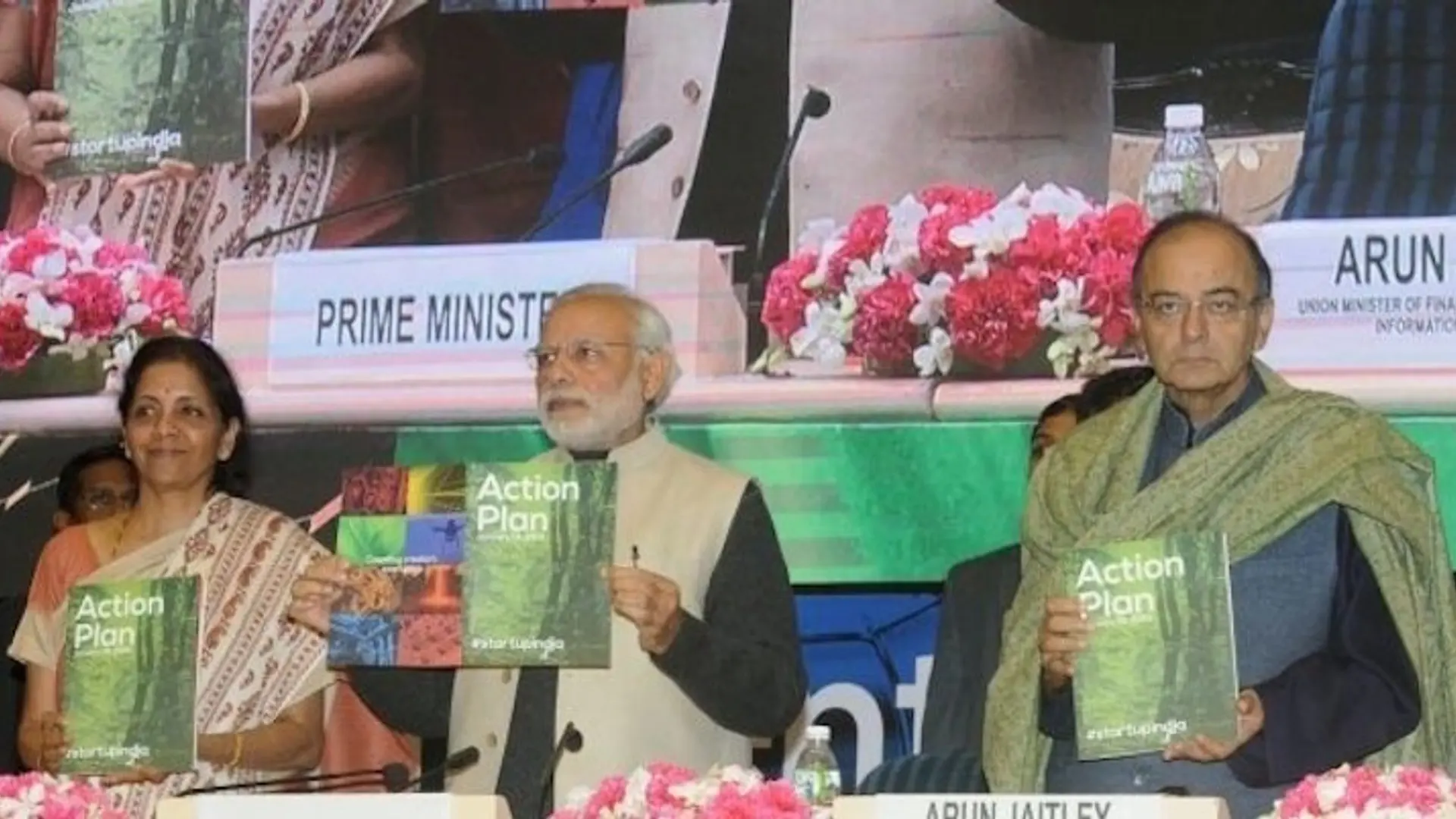

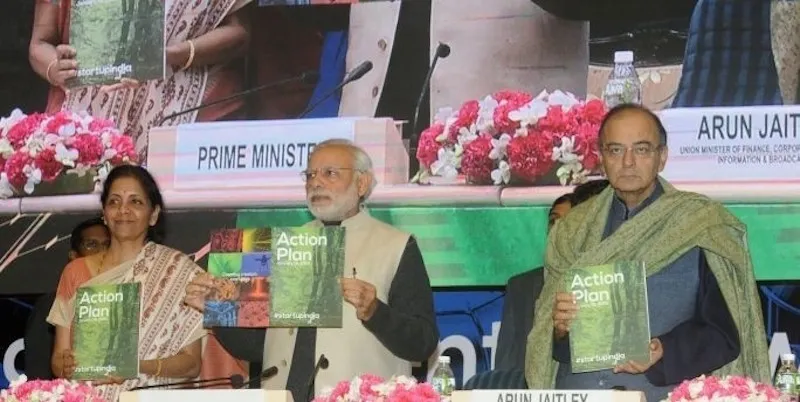

Startup India was launched by Prime Minister Narendra Modi on January 16, 2016, to nurture innovation and drive economic growth and employment opportunities.

According to a new gazette notification, the amended definition of a startup is as follows:

- if it is incorporated as a private limited company (as defined in the Companies Act, 2013) or registered as a partnership firm (registered under Section 59 of the Partnership Act, 1932) or a limited liability partnership (under the Limited Liability Partnership Act, 2008) in India; and

- up to seven years from the date of its incorporation/ registration; however, in the case of startups in the biotechnology sector, the period shall be up to 10 years from the date of its incorporation/ registration; and

- if its turnover for any of the financial years since incorporation/ registration has not exceeded Rs 25 crores; and

- if it is working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

Provided that any such entity formed by splitting up or reconstruction of a business already in existence shall not be considered a ‘Startup’.

Explanation

- An entity shall cease to be a startup on completion of seven years from the date of its incorporation/ registration or if its turnover for any previous year exceeds Rs 25 crores. However, in respect of startups in the biotechnology sector, an entity shall cease to be a startup on completion of 10 years from the date of its incorporation/ registration or if its turnover for any previous year exceeds Rupees 25 crores.

- Turnover is as defined under the Companies Act, 2013.

Process of recognition

The process of recognition as a ‘Startup’ shall be through an online application made over the mobile app/ portal set up by the DIPP. Entities will be required to submit the online application along with the Certificate of Incorporation/ Registration and other relevant details as may be sought.

Startups also have to submit a write-up about the nature of business highlighting how is it working towards innovation, development or improvement of products or processes or services, or its scalability in terms of employment generation or wealth creation.

Tax benefits

In order to obtain tax benefits, a startup should –

- be a private limited company (as defined in the Companies Act, 2013) or a limited liability partnership (as defined under the Limited Liability Partnership Act, 2008) which is incorporated on or after the 1st day of April, 2016, but before the 1st day of April, 2019, and

- be working towards innovation, development or improvement of products or processes or services, or should be a scalable business model with a high potential of employment generation or wealth creation, and

- obtain a certificate of an eligible business from the Inter-Ministerial Board of Certification as constituted by Department of Industrial Policy and Promotion from time to time.

Recognising the need to encourage innovation in India, innovativeness shall be considered from a domestic standpoint. Provided that the mere act of developing:

- products or services or processes which do not have potential for commercialization, or

- undifferentiated products or services or processes, or

- products or services or processes with no or limited incremental value for customers or workflow would not make a Startup eligible for tax benefits.

Revocation

Subsequently, if such recognition is found to have been obtained without uploading the relevant documents or on the basis of false information, DIPP reserves the right to revoke the recognition certificate and certificate of an eligible business for tax benefits immediately without any prior notice or reason.