The world’s most important internet trends report is out—find the details here

According to Mary Meeker’s evaluation of internet trends report, the Indian market is showing a major hike in internet usage, thanks to low-cost data.

If there is one research report entrepreneurs, investors, digital marketers, and corporate aficionados await with great anticipation, it is Mary Meeker’s evaluation of internet trends.

The former venture capitalist, who is now a partner at Kleiner Perkins Caufield & Byers (a Silicon Valley-based VC firm that has invested in Google, Amazon, JD.com, Twitter, Airbnb, Uber, and Snapchat, among others), has, over the past few years, developed a reputation for giving valuable insights about the digital world. Formerly a securities analyst at Wall Street, Meeker was ranked 77th on Forbes’ list of most powerful women in 2014.

In the 2017 report— released on May 31—Meeker has some relevant data for industry observers. A 355-page (an all-time high) e-book tells you everything you need to know about the internet in the present world: its growth, penetration, impact on small and large businesses in various sectors, and upcoming trends. Read on to find out more.

Slow growth, huge impact

The study claims that globally, smartphone growth is slackening, as is internet penetration. In fact, says the report, smartphone shipment in 2016 grew only three percent from the previous year, whereas 2015 saw a 10 percent growth from 2014.

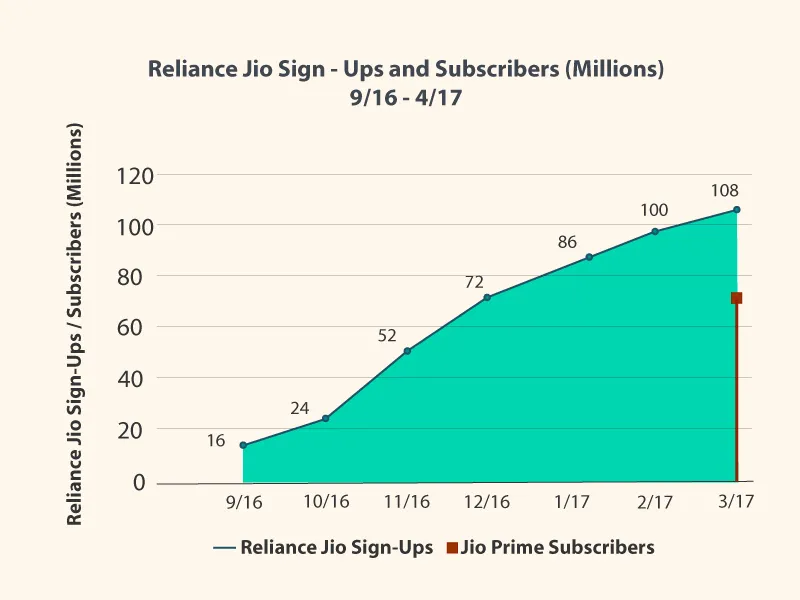

Curiously, according to the report, unlike its developed counterparts like the US and China, the Indian market is showing a major hike in internet usage, thanks to low-cost data, which was previously inaccessible. (Reliance Jio’s revolutionary offers ensured 108 million sign-ups in the seven months since launch, out of which 72 million converted to paying subscribers.)

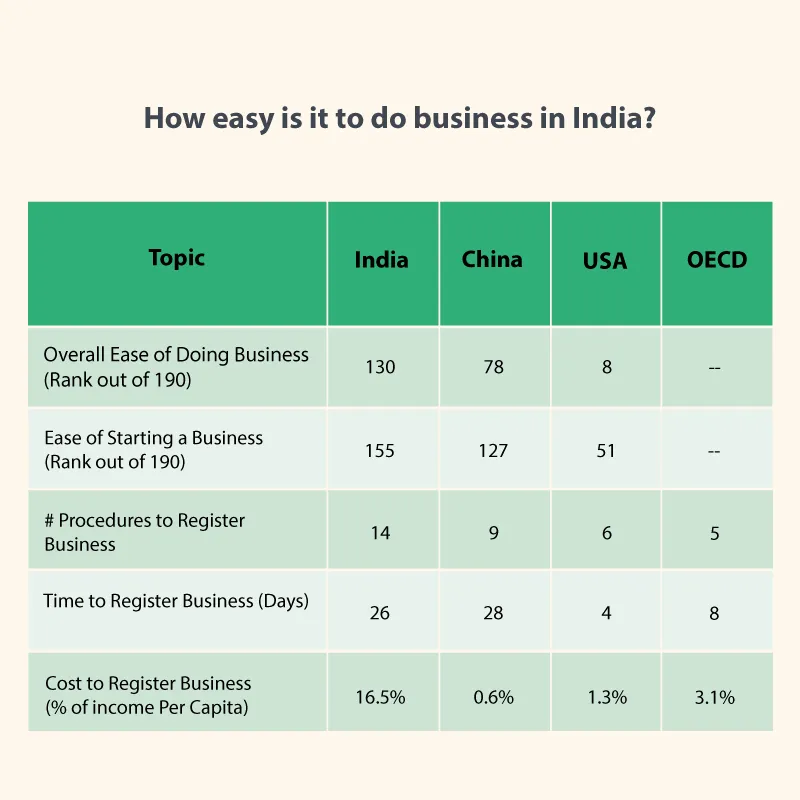

However, the report adds that India’s data and smartphone costs are still too high for the majority of the 1.3 billion citizens. It is only with decrease in smartphone prices that the next 200 million users can come on board the online world.

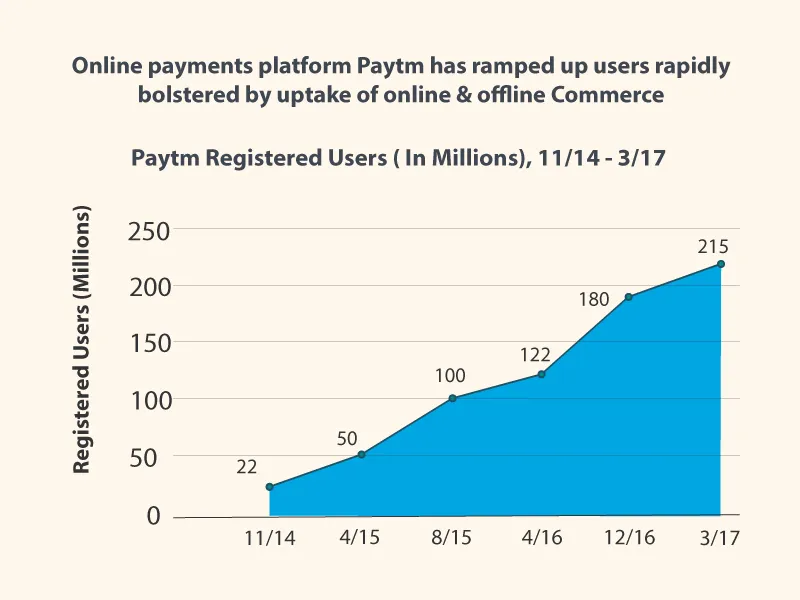

The industry it can affect the most is e-commerce. The online retail industry has grown so much in a short period of time that Amazon India, which had less than 30 million SKUs and 35,000 sellers in September 2015, increased it to 80 million SKUs and 1,20,000 sellers in one year.

New-generation advertising

Few sectors have undergone the kind of transformation advertising has seen in the last two decades. According to Meeker’s report, global TV ad spend in 1995 was approximately $75 billion, whereas it is around $190 billion now. But in a bigger turnaround, global internet ad spend has gone from less than a $1 billion in 1995 to more than $200 billion in 2017.

The report predicts that internet ad spend will beat that of TV in the next six months.

But digital marketers should not rejoice yet—ad blocking has also grown dramatically over the last eight years. In 2009, less than 20 million internet users had desktop ad blocking, but this figure has now grown 10 times. In mobile ad blocking, 2015 saw 200 million users, which doubled by 2016.

Desktop blocking is minuscule among Indian and Chinese internet users though—one percent— whereas in the US it is 18 percent. On the other hand, India and China are more cautious about mobile ads, with 28 percent and 13 percent respectively using ad blockers, while it is only one percent in the US. (Eighty percent Indians use the internet on mobile, unlike the 60 percent in China and 40 percent in the US.)

Business expansion

Internet penetration has led to the expansion of many businesses. Google, while hardly 20 years old, has gone from being an online search engine to a web browser, IoT device maker, and AR/VR software and hardware manufacturer, among other things. Global e-commerce player (China-based) Alibaba also counts payments, cloud services, logistics data platform, digital media, and entertainment among its other businesses.

The ad ecosystem has been a major business for Google, Amazon, Alibaba, Facebook, and Tencent. In India, even the unorganised sector has benefited.

India’s online penetration has also risen from four percent in 2009 to more than 27 percent in 2016—a 40 percent annual growth. This has helped the unorganised market by reducing interference of middlemen, thereby allowing up to 25 percent lower prices for consumers, says the report.

India is seventh in world GDP ranking now, after the US, China, Japan, Germany, UK, and France. But when it comes to internet users, India is second only to China—with 54 million in 2009 swelling to 355 million in 2016—as it is in the amount of time spent on Android phones. If Meeker’s predictions are right, the next phase of internet revolution in India has already begun..