[Exclusive] Flipkart to launch 165 more categories in private label this year (and more)

In an exclusive chat with YourStory, Adarsh Menon, Head of Private Labels and Electronics at Flipkart, elaborated on the company’s plans for the year in private labels.

After launching 53 categories under eight private labels since December 2016, e-commerce market leader Flipkart is all set to launch another 165 categories this year. Having launched private label products in fashion, furniture, consumer durables and large appliances, Flipkart will focus on expanding the range of these three categories.

The ten-year-old company has been focussing on profitability since the new CEO Kalyan Krishnamoorthy took over in January 2017. Private label is a major tool in this regard, even as the online marketplace’s loss rose to 68 percent in FY17.

In an exclusive chat with YourStory, Adarsh Menon, Head of Private Labels and Electronics at Flipkart, elaborated on the company’s plans for the year in private labels.

Long story short

Flipkart had tried its hand at private labels earlier (around 2014) with ‘Digiflip’ tablets, ‘Flippd’ apparels, and ‘Citron’ home appliances. But the experiment failed to make waves.

Flipkart’s second innings in private label began in December 2016, after Adarsh took over as the head from his previous position as VP of Electronics and Auto. The reason was simple — for any offline or online retailer, exclusivity matters the most in terms of brands and collections to get repeat customers. AmazonBasics by Amazon and AJIO by Reliance’s online platform follow this rule diligently.

In its second attempt at a larger scale, Flipkart launched their private label Smartbuy in a simple category — cables and chargers. It was followed by a trickier category – bedsheets — which has several nuances such as fabric, design, and thread count, unlike electronics which are standardised. They launched mixers next, to disrupt the category by giving great quality at 20-25 percent cheaper rates than other products on Flipkart.

All these products were manufactured across India, China, and Malaysia.

Strategising for each category

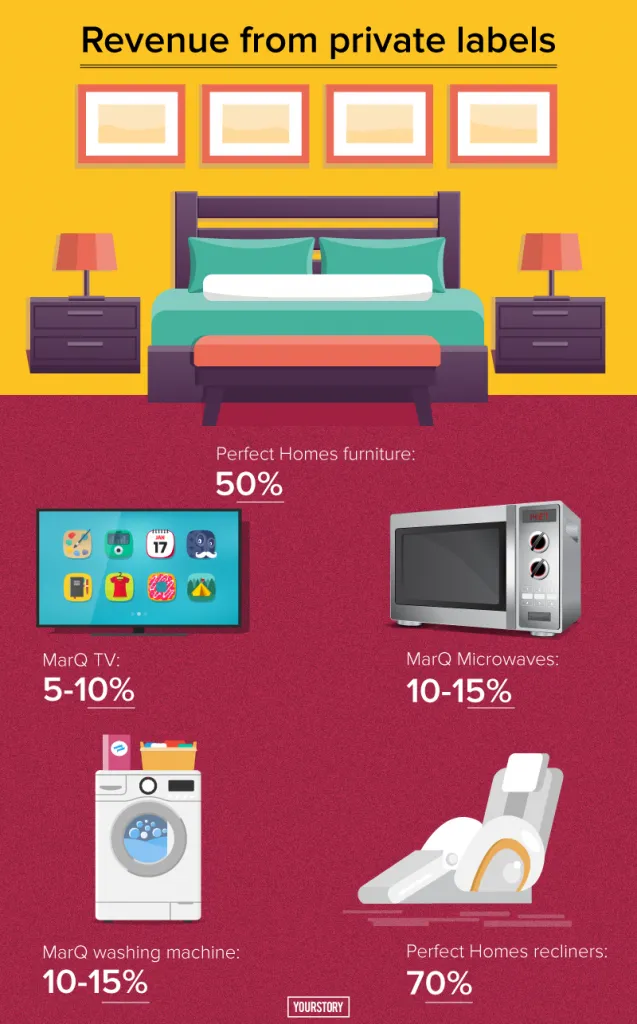

Private labels give 40 percent margins on an average. But are the customers ready to pay for private labels as they would for a more familiar national brand? This is where each category demands particular attention.

Flipkart’s vast data from customer feedback and research shows acceptance by price point. Adarsh gives an instance: in the 32-inch TV range, once the price goes to Rs 14,000-15,000, the number (of customers) drops dramatically. Consumers want it, but can’t pay so much.

“We have reliable data at serious scale – from millions and millions of customer interactions. We can find the sweet spot on the spec: like 32-inch TV at Rs 12,000 is more popular. It forms a guiding path to define the product, specs, price,” he says.

Also read: How Flipkart quality of its private label products

In fact, according to Adarsh, small appliances category received a surprising response, despite the presence of established brands such as Philip and Maharaja in these categories. “We were expecting such great numbers by the second year of launch. But MarQ is a Flipkart brand; customers trust it,” he says.

The main aim is to enable customers to shop who would otherwise postpone their purchases to Diwali season offers or after getting bonus at work, to buy it without hesitation. (Smartbuy’s tag line is ‘Better Possible Today’.)

Adarsh elaborates on their strategy, “In consumer durables, we have picked up seven to eight top selling products in the category, and identified the best spec of each product. For instance, in TV, it could be remote controller, audio, video, user interface, etc. We physically give these parts and give it to our factory partners. They manufacture a product which includes the best of all; thus, the final product will have all the best features, and is made available at 15-20 percent cheaper price.”

In furniture, they launched the private label ‘Perfect Homes’ because there is no trusted brand in the category. “So, we knew there was an opportunity to build a brand that consumers trust,” Adarsh explains. Perfect Homes has nine categories including bedsheets, dining tables, shoe racks etc.; the number will be 20 by March 2018.

All private label products come under ‘Flipkart Assured’ which guarantees that the products have gone through six levels of quality checks, and they will have an accelerated delivery process. Installation and after sales for large appliances and furniture are done by Jeeves, the services company which Flipkart acquired last year.

What is new in the private label game?

In January, Flipkart launched air conditioners and smart televisions under MarQ at the famed Consumer Electronic Show (CES) 2018 in Las Vegas. Now they have ventured into personal healthcare (for men and women) with items such as hair dryers, straighteners, trimmers, etc. (A bigger range of MarQ washing machines will be launched in February, and one for air conditioners and smart TVs in March.)

Flipkart has also launched Billion, a ‘made-for-India brand’. (For instance, customers had expressed concern that they need to make multiple repetitions with cooking because Indian families are typically larger; hence, Billion’s mixer has 25 percent larger jars.)

But why the decision to launch another label in the same category? Adarsh’s answer is simple: “The more the variety, the more choices consumers have.”

Democratic platform

To continue as an impartial platform and not upset its brand partners, it is essential that the private label is treated the same as others in terms of marketing. With the entry of the private label, isn’t there a conflict of interest with other brands selling similar products on the platform? Adarsh doesn't think so.

“On our platform, there is a customer for each price point. MarQ will occupy the opening price point. Customers who could not buy earlier because the products were too expensive, have now started buying this product. A customer will take a long time to shift from Samsung to MarQ — a brand which has higher price has their own loyal consumers. Any brand which is strongly positioned and differentiated sees no drop in business. But the overall category numbers are going up,” he says.

But many sellers have told YourStory that Flipkart promotes its private labels more with banner ads, eating into their visibility and product share. Asked about this, Adarsh says. “We promote what customers want; it’s a democratic platform. If a private label offers great products at great price, then we will absolutely show that in the front — that’s how the category grows. We highlight the best price on any given day for any brand.”

He adds that Flipkart’s private labels are sold by more than 50 sellers, who are curated according to best service and product scores.

Target for 2018

Flipkart’s 2018 targets are three:

- Give wider range for the three brands – In MarQ, there will be 20 categories (from the current nine) with more washing machines, ACs, smart TVs, boombox speakers, refrigerators, air purifiers, water purifiers, etc. In Perfect Homes (furniture), chest of drawers, lounge chairs, etc., will be included, and in Smartbuy there will be 130 more categories in general merchandise and sports-related items.

- Global manufacturing is concentrated in few hands. Flipkart aims to map that landscape well, and get great products which are not otherwise available in India.

- Move on to the next set of categories — which do not have a lot of brands at present.

Flipkart has always claimed to have “everything for everybody”. To that end, Adarsh stresses that the private label aims to fill gaps in each category. “The private labels cannot be and need not be everything for everyone. Whatever the category footprint is, the private labels are available across it,” he says.

With Flipkart planning to get into grocery sector, FMCG categories will also be launched in time, depending on business model and scale.

Will they sell private labels offline too? Not any time soon, Adarsh says. “We have not reached range completion for online demand yet. Offline sale will be considered only after that, say by 2020.”

Adarsh attributes the rapid scaling to having good talent in the industry. “We spoke to industry experts – across the US, Europe, Asia, global retailers with successful private labels such as Walmart, Tesco, Lifestyle, Shoppers etc. They said we must build a team that has those specific capabilities.”

The private label team has now grown by more than 100 percent. “We wanted people with specific skills: if it is home plastics industry, we want someone who has experience in QC, QA since college, and has grown in that space only. He should be the God in that industry,” Adarsh concludes.

![[Exclusive] Flipkart to launch 165 more categories in private label this year (and more)](https://images.yourstory.com/cs/wordpress/2017/01/Kalyan-1.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)