No plans to shut down POS business, clarifies PhonePe co-founder Rahul Chari

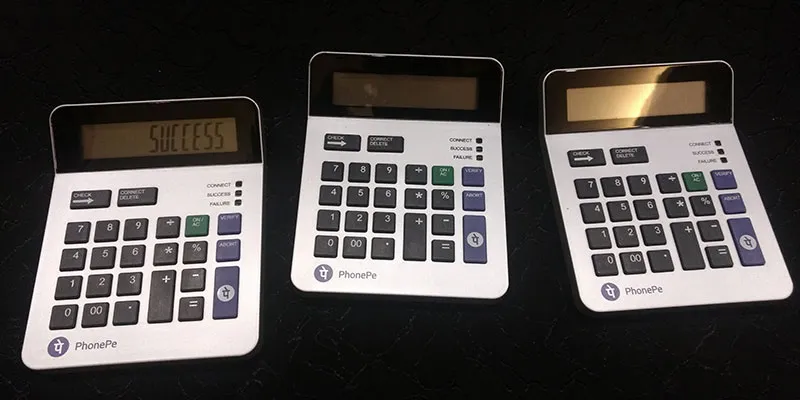

In October 2017, Bengaluru-based payments company PhonePe launched its indigenous Point of Sale (PoS) calculator, powered by Bluetooth technology. Less than a year later, media reports claim that the company is looking to shut down this business given manufacturing hurdles, and reluctance from sellers.

When YourStory reached out to Co-founder Rahul Chari, he had a different story to tell. Having deployed close to 10,000 PoS devices already, he claims there is demand from not just the home market, but also overseas markets in South East Asia and Africa. The company, though, is choosing to focus on the Indian market, and actively looking to deploy another 50,000 PhonePe calculators by November.

Edited excerpts of an interview with Rahul:

YS: There are rumours that PhonePe is looking to scale down its PoS business. What is your take on this?

Rahul Chari: The PoS business is my pet project, so I can definitely confirm that there are no such plans. We agree that deployments have been slower than what was expected, but there is no effort to slow down or kill the business.

Our background is more inclined towards software and scaling internet businesses, so it took us some time to understand the supply chain side of the business. Having deployed close to 10,000 PoS devices, we can say we have got our supply chain finally right. Just next week, we are expecting a shipment of 40,000-60,000 devices, which will be deployed latest by November.

YS: Where will PhonePe deploy the new devices?

RC: There are two active used cases where we see the new batch being deployed. One is petrol pumps; that is where two-thirds of the upcoming batch will be deployed, while the rest will go into organised offline retail players like Mother Dairy.

Thereafter, we will procure another batch of 100,000 devices by January next year.

YS: What were the manufacturing challenges for the PoS business?

RC: The problem was that we could not understand the manufacturing pipeline, and didn’t anticipate the Chinese New Year. So, we had to change our manufacturer. Another issue was the sturdiness of the device - if it fell, the back casing (of the battery) would fall out. Fixing some of these aspects put us a little behind in our schedule.

To solve some of these issues, we have two vendors now. We are also looking to hire an Indian vendor to make this indigenous device a ‘Make in India’ story, but we are facing challenges with the pricing.

YS: What is the kind of traction that PhonePe is seeing with its PoS calculator?

RC: We have deployed close to 10,000 PoS devices. Of these, 75 percent are active, registering more than one transaction every day. At fuel outlets, of all the payments via PhonePe, 50 percent are on the PoS device, and the rest through QR codes. On average, these devices see close to 32-45 transactions daily at fuel outlets.

YS: What is the manufacturing cost of these PoS devices? Do you see PhonePe charging merchants for the same?

RC: At the moment, the device is free of cost for merchants, but we are looking to charge merchants in future. At an overall manufacturing level, the cost of one PoS device was close to $10. We have managed to reduce the manufacturing cost by a dollar (on each device) in the current batch.

YS: What can we expect from PhonePe in terms of its PoS strategy?

RC: Definitely, more variants. Looking at the feedback from merchants, we are looking to create low-cost printers for our PoS devices. We are already piloting with 500 such devices in the market. We are also looking to have a larger display which can also accommodate a dynamic QR, merging the two form factors. And we plan to do all this while keeping the cost of the device low.

We aim to roll out newer variants in the market by the January batch. The cost of manufacturing these variants, though, will be a bit higher.

YS: So, how does PhonePe plan to popularise the PoS business with unorganised retailers?

RC: We definitely anticipate demand, especially from general stores. But, we want to first deploy QR codes with unorganised retailers because we feel there is a certain volume that needs to be reached before it makes sense for them to upgrade to a PoS device.

Any merchant who sees transaction volumes in double digits on a daily business is right for the PoS proposition.

YS: Why is PhonePe concentrating on the organised retail space? What are the company’s plans to penetrate the offline space?

RC: The reason we have focussed on organised retailers like McDonalds or KFC is due to the visibility and access. So, it is definitely a deliberate approach. Also, the unorganised space requires a lot of feet on the street, and the kind of effectiveness in terms of transactions and visibility is a little slow.

We crossed the 2-million-transaction mark last month at offline organised outlets, and look to scale this number to 10 million by December. In coming months, we will look at the unorganised retail segment, and will deploy manpower to increase our presence in the offline segment. We have already started to set up satellite offices in multiple places.