Are you a SaaS company looking to scale? Here’s why you must go beyond India and target the global market

This is the first of a four-part series that seeks to shed light on why SaaS founders in India must consider pivoting their sales and marketing toward the global market. In this article, the author addresses India’s small market and the challenge of offline sales.

“Not scalable, not predictable and yet repeated. This done knowingly — is fine. Attempting this and not knowing is a slow poison.”

— Vivek Khandelwal, Founder of iZooto

Can you name a software-as-a-service (SaaS) startup from India that has scaled to more than $10 million in annual recurring revenue (ARR) by targeting the domestic market? I cannot.

I was a SaaS founder once myself, and I know how enticing it can be to discover a problem and build a solution for the people in your network. But do not do this beyond a set of beta customers, because — as my peers and I have learned — selling SaaS to the domestic market is not scalable.

Before going any further, I’d like to say that the four-part series will provide SaaS founders a critique of the Indian market and encourage them to pivot their sales and marketing towards the global market. This article only addresses SaaS targeting the micro, small and mid-sized businesses (MSMB) market, and not the enterprise market.

In subsequent articles, I will cover areas such as the low perceived value of software, the culture of B2B payments; and the culture of B2B services and the risk of custom development

Let’s get a few details out of the way first. I define ‘scale’ as greater than $10 million in ARR because that amount of revenue indicates a large number of customers. Also, I exclude payment gateways from my definition of SaaS. Further, when I say SaaS companies targeting the domestic market, I define that as any SaaS startup that spends more than 50 percent of its sales and marketing budget on acquiring customers in India.

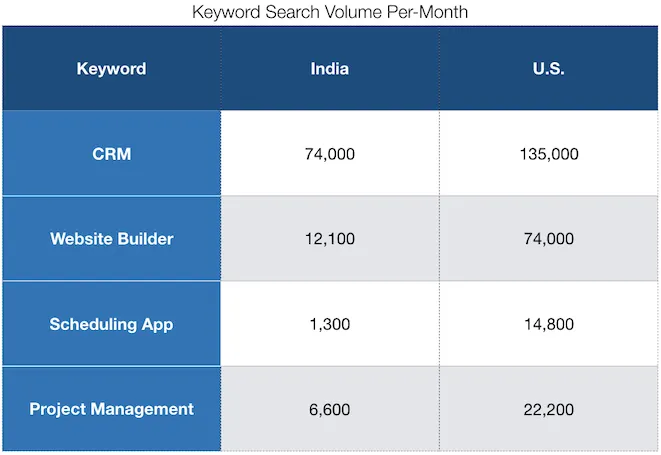

Google search volumes serve as a barometer for demand in the market

Do a Google keyword search for any SaaS-style product (e.g. “CRM”, “Website Builder”, “Project Management”, etc.) and you will see how the search volumes in other markets compared to that of India.

The dataspeaks for itself. If a startup targets the Indian market, it is targeting a relatively small online market.

“But, wait!” I hear a SaaS entrepreneur object, “consider this …”

- “Though India’s online market is small, India’s offline market is large!”

- “And, there is enough online business in India for me to build a scalable startup.”

The first point I’d like to address right away., Just because a market is large does not mean it is scalable. The second point I will address in future articles in this series.

Offline SaaS is low margin

To characterise the market, SaaS entrepreneurs will agree that the average Indian SMB does not leverage modern technologies to improve its business operations. And, based on the above search volume data, the average Indian SMB does not search online (Google) to find solutions to improve its business operations.

Why do businesses not search online:

- Businesses are unaware they have a business-operation inefficiency

OR

- Businesses are aware they have a business operation inefficiency, but look for solutions through their personal network, and not by searching online

For SaaS founders, the problem with these two scenarios is that they will have to invest significant resources into contacting SMBs in person and educating them on the inefficiencies of their business operations. This is a challenge because educating a market takes time. Education requires meeting prospective customers multiple times, sophisticated sales representatives who can articulate the customer problems and sell the SaaS solution. That is an expensive endeavour and is a barrier to scale for any SaaS startup.

But I’m not the only one saying this. Vinod Muthukrishnan, Founder of CloudCherry, one of India’s fastest growing SaaS startups, had this to say:

“The issue in India is that the average revenue per user (ARPU) is low. For a SaaS company to have 80 percent gross margins, the cost of all people and general & administrative (GA) expenses around customer success/support should not exceed 10–12 percent, assuming cloud costs are 8–10 percent of ARR. If the ARPU is low and you need to fly every month to see the prospect client in person in Mumbai and spend three hours a day educating and chatting with them on multiple things, basically, the math doesn’t add up. Both vectors are stacked against us — ARPU (low) and service expectations (high).”

As Vinod points out, because of the high costs of in-person education and sales, SaaS startups generate lower gross revenues. This reduces the capital for sales and marketing to acquire customers, making the startup unscalable.

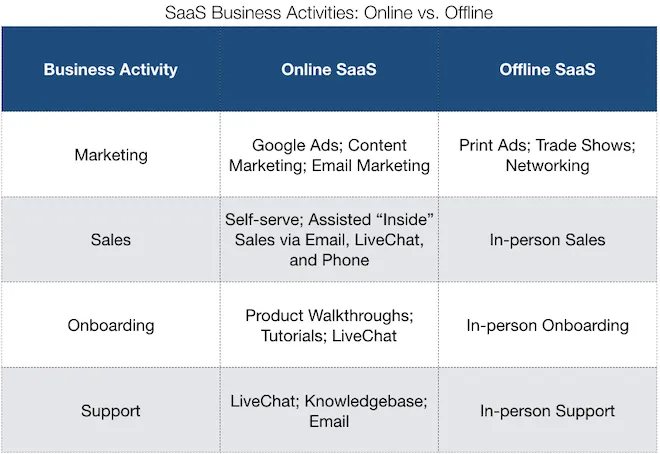

In the next section, I describe how online SaaS models are different and more scalable than offline models.

The online SaaS is high margin

By leveraging technology, you can see how online SaaS startups can market to, acquire, onboard, and service a larger number of customers with fewer resources than offline SaaS startups. This makes online SaaS a more scalable approach.

The difficult pivot

The skillset and culture required to operate an online SaaS outfit as opposed to an offline one is worlds apart. This is risky because the longer a SaaS invests resources into building a sales and marketing culture to acquire an offline market, the harder it becomes to pivot to an online market. So SaaS startups can literally get “stuck” by selling offline. I’ve had this experience myself, and so have many of my peers.

In closing

There’s a reward at the end of this tunnel if you’re willing to pivot to the global market. As Shekhar Kirani, Partner at Accel Partners once said:

“I think there is an extraordinary opportunity for entrepreneurs from India to build massive B2B/SaaS companies purely by focusing on large global with a high-quality product. Having a base in India is a massive advantage on unit economics of demand-gen, inside sales, and R&D.”

If you’re still not convinced about the risks of the domestic market, then look out for my next post on the low perceived value of software in India.

Are there other challenges you see to scaling a SaaS? Or, do you just disagree with the points I’ve made. If you have any comments or feedback on the article, I’d love to hear them in the comments section below.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)