2018 was the year when Indian startups attracted new investors, welcomed new 'unicorns' and began showing signs of maturity

2018 funding trends: key takeaways

- Indian startups raised $12.68 billion in equity funding, plus $1.14 billion in debt funding in 2018, across a total of 864 deals, surpassing 2017

- Late-stage startups with a proven track record took the lion’s share of funding raised, even as India welcomed eight new ‘unicorns’

- Fintech/financial services was the star-performer as ecommerce bid goodbye to Flipkart from the funding stakes following its acquisition by Walmart

- Chinese investors began investing in earnest, putting money into 21 startups as compared to just 12 in 2017

- Investors from Japan (and not just SoftBank), as well as other countries, also upped their funding in Indian startups

When we wrote about the trends in startup funding towards the end of November 2018, the ecosystem had raised close to $11 billion in equity funding. By the time the year ended, that number had increased to $12.68 billion in equity funding, plus $1.14 billion in debt funding, taking the total to $13.88 billion. That’s a shade over the $13.7 billion raised in equity and debt combined in 2017.

The big boost came primarily from two deals in December: Swiggy’s $1 billion Series H round and BYJU’s $540 million. Incidentally, South Africa-based Naspers was a common investor in both deals. After a super-slow November, Christmas came early for many startups, with $2.4 billion in funding raised during December.

The number of deals closed in 2018 reflected growing investor confidence – 864 in equity funding versus 830 in 2017. The number of debt funding deals too increased to 57 from 45 last year.

Going into 2019, we present the key numbers for funding raised by Indian startups last year.

Where the money went

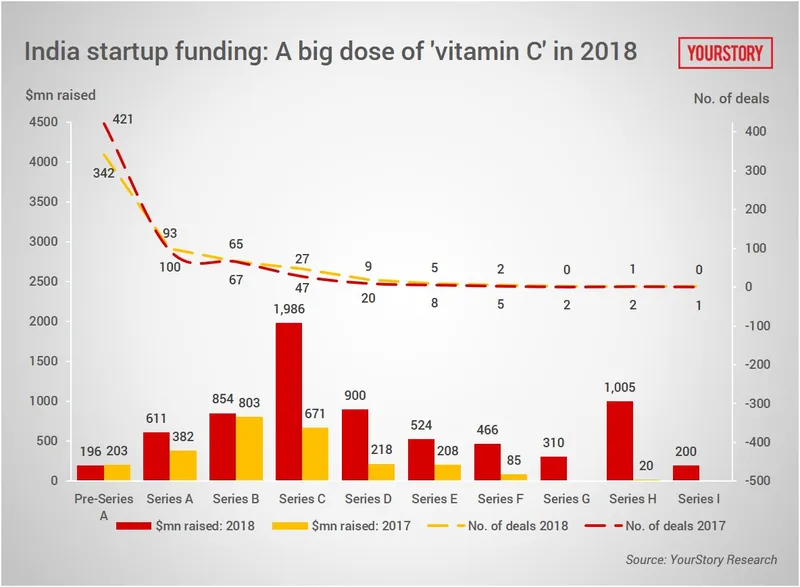

There was some cause for concern in the very early stage, with the number of Pre-Series A deals falling to 342 from 421 in 2017. The amount raised also dipped to $196 million from $203 million last year.

As Sanjay Anandram, veteran investor and mentor to early-stage funds and social impact funds, explains,

“Early-stage rounds have reduced significantly as most investors now want to place a bet on companies that show traction and growth. They believe in backing these companies as it means better returns. The early stage rounds will begin picking up depending on the kind of bets that have been placed. Currently, newer companies are taking time to raise funds.”

Adds Naganand Doraswamy, Founder and Managing Director at IdeaSpring Capital, “While it isn't easy now to raise funding as it was three years back, the atmosphere is nevertheless positive, because companies too are maturing and are working on scale and unit economics.”

As seen in the chart above, funding raised in Series A and Series B continued to climb, but the biggest boost came in the Series C space, where investors put in $1.98 billion across 47 deals compared to just $671 million across 27 deals last year. This was the first time that Series C crossed the $1 billion mark. Also breaking through the $1 billion mark was Series H funding (Swiggy and fintech player MoneyOnMobile).

Funding in the Series D stage closed at $900 million, quadrupling from $218 in 2017.

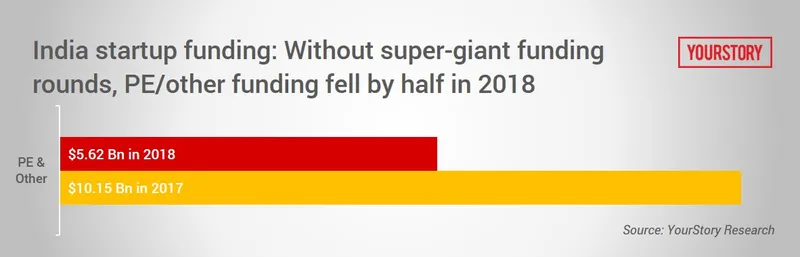

PE and other rounds, however, shrank by half to $5.62 billion from $10.15 billion in 2017, mainly because there were no super-giant funding rounds like the ones seen last year. In 2017, the likes of Flipkart, Ola, and Paytm had together mopped up nearly $7 billion.

[Check out our infographic on the biggest funding rounds of 2018]

2018: The year of Indian ‘unicorns’

As we wrote in November, the clear trend was that of investors placing big bets on late-stage companies: startups that have survived the initial test and have a demonstrated ability to grow. Investment data also shows an increase in the risk appetite of investors, with a significant jump in the pace and number of deals in 2018.

These late-stage startups, many of which are ‘unicorns’, once again mopped up a huge chunk of the funding. This has been the pattern since 2015, except for one year (2016) when they raised only a minimal amount. See graph below.

As many as eight startups acquired ‘unicorn’ status in 2018: Foodtech giants Swiggy and Zomato, online retailer Paytm Mall, B2B ecommerce provider Udaan, fintech bigwig PolicyBazaar, the world’s highest-valued edtech company BYJU’s, hospitality startup OYO and SaaS player Freshworks.

Together, the ‘unicorns’ raised $5.09 billion in 2018 – about 40 percent of all equity funding raised. Last year, the figure stood much higher at 57 percent because of the super-giant rounds raised by Flipkart, Ola and Paytm.

Says Satish Andra of VC firm Endiya Partners,

“There have been larger companies raising funds and ‘soonicorns’ (a term informally used to describe companies approaching $1 billion in valuation) becoming ‘unicorns’, and some more companies, in turn, becoming soonicorns. The larger companies will continue to get the limelight.”

Older ‘unicorns’ include payments giant Paytm, cab aggregator (and now also foodtech player) Ola, ecommerce players SnapDeal and ShopClues, mobile messaging app company Hike, online classifieds platform Quikr, adtech network InMobi and renewable energy provider ReNew Power.

It’s no longer just Bengaluru versus Delhi

For the better part of the year, Delhi-NCR was ahead of Bengaluru in terms of funding raised. Then came December. Thanks to the money raised by Swiggy, BYJU’s and a handful of others, Bengaluru retained its crown of being India’s startup capital both in terms of the number of deals and the funding raised. See chart below for details.

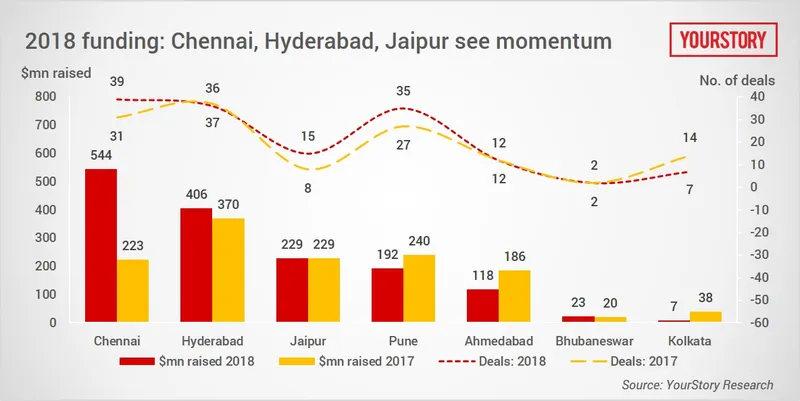

What was interesting to note was the growth of funding going to startups beyond the top three hubs. Chennai put in a stellar performance, while Hyderabad held its own, as did Jaipur. Pune raised less, but had a higher number of deals. Funding raised by Ahmedabad-based startups fell, though the number of deals remained steady. Bhubaneswar stayed steady, although Kolkata lost momentum.

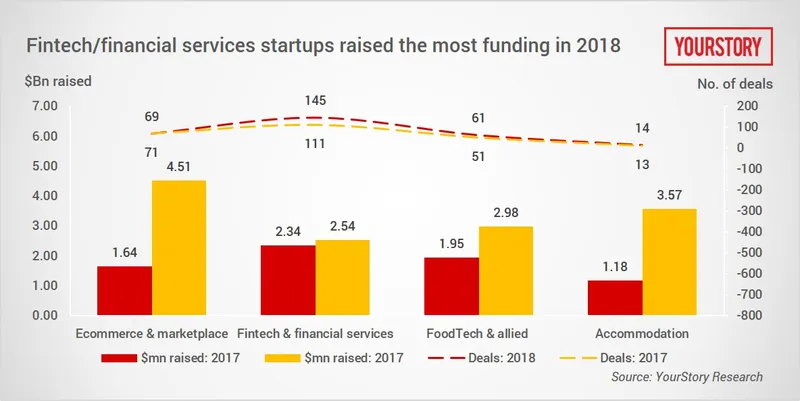

In terms of sectors, Fintech was at the top of the startup funding charts, mopping up $2.34 billion across 145 deals. Last year, it raised more ($2.45 billion across 111 deals) but played second fiddle to Ecommerce and marketplaces, which had raised $4.51 million. Most of that amount had gone to Flipkart, which was acquired by US retail giant Walmart in mid-2018.

Foodtech went from being pariah to pet favourite, though most of the $1.95 billion raised was cornered by Swiggy and Zomato. A similar story played out in Accommodation, where OYO’s $1 billion dominated the $1.18 billion closed in 2018.

The one sector that investors really paid attention to in 2018 was Artificial Intelligence. The sector, including Machine Learning, mopped up $328 million across 30 deals, compared to a paltry $26 million across 18 deals in 2017.

India became a favourite with a new breed of investors

As we wrote in November, capital from China made a mark this year with a big jump in the number of investments made in Indian startups. This also opened up newer strategic opportunities such as exits and the possibility of expanding internationally. What’s more, they’re willing to pay top dollar to get a piece of the action, irrespective of the bilateral and geopolitical differences between the governments of the two countries. China is positioning itself as one of the top investors in India’s booming startup ecosystem.

As V Balakrishnan, Chairman, Exfinity Ventures, told YourStory a few weeks ago,

“The Chinese have realised that India is a big potential market on the consumer side, and they want to replicate the success they had in their country.”

The Indian and Chinese economies are highly complementary, so there's enormous scope for cooperation and collaboration. This, in turn, is an opportunity for India’s startup ecosystem to provide the type of returns that investors are looking for.

In 2018, Japanese investors too showed a lot of interest in Indian startups across ecommerce, hyperlocal, SaaS, automotive, transport, real estate, biotech, real estate, media, among others. The Japanese investment story is no longer about SoftBank; there are quite a few Japanese VCs, industrial houses and universities which are betting big on India.

YourStory data reveals that of the 32 deals that Japanese investors participated in, 10 were pre-series A and Series A. Another 13 deals were largely bridge financing or top-up to existing rounds. Indian startups also discovered that Japanese investors take longer to close a deal than their American and Chinese counterparts.

As Siddarth Pai, founding partner and CFO, 3one4 Capital told YourStory,

“Japanese investors take a cautious, careful and studied approach to make an investment since they view investing as a partnership with both parties contributing according to their strengths.”

A new breed of specialist investors

2018 also saw specialist VC funds begin investing actively in early-stage tech startups, including Endiya Partners, pi Ventures, Stellaris Ventures Partners and Ideaspring Capital, all of which are investing in specific sectors, including some like deep tech and deep science, where capital has been scarce.

The Hyderbad-based Endiya Partners, for instance, is clear that it will not invest in me-too startups. It invests in early-stage deep tech startups across SaaS, Security, Mobility, Semiconductors, Fintech, Digital health and Medical devices. pi Ventures actively invests in early-stage AI, ML and IoT startups. There are several more and it will be interesting to see what bets they place in 2019.

2019 funding: What’s in store

For one, there is plenty more dry powder in the market. A number of venture capital firms have closed Asia- and India-specific funds and the time seems ripe for bigger, bolder bets. The new year began on a positive note, with Jaipur-based CarDekho raising $110 million in a Series C round and Delhi-based Vyome Therapeutics raising a $22 million Series D round.

[Also read our story on investor expectations from 2019]

Anup Jain, Managing Partner, Orios Venture Partners, summed it up when he said: “The stage has been set for a second wave of investments and entrepreneurs to enter the ecosystem with greater confidence in the coming years. Thus, 2018 will go down as the year that created the hockey stick effect for the startup ecosystem as we look back after a few years.”