Here’s how you can use digital marketing to secure investments for your startup

Investments are the yardstick that helps measure any startup’s potential for success so it’s critical to put together the perfect Investor Pitch Deck.

What conveys best to an entrepreneur that the idea s/he has invested in over some is truly worth the effort and resources? Investments.

When you can convince others - experienced others - to believe in your seemingly crazy idea, then you can really sit back for a bit and enjoy the moment when you realise that all of your time and money was not spent for nothing.

Thus, investments are often the lynchpin and measuring stick of any startup’s potential for growth and flourishing.

Subhendu Panigrahi, CEO at Skillenza and Co-founder at Venturesity, says: “We are always asked about how we reach out to customers and what the go-to-market strategy is in our investor pitches. The points that we focus on are channels used to reach out to customers. What is the Customer Acquisition Cost? If the CAC is low, the business is interesting.”

So what about the odds?

As many as 80 percent of all venture-funded startups fail, 45-50 percent simply shut their doors, and the rest fail to bring any significant profit to their investors. According to the Bath University, only 10 percent of startups happen to bring some returns to their investors.

Understandable why investors hesitate when approached by startups and asked for investments.

Your job is to convince them otherwise.

To realise what investors are looking for in your startup, you have to know what concerns they have when looking at a startup they probably never heard of before.

I’ve looked at tons of writings from investors who speak of successful or failed pitches they are subjected to daily. And one thing became very obvious - investors aren’t really looking for the utmost innovative product or service, what investors really need from you is to convince them that you have what it takes to navigate your business through the rough patches, and have a solid enough strategy to aid you in handling the grind. What you should also be able to showcase is that your company is not merely an ephemeral idea bound for success, but has already received some traction - via excellent feedback/reviews from existing customers, social Media buzz, appealing mentions from industry influencers, and so on.

So let’s remind us what should be in your Investor Pitch Deck.

Investor pitch deck

Essentially, an investor pitch deck is a 15-20-slide PowerPoint presentation, which presents your startup in an attractive way to potential investors. Forbes outlines what slides a typical presentation should contain:

- Company Overview

- Mission/Vision of the Company

- The Team

- The Product

- The Problem

- The Solution

- The Market Opportunity

- The Customers

- The Competition

- Traction

- Business Model

- Marketing Plan

- Financials

- Q&A

The first slides have mostly to do with general intros – about the company, the employees, and eventually, the product itself. The real challenge, though, lies in the other sections.

Slides on HR solutions, financial information, and revenue models are pretty obvious - you state what you already have and plan to do. Every startup has those strategies and information in place. But the rest is a different story. As a startup, you probably cannot afford to conduct a thorough market research that includes focus groups, or pay an agency to analyse your competitive landscape and build up your visibility through publicity, and later send out a comprehensive report on the results.

That is when online marketing and SEO and digital marketing tools enter the stage to resolve some of the challenges you are faced with when creating a perfect Investor Pitch Deck.

Digital marketing/SEO & your investor pitch deck

Archit Gupta, Founder at ClearTax: “Investors look for the proof of sustainable growth in a startup. Understanding your customers and identifying the most cost-effective channels to acquire them become the task of a startup's growth team. At ClearTax, SEO, inbound marketing, and word-of-mouth advertising have helped us grow to a million-plus users today. We chose a more direct approach to reach our target audience instead of traditional advertising methods, and it has worked wonderfully for us. It's also a proof of validation and brand presence for potential investors.”

Tools can’t directly give you all you need to get those desired investments; what they can do is make a big part of your pitching efforts easier.

So we will go through areas of your Investor Pitch Deck that can be covered by certain tools that can give you what you need and what investors are looking for - data-driven solutions and strategies.

Market opportunity

You can have the top product characteristics, the best user-friendly features, and the lowest prices, but if you fail to realise that you don’t have the customer base for your product, what’s really the point?

The very first thing you’d want to emphasise in your presentation is that you know for sure and you have the facts to prove that there is actually a market for your product.

There are various approaches to measuring the market opportunity. But what is it all about, anyway?

Establish your market size and roughly estimate what part of that market your company can get. SEO and digital marketing tools can reveal plenty of insights about your target market. As we mentioned before, it is very unlikely that your startup can invest in a thorough market research, with in-depth Nielsen-like reports and focus groups, but looking at digital usage will also uncover what others spend hundred thousands of dollars on.

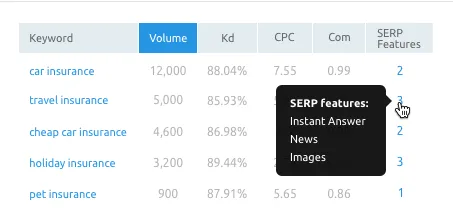

Leverage keyword analysis to find your potential market size: SEMrush’s Keyword Magic Tool, LongTailPRO, or Wordstream’s Keyword Tool can point out the search volume for any keyword that you are likely in need to target, and, since most people are going to the web to look for companies and their products, search volume is a great indicator of the number of customers you can potentially interest. By estimating how many users are Googling your product type, you can assume with a level of certainty that these people can potentially be interested in what you offer and can be converted into your prime audience.

Furthermore, the cost per click numbers for each keyword you target will give you an opportunity to forecast how much expenditure you should count on to get a designated market share.

According to Neil Patel, competitor analysis will also help you measure your market size and how much market share you can potentially gain.

Competitors

Competitors won’t only show you your own market opportunities. In fact, investors expect you to know your field from inside out. And competition analysis is a huge part of that knowledge.

By showing your knowledge about your competitors and sharing ideas about their ups and downs, you will be able to showcase your own value proposition.

Ideally, create a table and highlight every feature that your competitors have and check where are your wins and losses, and what particular areas require investments, both money and resource-based. Don’t forget to communicate your competitive advantage.

Here is what you should do:

- Determine your competitors

- Define your competitive advantage

- Showcase your wins against your competitors.

Any business model creation should begin with a comprehensive competition research. But for an investor’s pitch, the competitor research should work to your startup’s advantage and eventually build up your credibility. This is the time to “blow your horn”.

A two-time technology entrepreneur Caroline Cummings advises: “Impress the investors with what you and your team have accomplished to date.”

Note that your competitors are always of particular interest to your investors and they can also be the stumbling block for your investments. It’s in your hands to prove that you have your competitors covered and know where you’re going.

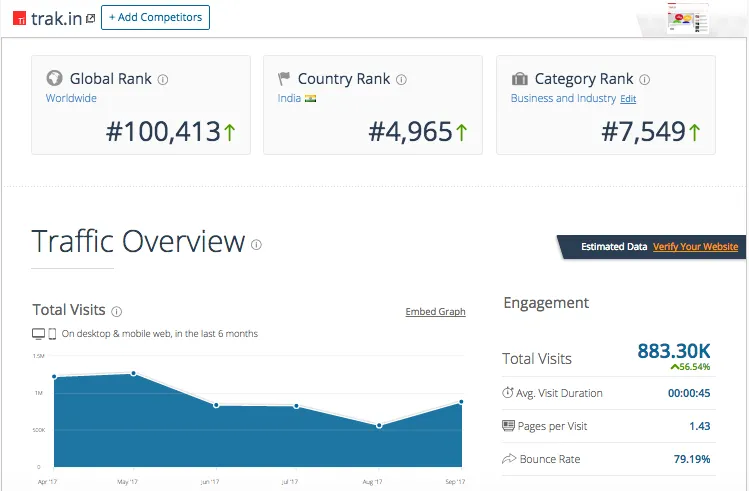

- The Organic Research Report and SimilarWeb will measure website traffic and organic keywords for each domain of your choice to help you determine your biggest competitors within organic search.

- And probably the most important aspect of competitor monitoring - Brand Monitoring - will allow you to learn from your competitors by discovering their performance and spying on their expenditures.

Once you’ve done your homework on your competitors, you can prove that your performance versus expenditures is more efficient than your competitors’, and that is how you showcase your advantages over your competition.

Your job is to impress investors. And by outwitting your competition even in the smallest areas like spending less to rank higher for the same keyword than one or two of your biggest competitors will play in your startup’s favour. But to gain even more credibility for your startup, you have to show your potential investors that you aren’t just another struggling company; on the contrary, you’ve already gained some publicity and traction from the market you know inside out.

Traction

Eighty-two percent of investors take your brand strength into account when making their final investment decision. You have to show that the traction you received resulted in some feasible evidence of success - increased traffic, higher customer acquisition, game-changing deals. Even some social buzz can do the job.

Here is what traction is all about:

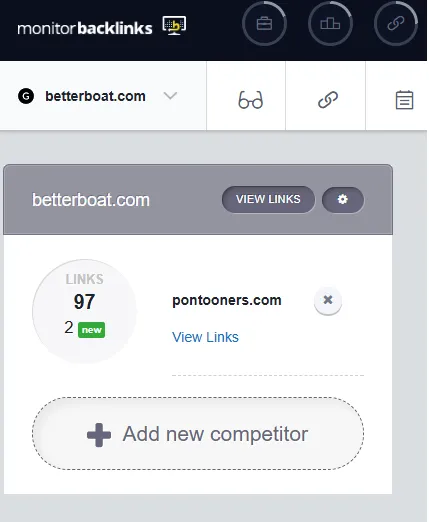

- Effective PR starts with effective outreach - to the relevant and the most beneficial media/sites. The Link Building Tool, Monitor Backlinks and Open Site Explorer can monitor your competitor’s backlinks to show you what traffic sources bring them the greatest outcomes (traffic, buzz) so that you know which sites you should target and which media/sites you can disregard. Thus, tracking and reverse engineering your competitors’ link-building strategy can potentially help with your own outreach efforts to reach relevant media, connect with the most relevant influencers, and make sure that no opportunity goes missing.

- I’d like to find someone who managed to gain an impressive publicity and, thus, visibility without using paid advertising. Hence, a tool like Advertising Research or Moat will uncover your competitors’ advertising strategies and expenditures, show their ad copies, and reveal the particular keywords they target. Use that info to learn their best practices and build your own ad campaigns.

- And, of course, what’s good traction without good old social media. No brand can afford to disregard social media. SM entails your visibility, customer service, support, Public Relations, and so on. And Social Media Tracker, Brandwatch, and OCTOBOARD can help you build the ultimate social media strategy by looking at your competitors and which channels return more benefits to their business, what content type engages their audience and, moreover, will also monitor and analyse your own social media activities.

Key slides: customer acquisition & marketing strategy

What we considered above should help you eventually dive into the key area of your Investor Pitch Deck - your marketing strategy that will ideally result in some impressive customer acquisition outcomes.

According to Entrepreneur, when it comes to investing in a company, most VCs assign a great deal of importance to digital marketing and won’t invest in a startup that fails to show some solid tactical plan for digital marketing. Basically, that plan is the step-by-step description of how you are going to reach those people who will eventually purchase your product.

And all of the areas and tools we mentioned above can help you find answers to these crucial questions that should be addressed in your investors pitch:

- What will be your key marketing channels - paid advertising, social media, email marketing, content strategies etc.?

- Which channels already work for your startup and which ones brought you some early victories?

- Do you have a rough idea of preliminary customer acquisition expenses?

- What publicity-provoking tactics will you employ?

- Have you already attracted some early buzz?

Being based at Ahmedabad, the capital of Incubations [There are 25+ Incubation centres at Ahmedabad] and also, being a founder of a digital marketing agency, it’s been a great experience to mix both things. These are my inputs for your pitch deck. What tools are you using for the same?

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)