Vietnam and its telecom sector: how the country answered the call for reform

Vietnam has come a long way from its predominant agrarian economic model, as it continues to make giant leaps in the export, tourism and mining sector. The country continues to outperform its Southeast Asian peers in exports, as it was ranked 24 in the world in 2015. The coastal country’s economy – which underwent a major resurgence following the economic instability of the 70s and 80s – has established itself as the 47th largest economy in the world in terms of Gross Domestic Product (GDP). Some international agencies have even touted the socialist country’s GDP to have the highest average growth running to the year 2050.

As the country heads towards the cusp of economic liftoff, we look at its upcoming telecommunication sector.

With the digital era mushrooming globally, Vietnam was not to be left behind. The country has seen a constant spike in internet usage and social media presence. Out of a population of 90 million+, 53 percent are active internet users, 48 percent are active social media users, and 43 percent of them are active mobile social users.

Source: Shutterstock

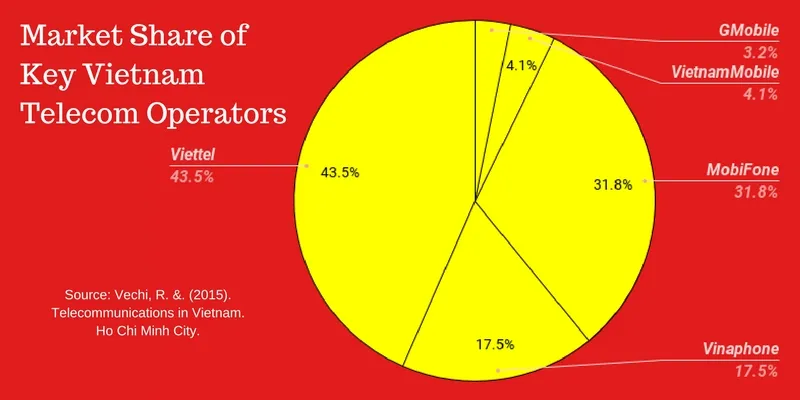

Since last year, the number of internet users has increased by three million and active mobile social users have increased by 12 million. As per records, by the end of 2017, the number of smartphone users in Vietnam is estimated to reach 28.77 million. Major mobile providers such as Viettel Mobile, MobiFone, VinaPhone, VietnamMobile and GMobile have been vying for dominance in the ever-growing market.

Before speaking about the players dominating the telecom market today, let’s examine the evolution of the sector since Vietnam’s independence from France in 1945.

Early history of the sector

Post-independence, the Vietnamese government created the Department General of Posts and Telecommunications (DGPT), which was controlled by the Vietnamese Communist Party, the Vietnamese Government, and the Department of Defense. DGPT overlooked and handled the affairs of communication in the country. Though Vietnam officially gained independence from the French in September 1945, the many internal strifes ensured that its unification was only possible in 1976. Hence, the development in the telecom sector can be divided into three distinct phases:

- 1945 to 1975

- 1976 to 1985

- 1986 to present

Between 1945 and 1975, the Communist party governed the country’s telecom sector with an iron fist. Since the country was caught in turmoil on multiple fronts, the government maintained extreme restrictions on the accessibility of the service. Telecom services at the time were limited only to government activities and defence systems.

Even after the reunification of the country in 1976, the government refused to ease their grip on the sector. The second phase, however, saw the system being expanded, although the use and access to services were limited to high-ranking government officials.

Post-1986, the Vietnamese government called for economic and political reforms, termed as Đổi Mới. The reform also helped in restructuring the telecom sector. But the onset of the Cold War proved to be a major roadblock which hindered its access to high-tech equipment. Even until 1995, the telephone density in Vietnam was only 3.8 telephones per 100 people, which at the time, in comparison to other countries in the Southeast Asian region, was significantly low. Another drawback was that people had to pay three to four times higher than average global telecommunications prices for telecom services.

Opening the sector to private players

An oligopoly in terms of market dynamics, the main regulators and operators in the Vietnamese telecom market – Vietnam Posts and Telecommunications Group (VNPT) and DGPT – were essentially the same entity. The problem was that in this sector, market access was not based on competition, and many restrictions were imposed on foreign players, which shackled the growth of the underdeveloped market for a long time. At the same time, the government did not have the capital to increase the supply of telecommunications services, leaving only a few with access to the services – which quality-wise left a lot to be desired.

In 1990, the DGPT, with hopes of turning this situation around, bifurcated its regulatory body from its commercial dealings. This allowed market segments to be more open to competition, with new entrants making way into mobile services by 1995. As a part of this pro-competitive policy, two domestic telecommunication companies were formed: The Military Electronic and Telecommunication Company (Vietel), and Saigon Post and Telecommunication Company (SaigonPostel).

Domestic expansion

By the turn of the millennium, five domestic companies had emerged and begun to dominate the market. At this time, these were namely The Vietnam Post and Telecommunications Corporation (VNPT), Vietel (under the control of DGPT and the Ministry of Defense), Saigon Postel, Vietnam Maritime Telecommunication Company (Vietshiptel) and Electricity Telecommunication Information Company (ETIC), which was also under control of DGPT and Electricity of Vietnam.

However, the numbers were still low in terms of the global telecom market. This was in large part because instead of competing with the then linchpin of the telecom sector, VNPT, the other companies began to make use of VNPT’s infrastructure, which subsequently gave the latter undesignated control of their activities. At the same time, these five companies were required to abide by the regulations imposed by DGPT, which went on to limit the scope of their operations.

With no respite in sight, these small fishes looked towards foreign telecom players to gain more ground in the sector. Till then, under the Vietnamese Investment Law of 1992, foreign companies were only allowed to provide services to Vietnam’s telecom market. Under the law, foreign entities had to enter into a Business Cooperation Contract (BCC) with local companies, allowing the latter to procure the needed equipment and training for local operators. As per records, nine BCCs have been signed to date, but only Telstra and Comvik have been able to reap the benefits and keep their accounts in the pink.

Entry of foreign players

When the government realized that the success of the BCCs was short-lived, it began to allow foreign companies, like Daesung Electronic Wire Co Ltd of Korea and Telstra International Ltd, to establish joint ventures or exist independently in the area of telecommunications equipment production. This significant move helped the tide turn in favour of the Vietnamese telecom sector.

For the past few years, Vietnam’s telecommunications market has received the strongest competition from foreign companies like Telstra (Australia), Alcatel and France Telecom (France), Siemens (Germany), and Goldstar (South Korea). To ensure that it wasn’t falling too far behind in light of the lack of technological and financial resources it could boast to its name, Vietnam began to encourage foreign investment in the installation of telecommunication infrastructure. For example, Siemens was designated to build and install the whole trans-Viet microwave link system from Hanoi.

Vietnam also made commitments concerning its telecom sector in its Bilateral Commercial (Trade) Agreement with the United States, as well as within the ASEAN framework. Direct association with global players dominating the telecom market, both within and outside the country, convinced the Vietnamese government that they needed to invest more money into market development. Thus, they began to grow the number of main telecom lines in the country and ensured that all provincial exchanges were digitalized and connected to the main cities of Hanoi, Da Nang, and Ho Chi Minh, by fibre optic cable or microwave radio relay networks.

Subsequently, the use of mobile phone subscribers also increased, and by 2012, there were 134 million mobile phone subscribers, placing Vietnam sixth in the world in terms of the number of active mobile connections. Looking at these numbers, more and more mobile networks began to emerge in the market, with five of them – namely, Viettel Mobile, MobiFone, VinaPhone, VietnamMobile, and Gmobile – emerging as the ringleaders of the industry today.

Today, most of the top telecommunication companies in the world have already established offices in Vietnam, and a majority of European and Asian companies have been in the country for at least four to five years. Global telecom players like 5BARz International are looking at the ‘unprecedented growth’ and ‘undeniable potential’ of Vietnam to expand their services there, as recounted by the company CEO himself. At the same time, local players like MobiFone and Viettel are making financial breakthroughs overseas, earning revenues of $1.8 billion and $9.94 billion, respectively.

All of this points towards an industry which is not just fledgeling, but growing by leaps and bounds, and which will help Vietnam breakthrough into the highest echelons of the telecommunication sector on a global scale.