Are investors finally restoring their faith in Indian startups? Funding numbers script a curious story

Call it a roller-coaster ride, a correction, or the arrival of spring, funding patterns in the first six months of 2017 show an improvement in investor sentiment across sectors and stages. The transition from Pre-Series-A to Series A, however, remains a challenge.

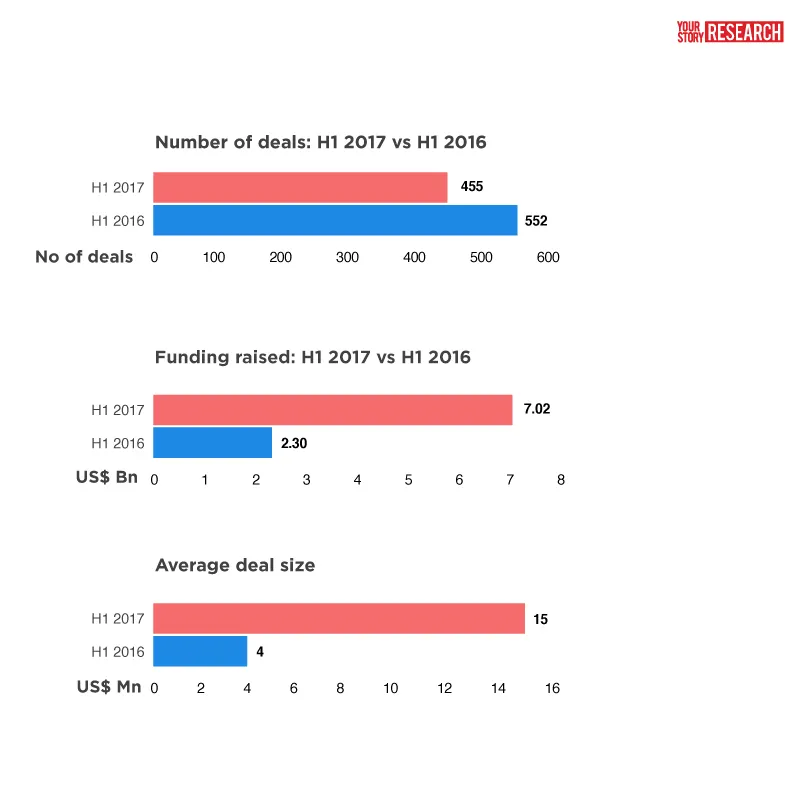

Halfway through 2017, India’s startup ecosystem has seen a whole lot of action on several levels. According to YourStory Research, the past six months saw close to $7 billion raised in funding across 455 deals.

By comparison, the first half of 2016 had over 552 deals but funding raised was far lower at $2.3 billion. To put that in perspective, last year’s figure was lower than what Paytm and Flipkart raised just between themselves this year. Clearly, the average ticket size has become healthier this time around at $15 million versus just $4 million in H1 2016.

We seem to have come off both the highs and lows of the roller coaster ride, settling into an encouraging rhythm of both early and late-stage funding. The two biggest deals of the year were undoubtedly Flipkart and One97 Communications (Paytm’s parent company) raising $1.4 billion apiece. E-commerce leader Flipkart raised the sum of $1.4 billion from eBay, Tencent and Microsoft. Around the same time, Naspers increased its stake in Flipkart to 16 percent by acquiring shares from another existing Flipkart investor for $71 million. A flagbearer of the Indian startup ecosystem, Flipkart’s fund raise seems to have the ecosystem pumped and restored faith in the future of Indian startups.

Paytm’s parent company One97 did one better, raising $1.4 billion from SoftBank in the largest funding round by a single investor. And this after it had already raised $200 million.

Also read: Flipkart-eBay India in a $2Bn tango?

Bringing in the winds of change

The posterboys were hardly outliers. The half-year also saw large rounds of private equity funding going for companies like Ola ($330 million), MakeMyTrip ($180 million), and OYO Rooms ($350 million).

In a reflection of the maturity of the startup ecosystem, Bengaluru-based cab aggregator Ola even took steps to protect itself and restricted some of investor SoftBank’s rights in order to protect the founder’s interests. Flipkart, even after multiple rounds of devaluation, came back fighting and went on to acquire rival eBay’s India operations.

Investors too seemed less risk-averse. Despite the impasse that Snapdeal faces with respect to its acquisition, lead investor SoftBank went right ahead to bet big on another of its Indian portfolio companies, Paytm, recording the largest funding round by a single investor. This was in stark difference to late 2016 when SoftBank and Tiger Global both took a step back focussing on consolidating their existing investments and not participating in any new or follow-on rounds. (Tiger is still in hibernation; portfolio company BlackBuck raised a Series C round this year where it did not participate.)

Parag Dhol, Managing Director, Inventus Capital says,

“There is a sense of sanity and order that is beginning to prevail in the startup ecosystem. Everyone is pausing, looking at the value that a startup is bringing and then funding (it). Unlike 2015, when funding amounts and deals where high, this year, there is a shift and change, which is for the positive.”

A point to note is that in 2015—at the height of the euphoria—investors pumped in close to $15 billion in funding into Indian startups. By comparison, $7 billion in the year so far is encouraging. Startup mentor and investor Sanjay Anandaram believes that sanity has begun to prevail and believes the trend will continue at least up until the first half of 2018.

Raising funding today has nevertheless become tougher, especially for me-too startups and those that did not have solid fundamentals. Sanjay adds,

“Even with $7 billion being pumped into the startup ecosystem, a majority of the funding was taken by Flipkart and Paytm, and if that is removed, the money that startups raised is curtailed and not what it was two years back. Most of the funding has been taken by existing companies.”

Still, several stood out—some by virtue of being a part of a differentiated or ‘value-generation’ segment.

The sectors that prevailed

Parag believes that the overall startup ecosystem today is going through an overhaul, with everyone from entrepreneurs to investors understanding the importance of value-creation. “It all depends on the prevailing market conditions and dynamics,” he adds.

Not surprisingly then, Fintech was amongst the best funded sectors in H1 2017. YourStory data shows that 59 fintech startups raised a total of $1.8 billion. By comparison, H1 2016 saw only $26.6 million being raised across 45 deals.

This was also the sector that raised the highest known seed funding in the Indian startup ecosystem. Varun Dua, Co-founder Coverfox and now Founder of Acko General Insurance an independent general insurer, raised a seed round of $30 million. Incidentally, Coverfox, from where he moved out, has also raised $15 million funding.

The push towards fintech started late last year. Sanjay says this isn’t surprising because that’s when demonetisation happened, and the government was pushing towards electronic payments and online transactions.

Related to the increasing digitisation everywhere was the growing interest in cyber security startups. India is home to only a handful of startups in this space, and two of these raised undisclosed amounts of funding in H1 2017. None were funded in the prior-year period.

Another sector that enjoyed a bit more of the limelight was Agritech. While no deals were made in this space in the first half of 2016, this time around, six startups raised a total of $24 million.

Surprisingly, for all the fear around it, Foodtech saw more than a respectable amount of funding come its way with 32 deals raising $217 million. By comparison, H1 2016 saw 24 deals amounting to just $71 million.

While there was early-stage funding pumped into Wow! Momo, Roll King and Wegan foods, a large chunk of the amount comprised late-stage funding like $80 million by Swiggy, $6.4 million by Faasos and $20 million by Zomato.

This is reflective of two trends: one is that while investors are open to what was considered the graveyard of investments, they are still somewhat wary. The other is what investors are fond of saying: that a company with a solid business plan and good fundamentals will never want for funding.

While sanity did prevail, it is noteworthy that several newer sectors caught investor attention. Adding to this bit, Srini Vudayagiri of PE firm Peepul Capital believes that even if Flipkart and Paytm gobbled up close to $3 billion of the $7 billion funding, there were other sectors like Healthcare and Financial services that stood out.

He and Sanjay believe that there will be stronger focus towards Logistics in the second half of this year, primarily because of the GST transition. In fact, BlackBuck, the B2B logistics startup was one of the few companies that raised a Series C round ($70 million from Sands Capital). The other was e-commerce logistics provider Delhivery ($30 million from Fosun International).

The elusive series and stages

In terms of series and stage deals, in H1 2017, fewer startups raised pre-Series A funding during first half of the year, with a total of 241 deals wrapping up about $130 million.

The comparable period last year saw 401 deals mopping up $166 million. While the number of deals and total amount raised declined, the average deal size climbed to $539 million vs $414 million last year.

The Series B space held strong, clocking 35 deals vs 30 last year, and a total of $296 million vs $286 million. However, on a positive note even as late-stage deals slowed down worldwide, India plodded along as the deals got larger further up the funding ladder – Series C saw the biggest jump over H1 2016, with just eight deals bringing in $397 million in H1 2017.

Also read: Finally, startups get a healthy dose of 'vitamins' B and C in 2017

City lights

One big surprise was that NCR retained its lead over Bengaluru, both in the number of deals and total funding raised. Startups in NCR, which comprises New Delhi, Gurgaon and Noida, raised a total of $3.35 billion in funding across 138 deals.

Bengaluru came in second, raising $2.56 billion from 129 deals. In H1 2016, NCR recorded 188 deals, raising $688 million vs Bengaluru, which raised $780 million from 156 deals.

If Flipkart’s $1.4 billion (from eBay, Microsoft, and Tencent in April) accounted for more than half of the funding raised by a Bengaluru-based company in the first six months of 2017, a similar story played out in NCR. One97 Communications, the parent company of Paytm, raised a similar amount from SoftBank Group Corp. for its payments business.

Also read: Guess which Indian city has cornered the most startup funding in 2017 so far?

Where are the exits?

According to YourStory data, 101 acquisitions and exits took place over H1 2017 (versus 80 acquisitions made in the H1 2016), reflecting that the startup ecosystem is beginning to mature. Last year’s top acquirers included Paytm, which acquired the Noida-based Shifu, Quickr, which took over CommonFloor, Yatra’s takeover of Travel-logs, OYO Room’s acquisition of Zo Rooms, and Amazon’s acquisition of a Delhi-based fintech startup.

This year, the online real estate space saw more consolidation with PropTiger acquiring the much-beleaguered Housing. In the foodtech space, Berlin-based Delivery Hero acquired Rocket Internet’s Foodpanda, while BookMyShow acquired Burrp for a paltry Rs 6.7 lakh—for a couple of these, the exits might well be an opportunity to resurrect their brands or at least scale operations.

Parag adds,

“Exits continue to be challenging and they happen to be the biggest question mark in the Indian startup ecosystem. I think it has got less to do about the acquirers and more with the fact that we need to create more worthwhile companies. (Either) we are not funding the right companies, or the Indian market isn’t big enough. But the point is that this needs to change for all of us to survive.”

Also read: Big startups gobble up little ones, but where are the big IPOs?

Comments Srini,

“At different periods in time, there will be different sectors that go through different cycles of funding, investor preferences and growth. A combination of these influences gets funded and what kind of money gets pumped into the ecosystem. And this happens across industries. There are other sectors are clearly picking up, which is a good sign.”

Overall, the first half of 2017 seemed like sanity prevailed. Parag believes that investors are taking longer to evaluate startups and betting only on those that are creating real value.

![[Funding alert] Edtech startup Embibe raises Rs 90 Cr from Reliance Industries](https://images.yourstory.com/cs/2/730b50702d6c11e9aa979329348d4c3e/yourstoryAditiAvasthi1576577844445png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)